This post was originally published on this site

We’re seeing some big rebounds Tuesday for gold and oil, which have taken hard hits in the last couple of sessions, even as stocks appear bogged down.

According to the UN’s bombshell IPCC report released Monday, the time for nations to debate climate change is over, and actions have to be taken now. The same could be said for investors and their portfolios when it comes to climate impacts. A recent survey showed economists and financial professionals believe asset markets are far underestimating any risks.

What should investors start thinking about now? Our call of the day, from a team of Jefferies strategists led by Aniket Shah, offers up five big investment takeaways from the climate report.

- Premiums for first responders. The UN warns that carbon emissions cuts must be immediate to keep the world below 2 degree global warming thresholds. Companies moving fastest on C02 reductions will likely be rewarded by capital markets, says Jefferies, who note that 61% of countries and 21% of companies have net zero targets. “Technologies exist today which allow us to replace emitting point sources with non-emitting point sources, one potential area that sticks out to us is utilities and the value chain where renewables can replace traditional sources today,” said the team.

- Pinpointing physical risks. In a world above the 2 degree threshold, droughts will be 2.4 times more likely and a one-in-50 year heat wave 13.9 times more likely than in a climate where humans aren’t harming it. “Investors will need to develop a much more sophisticated supply chain analysis and risk framework around physical climate risks and their impact on business operations,” said Jefferies. They point to insurance among those industries facing headwinds, which will mean not just higher claims, but possible aggregation risks.

- Factoring in tipping points. The U.N. report lays out how warmer temperatures increase the likelihood for high-impact outcomes, and “abrupt responses and tipping points of the climate system…cannot be ruled out.” Jefferies urges investors to “adopt a ‘tipping point’ framework to climate change investing. On the opportunities side, new technologies and policies can radically change the investment landscape too,” they said. One example is President Joe Biden’s goal for half of all new cars sold to be electric by the end of the decade.

-

Carbon dioxide removal risks. Technologies that strip out carbon dioxide is big business — the International Energy Agency estimates it could total $27 billion this year. But the writers of the U.N. report appear fully aware of potential harm to water quality, food supplies and biodiversity from such technologies. “For companies that have significant reliance on offsets for reaching ‘net zero’ targets, this is a potential risk that cannot be ignored,” Jefferies said. Oxfam has calculated that just for Shell

RDSA,

-0.18% BP,

-1.10% ,

TotalEnergies

TTE,

-0.28% TTE,

-0.69%

and ENI

ENI,

+0.16%

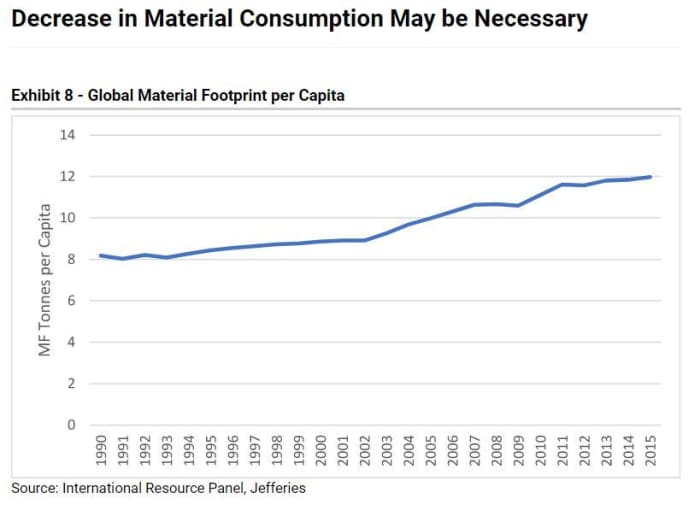

net zero targets, carbon sinks twice the land of the U.K. are needed. Carbon sinks are natural or artificial deposits that take C02 from the atmosphere and store it. - Less stuff. The report laid out five projected socioeconomic global pathways through 2100, of which only one will keep temperatures in line with the Paris Agreement. That winning pathway involves a society driven by overall well being and not economic growth. “The majority of the global economy is consumption, particularly consumption from high income people; a paradigm shift away from economic growth could significantly hurt consumer spending across all sectors and geographies,” said Jefferies. The investment impacts of less stuff: huge.

Read: 20 stocks for maximum growth as the world switches to clean energy

Small-business gloom and AMC surges

Not “out of the woods yet.” That was AMC Entertainment’s

AMC,

chief executive Adam Aron tempering optimism over the movie business’s recovery after reporting a narrower quarterly loss late Monday. Shares are up. as it also announced a theater deal with AT&T’s

T,

Warner Bros.

Small businesses in July lost almost all of their confidence gains made in June, says the latest NFIB survey. Preliminary second-quarter productivity and unit labor costs are still to come, a day ahead of important inflation numbers. Chicago Fed President Charles Evans will hold a press conference at 2:30 p.m. Eastern.

Atlanta Fed President Raphael Bostic said Monday that conditions were ripe to begin progressing with tapering.

The world’s biggest tech investor, Softbank

9434,

reported plunging profits as the value of some of its largest investments fell.

Bitcoin

BTCUSD,

continues to march higher even after the industry didn’t win a change to cryptocurrency tax reporting rules as part of an infrastructure bill that’s poised to pass Tuesday. Crypto platform Coinbase

COIN,

will report results after markets close Tuesday.

The markets

U.S. stock futures

YM00,

NQ00,

are flat, though Europe equities

SXXP,

are up and Asian equities had a mostly upbeat session, with China’s CSI 300

000300,

gaining 1%.

Random reads

Camping out for charity, 11-year old is on his 500th night and has raised £600,000.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.