This post was originally published on this site

Maxar Technologies (MAXR) has been a volatile stock in the market. In the past three years, its stock price has fluctuated in the wide range between $4 and $64 per share. Previously, Maxar had been extremely leveraged, which scared investors. With the recent MDA business divestment, we think Maxar’s balance sheet would be stronger, and the stock price could rise from the current level.

The biggest customer is the U.S. government

Maxar Technologies has two main business segments: Earth Intelligence and Space Infrastructure. Earth Intelligence generated 60% of the company’s 2019 revenue, with two products & services: Data Generation and Data Analytics/Platform. Maxar’s Data Generation provides customers high-resolution satellite imagery, mission-ready geospatial intelligence and sensor, ground system optimization. In the Data Analytics/Platform services, Maxar uses artificial intelligence and machine learning to analyze geospatial data sets on many platforms, which could be accessed by many users globally. All of these business segments provide products and services to customers via multi-year contracts. As a result, most of Maxar’s revenue is recurring. What we like about Maxar is its customer concentration. Its largest customer has been the U.S. Federal Government and agencies. In 2019, the U.S. government accounted for 56.4% of its total revenue. It is the best customer that Maxar could have in the current COVID-19 crisis.

The acquisition of DigitalGlobe has driven its service revenue significantly higher, from $380 million in 2017 to more than $1.1 billion in 2019. In 2019, only the Earth Intelligence business generated positive EBITDA of $548 million, whereas Space Infrastructure’s EBITDA came in at -$17 million. While hardware business requires high capital expenditure but is a low margin business, the software services would deliver higher growth and generate a much higher margin. We believe that the Data Generation and Data Analytics/Platform businesses in the Earth Intelligence segment would lead Maxar’s future.

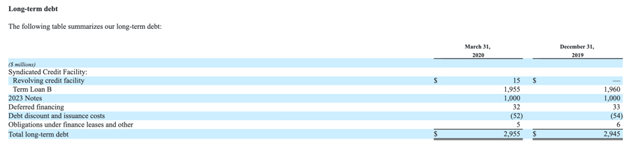

Highly leveraged balance sheet but still below debt covenant

What makes investors worry is its highly leveraged balance sheet. As of March 2020, it had only $12 million in cash but nearly $2.96 billion in both long and short-term debts. The total pension and post-retirement benefits were $193 million. Most of its long-term debt includes $1 billion in 2023 Notes, maturing in 2023, and $1.955 billion in Term Loan B, maturing in October 2024.

Source: Maxar’s 10-Q filing

We expect Maxar’s balance sheet will be stronger, due to its recent divestiture of the Canadian space robotics business, MDA. The sale of MDA would bring Maxar around $680 million, after closing expenses associated with the sales. If Maxar uses all of the proceeds to pay down the debt, its total debt will decline to $2.275 billion. Under Maxar’s debt covenant agreement, the maximum debt leverage ratio has increased to 7.50x at the end of the first quarter, 7.75x at the end of each quarter until September 2021 and 7.50x until September 2022. By 2020, Maxar’s expected adjusted EBITDA could stay in the range of $370-$410 million. If we assume that its 2020 EBITDA is $400 million, and the debt coverage ratio is roughly 5.7x. If its adjusted EBITDA comes in at the lower range of $370 million, its debt coverage ratio could increase up to 6.15x, which would still be well below its covenant restrictions of 7.50x.

Maxar should be worth $13 per share

Maxar is trading at $10 per share, with the total market capitalization of roughly $490 million. With the 2020 expected net debt of $2.275 million, the total enterprise value would be approximately $2.765 billion. As a consequence, given the 2020 expected EBITDA of $400 million, the market is valuing Maxar at roughly 6.9x forward EV/EBITDA. We believe that with the improvement in balance sheet strength, Maxar should be valued at approximately 9x EBITDA. Its share price should be worth around $13 per share, 30% upside from the current trading price.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.