This post was originally published on this site

Investment Case

I am a long-term investor. I seek out companies that I believe have a sound future due to the nature of their business. I don’t focus on one sector or niche, I just want to believe in what they do or sell will be profitable in the future. Besides this common sense, I also want to look at the ‘value’ of a company. This is hard to determine as the value is what the market wants to pay for it. Although ‘Mr. Market’ is often right, he is now and then very wrong in both directions.

I believe I found such an anomaly in NVE Corporation (NVEC). It’s a small-cap, which makes it more likely to stay under the radar. The company’s stock price has experienced quite a ride over the past 10 years. This is probably because it’s active in a niche tech sector: spintronics. This is a niche segment of semiconductors which use a different technology to store data. To put it simply: these spintronics use less power and are smaller than other similar devices. This makes them very viable for several applications such as factory automation and medical devices. Future applications could be made in automotive electronics, consumer electronics, and biosensors.

About NVE Corporation

“NVE Corporation is a leader in the practical commercialization of spintronics, a nanotechnology that relies on electron spin rather than electron charge to acquire, store and transmit information.The company manufactures high-performance spintronic products including sensors and couplers that are used to acquire and transmit data. Products offer smaller size, more precision, higher speed, and are more rugged than conventional devices. NVE parts are popular in industrial, scientific, and medical applications.Sensors acquire information, couplers transmit information, and memories store information. Thus our technology can provide the eyes, nerves, and brains of electronic systems. NVE’s award-winning products are sold through a worldwide distribution network. NVE was founded by Dr. James M. Daughton, a former Honeywell executive, in 1989.”

In essence, NVE Corporation produces spintronics that could be used in a wide range of applications. It’s already very profitable with their current business. The company has been slow in growing revenue over the past few years. There is still a large potential, though.

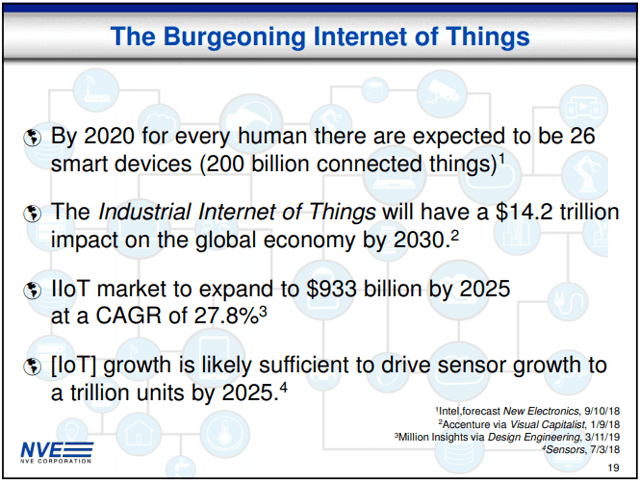

This Technology Has A Huge Potential

The figures above speak for themselves. The IoT potential alone is enormous. NVE only needs a small slice of this cake to grow exponentially. Considering the company had revenue of $25 million over its last fiscal year, it could grow revenue by selling some products to this market.

Besides the IoT market, there are also possibilities in medical applications in which NVE is already selling chips for hearing aids. The automotive sector is another possible market NVE could access. NVE still has a lot of work ahead and probably won’t be successful in all these markets. I like that they have a lot of irons in the fire for their revenue growth.

There are also positive signs by other companies getting into spintronics. Intel (INTC) is exploring spintronics and published a paper in the journal Nature about it. The paper talks about the low power consumption and small size advantages of spintronics. This proves that NVE is working on interesting technology.

NVE Is Very Profitable

I’ve talked about the spectacular market potential of NVE. This is where it gets interesting. A lot of these companies with exciting new technologies and huge market potential are burning cash. They are banking on future cash flows and need new capital injections without being certain to ever become profitable.

NVE is different.

The company has a high net profit margin. This increased further for the past few years from around 45% to 57%. This means it’s very strong at converting revenues into profit and cash. Every increase in revenue should also add to the bottom line.

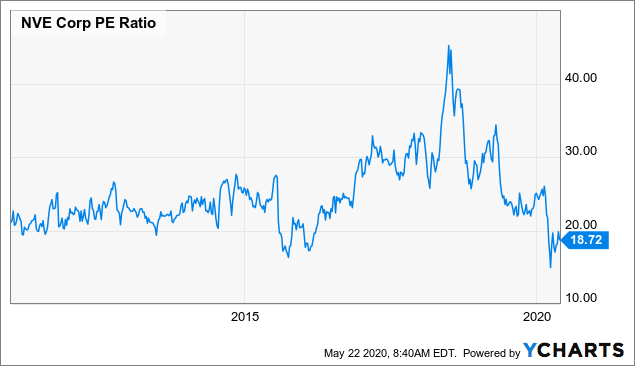

It’s very normal to rate upcoming tech companies by their P/S ratio. This looks rather high for NVE as it’s trading at a P/S of about 10. As said, NVE is very profitable, so it is converting a high percentage of these sales into earnings and cash. The company can be valued by normal measures such as P/E. The P/E is only hovering around 19. Considering the large cash position, profitability, and market potential, this seems rather low. NVE should, however, increase its revenue to gain market interest. I believe this possible over the coming years as they get some design wins.

NVE is trading at a low P/E in comparison to the past:

Data by YCharts

Data by YCharts

Expect A Continuous Dividend Income

NVE has been paying a dividend since 2015. They are currently committed to a quarterly dividend of $1.00. They can afford this dividend due to a large net cash position on their balance sheet. The dividend isn’t covered by the company’s earnings or cash flow. They are using the dividend to slowly reduce their net cash position which they built up in the years before paying a dividend. If all else stays equal, the company can keep up this dividend policy for at least 10 years. It should make more money by then.

This also means dividend increases are unlikely shortly. The dividend should be covered by the cash flow before they consider this. Besides, there are other ways to spend cash like buybacks and investments.

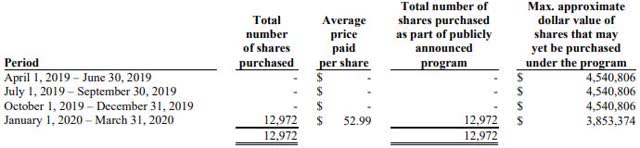

Buybacks Are Done Opportunistically

NVE has a share repurchase program of $5 million of which has still $3.8 million available. This is only about 1.3% of its current market cap. NVE announced the program on August 27, 2015. They initially made some repurchases around that time. As the stock price rose, the company stopped repurchasing shares. Only recently the share repurchases picked up again as the stock price fell due to the market sell-off:

Source: 2020 10-K

Source: 2020 10-K

This shows that the management believes the share price is undervalued at approximately $53. This prudent approach to buybacks is commendable. It proves the management is committed to optimally use their cash in favor of shareholders.

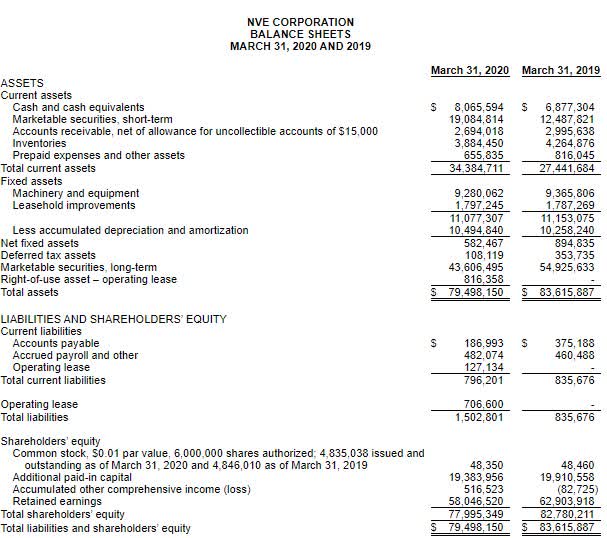

A Very Healthy Balance Sheet

I’ve talked about the net cash position before. This is their balance sheet at 3/31/2020:

Source: Earnings report 3-31-2020

Source: Earnings report 3-31-2020

To correctly assess their net cash position, we should add the long-term marketable securities. This isn’t conventional as the prices of these long-term securities could fluctuate more and they don’t convert to cash as quickly. NVE does use them like cash to pay their dividend. The cash, short-term and long-term securities add up to $70.7 million in 2020 as opposed to $74.2 million in 2019. As pointed out before, they burned this cash on paying dividends.

Summary

It’s a rare opportunity when a potential fast-growing company trades at a low valuation. This is the case with NVE. The company offers a relatively safe investment due to its net cash position, dividend yield, and buybacks. It looks like spintronics technology is very promising in several futuristic applications like IoT. The small size and low power requirements are a big advantage.

It will take time for NVE to grow revenue. The opportunities in new markets aren’t won over quickly and will require a lot of work to develop. The company has more than sufficient funds to continue paying dividends in the meantime.

NVE’s buyback behavior seems to prove the hypothesis that they are undervalued. The $5 million buyback program has been active since 2015. They only recently used the possibility as the stock price dropped. This could be a key indicator to buy around current price levels.

Disclosure: I am/we are long NVEC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Any investments you would take after an article or discussions with me are your responsibility. You should do your own due diligence before an investment.