This post was originally published on this site

U.S. stocks struggled for direction early Monday, as bond yields rose and traders looked ahead to Wednesday’s conclusion of a Federal Reserve policy meeting.

What’s happening

-

The Dow Jones Industrial Average

DJIA

was off 2 points, or less than 0.1%, at 34,616. -

The S&P 500

SPX

fell 6 points, or 0.1%, to 4,444. -

The Nasdaq Composite

COMP

was down 16 points, or less than 0.1%, at 13,692.

The Dow rose 0.1% last week, while the S&P 500 lost 0.2% and the technology-heavy Nasdaq declined 0.4%. The S&P 500 and Nasdaq each booked a back-to-back weekly loss.

What’s driving markets

Stocks were struggling for direction as benchmark bond yields inched back toward 16-year highs and investors looked toward a busy week of central-bank action.

The S&P 500 dropped 1.2% on Friday after recent stronger-than-expected economic news alongside rising oil prices raised concerns that inflation may stay stubbornly above the Federal Reserve’s 2% target.

Treasury bonds were reflecting these concerns, with 10-year implied borrowing costs

BX:TMUBMUSD10Y

at 4.347%, a fraction off their highest since 2007. U.S. crude-oil futures

CL.1,

traded above $91 a barrel, the most expensive since last November.

“Investors are increasingly concerned that the latest flurry of data points to firming inflation and perhaps a higher-for-longer rate environment that could weigh on the heavily megacap tech-concentrated S&P 500 index,” said Stephen Innes, managing partner at SPI Asset Management.

Clues to how central banks view these developments will be provided this week. The Federal Reserve will deliver its policy decision midweek, followed by the Bank of England on Thursday and the Bank of Japan Friday (local times).

Read: U.S. economy is trending in the Fed’s direction, so expect Powell to tread carefully next week

“The Fed decision on Wednesday is fully expected to result in a no-change decision, but crucially, the accompanying comments should give something of an insight into its current thinking,” said Richard Hunter, head of markets at Interactive Investor.

“With investors currently split on the outlook over the next year, the latest thoughts from the Fed could well prove to be market moving,” Hunter added.

See: Powell could still hammer U.S. stocks on Wednesday even if the Fed doesn’t hike interest rates

Also suppressing sentiment is the rising dollar

DXY

of late, according to Jonathan Krinsky, technical strategist at BTIG. “The three major cross-asset headwinds (dollar, rates, crude) continued their upward ascent last week, but it wasn’t until Friday that equities appeared to notice,” he said in a note.

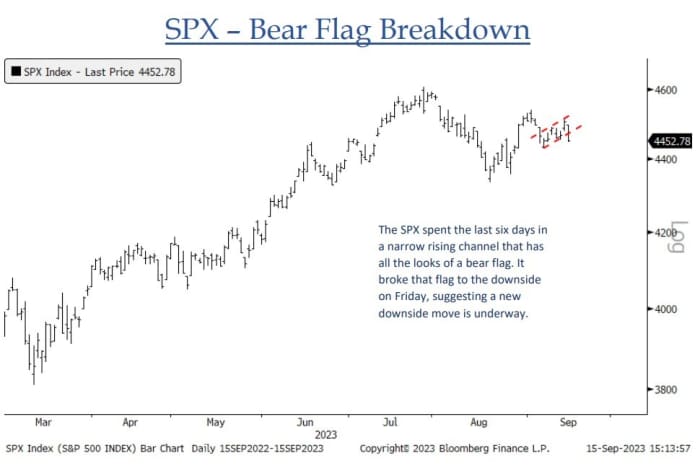

Source: BTIG

“With Friday’s weakness, the [S&P 500] is starting to break down from a bear flag while threatening its one-year uptrend. This is all occurring as we enter the worst part of the year seasonally, with this week down 26 of the last 33 years. Overall we think volatility is likely to expand as we head through a historically very rough period,” Krinsky added.

The stocks of the Big Three automakers — General Motors Co.

GM,

Ford Motor Co.

F,

and Chrysler owner Stellantis NV

STLA,

— were lower Monday, as workers continued their strike for higher pay and other benefits. The strike started early Friday after the carmakers failed to reach an agreement with the United Auto Workers.

Live blog: UAW set to resume talks with Ford, GM, Stellantis

U.S. economic updates set for release on Monday include the September home-builder confidence index, due at 10 a.m. Eastern time.

Companies in focus

-

Shares of DoorDash Inc.

DASH,

+3.10%

rose 0.9% after Mizuho upgraded the stock to buy. -

Dropbox Inc. shares

DBX,

-1.50%

fell 1.6% after a downgrade at William Blair.