This post was originally published on this site

It was a recovery for the Wall Street record books on Monday.

The Nasdaq Composite Index

COMP,

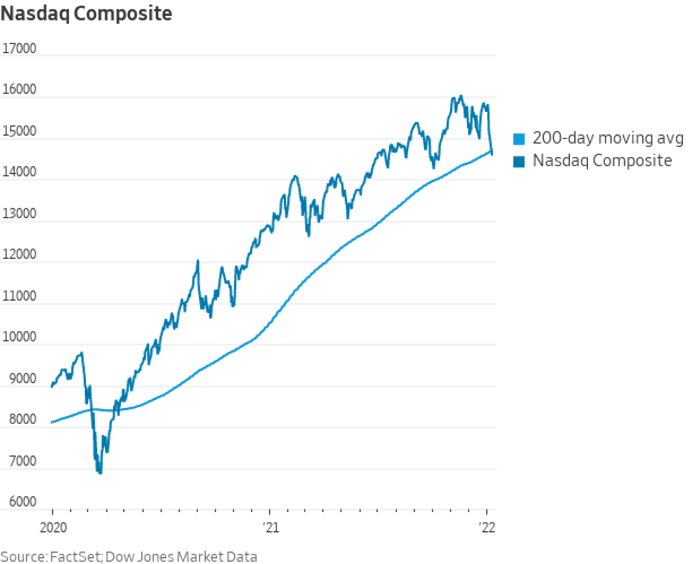

down 2.72% at its intraday low at 14,530.23, eked out a rally for the ages to bang out a finish in positive territory, which marked the largest comeback for the technology-laden index since Feb. 28, 2020, according to data compiled by Dow Jones Market Data.

Back in late February of 2020, the Nasdaq Composite fell 3.53% on an intraday basis, but ended the day up 0.01%.

Making the intraday rebound notable for the Nasdaq Composite was that the index’s slump was putting it at risk of closing in correction for the first time since March 8. The index, which finished at 14,942.83, needed to stay above 14,451.69 to avoid a correction from its Nov. 19 record close peak. A correction is commonly defined by market technicians as a 10% fall from a recent peak.

The powerful rebound for the Nasdaq Composite also saw the Dow Jones Industrial Average

DJIA,

and the S&P 500 index

SPX,

finish well off their worst levels of the day.

The rise in bond yields comes as investors are positioning for the prospect of higher interest rates as early as March, with parts of Wall Street joining many economists in saying the Federal Reserve has waited far too long to hike. Traders are also bracing for a consumer-prices report on Wednesday that could show a 7% headline year-over-year rise for December, and similar gains that won’t let up until the March reading.

The Nasdaq Composite also managed to avoid a close below its 200-day moving average which was at 14,688.73. The benchmark hasn’t closed below its 200-day MA since April 21, 2020, FactSet data show.

Dow Jones Market Data

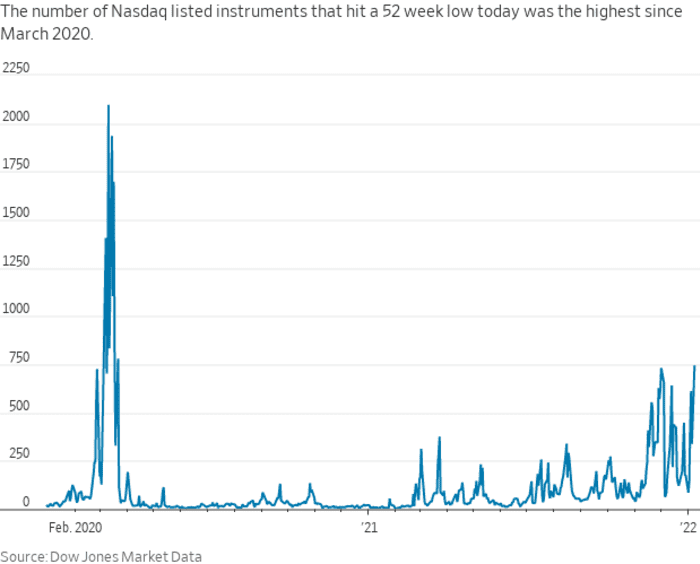

That said, the number of Nasdaq listed stocks that hit a 52-week low today was at its highest since March of 2020.

Dow Jones Market Data

—Michael Destefano and Tom Destefano contributed to this article