This post was originally published on this site

The rally in stocks to start 2023 hasn’t kept investors from pulling billions out of U.S. equity funds to start the year. But there’s a hitch.

While roughly $31 billion has left U.S. stock mutual funds and exchange-traded funds in the past six weeks, according to Refinitiv Lipper data, roughly the same amount has poured into bonds.

“For a lot of people, this is their first go at getting into bonds,” said Edward Moya, senior market analyst at OANDA, by phone on Monday. “There are a lot of people convinced that short term you are going to get some yield here.”

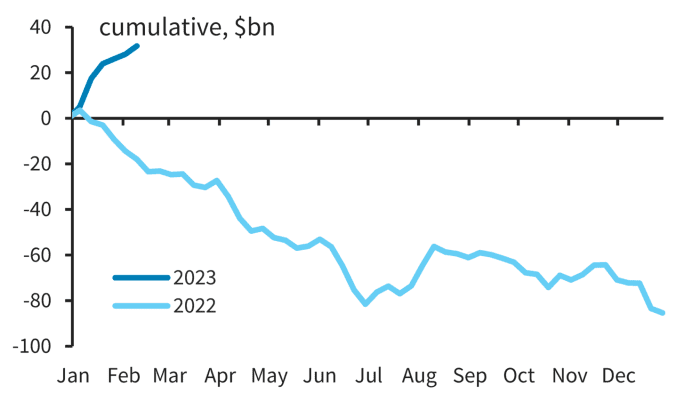

U.S. bond funds saw $32 billion of inflows on the year through Feb. 8 (see chart), a huge shift from their $18 billion of outflows over the same stretch of last year, according to Barclays data.

Funds are pouring back into bonds

EPFR, Barclays Research

High inflation and the Federal Reserve’s aggressive pace of interest rate hikes resulted in a punishing 2022 for investors in both stocks and bonds. Last year’s pain, however, has begun to be replaced by growing optimism around U.S. inflation that looks to be receding and by hopes that the Fed potentially may be nearing the end of its rate-hiking cycle.

Related: Bond Investing 101: What to know as the Fed sticks to its inflation fight

Economists recently have been warming to the idea that the U.S. economy could experience only a mild recession this year, or potentially to avoid one in a “no landing” scenario.

The Fed already has brought its policy rate to a 4.5% to 4.75% range, its highest since 2007. Fed officials have signaled rates could peak above 5% and stay high for some time, or until inflation looks poised to head down to its 2% annual target. The trajectory of inflation could still be a wild card for stocks and bonds, but all three major stock indexes are higher since January.

The Dow Jones Industrial Average

DJIA,

was up about 300 points on Monday and roughly 3.1% on the year, while the S&P 500 index

SPX,

was 7.6% higher to kick off 2023 and the rates-sensitive Nasdaq Composite Index

COMP,

had advanced almost 13.5% since January, according to FactSet data.

Still, appetite for bonds has ramped up with today’s higher starting yields. The “risk” free 2-year Treasury rate

TMUBMUSD02Y,

was at 4.5% on Monday, while the benchmark 10-year Treasury yield

TMUBMUSD10Y,

was near 3.7%, that compares with their one-year lows last March of about 1.3% and 1.7%, respectively, according to Dow Jones Market Data.

“The 2-year is at risk of staying above 4% for some time, as the Fed keeps up its inflation fight,” Moya said.

Read: CPI in the spotlight: Fed worried about sticky inflation

Similar strength in bond flows has been evident in exchange-traded funds, according to Matthew Bartolini, head of SPDR Americas Research, who pointed to seasonality tied to year-end tax implications that favor fixed-income over equities as likely playing a role.

Within bond ETFs, Bartolini said a standout has been the roughly $6 billion of flows that have gone into investment-grade corporate bond funds to start 2023, particularly with yields now over 5% in the sector, or the most since the global financial crisis.

The sector’s biggest such fund is the iShares iBoxx $ Investment Grade Corporate Bond ETF,

LQD,

with its shares up 2.5% on the year so far, according to FactSet.