This post was originally published on this site

Beware of potential romantic partners who are looking for money instead of love.

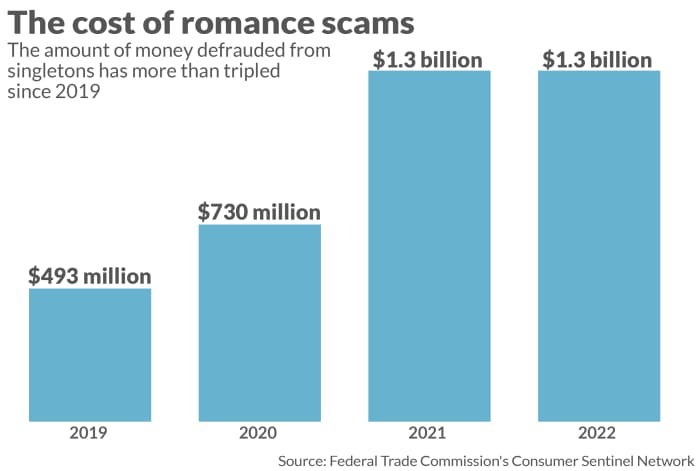

In 2022, nearly 70,000 Americans lost money to romance scams, up from 56,000 the year before, according to the Federal Trade Commission. People lost a total of $1.3 billion in 2022, broadly in line with the previous year, based on updated data, but up significantly from the $730 million lost in 2020.

For the first time, the agency included reports filed with the Internet Crimes Complaint Center in order to create a more comprehensive picture of how such scams work. The median loss for each case was $4,400, and people over age 70 were the most common victims.

“These scammers pay close attention to the information you share, and don’t miss a beat becoming your perfect match. You like a thing, so that’s their thing, too. You’re looking to settle down. They’re ready, too,” Emma Fletcher, senior data researcher at the FTC, wrote in the report.

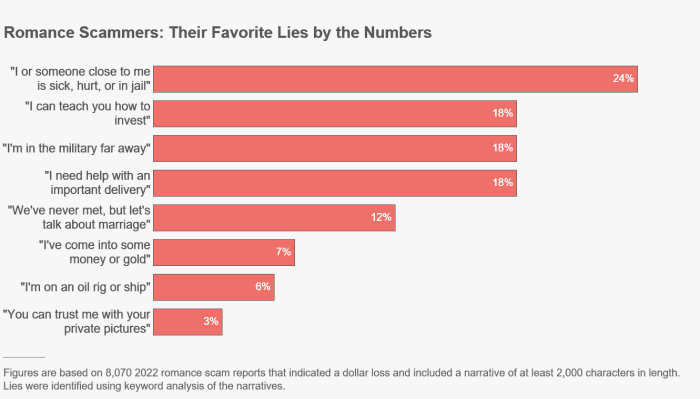

“But there is one exception — you want to meet in real life, and they can’t. Reports show their excuse is often baked right into their fake identity,” Fletcher wrote. “Claiming to be on a faraway military base is the most popular excuse, but ‘offshore oil rig worker’ is another common (and fake) occupation. In short, there’s no end to the lies romance scammers will tell to get your money.”

What’s the No. 1 lie told by scammers? They pretend there is an emergency with a friend or family member who is sick, hurt or in jail. This and other excuses may sound obvious, but many people may not be familiar with these scams or may be caught during a vulnerable moment. Or they may simply believe the person they are speaking with is a real potential love interest.

The next most common lies are “I can teach you how to invest,” “I’m in the military far away,” and “I need help with an important delivery.” In fifth place are scammers who talk about marriage even though they’ve never met the victim in person.

Source: FTC

Investing ‘tips’ and ‘sextortion’ are on the rise

Offering to do someone a “favor” by teaching them how to invest is one way scammers get people to part with their money, the FTC said.

The Federal Bureau of Investigation has said that there has been a notable rise in the number of people claiming to be cryptocurrency traders in recent years.

The bureau said those kinds of scams usually start with encounters on a dating app or a social-media platform. “In fact, 40% of people who said they lost money to a romance scam last year said the contact started on social media,” the FTC’s Fletcher said. “Nineteen percent said it started on a website or app. Many people reported that the scammer then quickly moved the sweet talk to WhatsApp

META,

Google Chat

GOOG,

or Telegram.”

The scammer might actually let the victim withdraw a small amount of money as a “profit” on their investment in order to gain their trust and convince them to invest more money.

“After the successful withdrawal, the scammer instructs the victim to invest larger amounts of money and often expresses the need to ‘act fast,’” the FBI warned. “When the victim is ready to withdraw funds again, the scammers create reasons why this cannot happen.” The victim is informed that additional taxes or fees need to be paid, or that the minimum account balance has not been met to allow a withdrawal, the agency added.

Another trick: Scammers convince victims to send explicit photos and then threaten to publicly release the pictures unless they pay money. Although only 3% of romance scams involve what’s known as “sextortion,” this form of blackmail has increased eightfold since 2019. These victims were most likely to be 18 to 29 years of age, with people in that age group six times more likely to report sextortion than those who are 30 years or older.

Scammers want you to send money via cryptocurrency

“All scammers, not just romance scammers, want to get your money quickly. And they want your money in a way that makes it hard for you to get it back,” the FTC said.

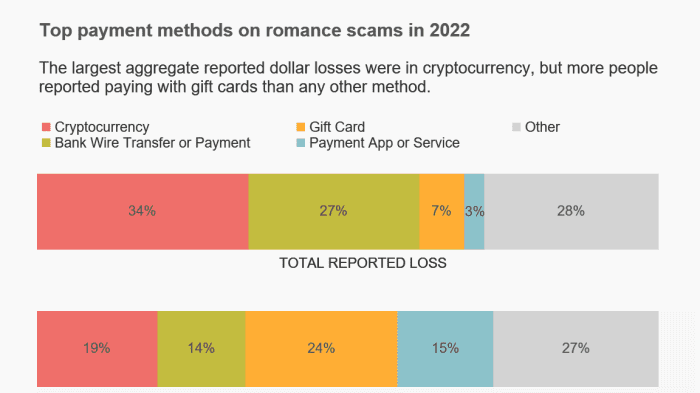

Many scammers want to be paid is in cryptocurrency, which accounts for 34% of losses. The median crypto loss for an individual to romance scammers is around $10,000, according to a June 2022 report by the FTC.

Gift cards are most often used to send money to scammers, with 24% of victims sending money this way. Scammers may ask the victim to put money on gift cards from Amazon

AMZN,

or Google Pay, and then ask for the PIN codes, the FTC added.

How do you detect a scammer? Be wary if someone doesn’t show their face on video or if they are calling from an overseas number — but remember that domestic phone numbers can also be faked. Experts recommend doing a reverse image search of profile pictures, and keeping friends and family informed.

The bottom line, according to the FTC: “Never send money or gifts to a sweetheart you haven’t met in person.” And if even if you have met someone in person, if that person suddenly needs money, that too is a red flag, experts say.

Report suspicious profiles or messages to the dating app or social-media platform, and contact the FTC at ReportFraud.ftc.gov. If someone is attempting to extort you, report it to the FBI. The FTC has more information here on romance scams.

Source: FTC