This post was originally published on this site

Feb. 3 was a red-letter day for S&P 500

SPX,

index investors. That day, shares of Facebook’s parent, Meta Platforms

FB,

plunged more than 26%.

If you held shares in the equal-weight index of the S&P 500

SP500EW,

Meta Platforms’s decline didn’t impact you like it did for shareholders in the more traditional capitalization-weight S&P 500. The weight of Meta Platforms’ stock in the equal-weight index is just 0.2%, whereas in the cap-weighted version the stock had almost 10 times the weight.

Accordingly, on Feb. 3 the Invesco S&P 500 Equal Weight ETF

RSP,

beat the SPDR S&P 500 ETF

SPY,

by 1.1 percentage points — an unusually large difference for just one day.

Yet cap-weighted strategies can also reward. For example, on Feb. 4, shares of Amazon.com

AMZN,

shot up more than 13%. Amazon also is one of the largest-cap stocks in the S&P 500. For that session, the cap-weighted S&P 500 beat the equal-weight version by 0.6 of a percentage point.

It’s not unusual for the relative returns of the equal-weight and cap-weight versions of the S&P 500 to flip back and forth like this. Since the end of 2019, in fact, the equal-weight S&P 500 has beaten the cap-weight version in 49.6% of the trading sessions and lagged 50.4% of the time. That’s about as close to a coin flip as you see in the chaotic world of Wall Street.

Longer-term trends

Over the longer term, the equal-weight S&P 500 has beaten the cap-weight version. Since 1971, according to data provided by S&P Dow Jones Indices, the equal-weight S&P 500 has outperformed the cap-weight version by 1.5 annualized percentage points.

Importantly, the equal-weight version has produced this higher return with greater risk, at least as measured by the volatility of returns. As a result its risk-adjusted performance is less impressive. In fact, the equal-weight index’s Sharpe Ratio is identical to that of the cap-weight version.

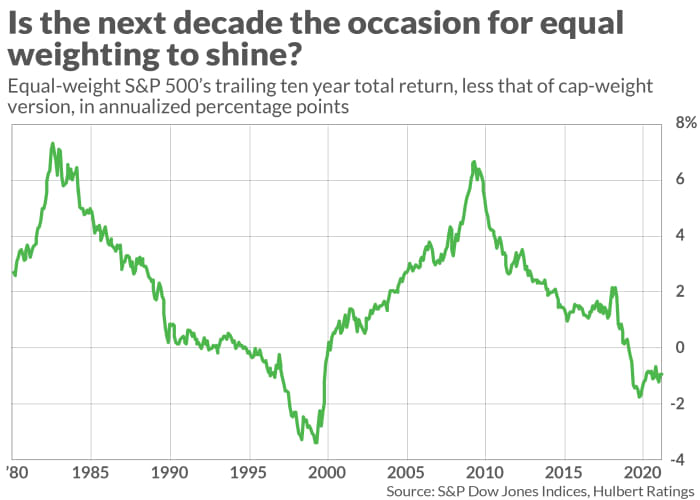

The chart above plots the difference between these two indices for trailing 10-year returns. Notice that, over the past four years, this difference has waxed and waned according to a decade or longer cycle. The cap-weighted version has outperformed over the past decade, leading some to believe that the tide is about to turn in favor of the equal-weight version.

To get more insight into what causes the equal-weight S&P 500 index to beat or lag the cap-weight index, I measured how sensitive the two versions are to the major stock market risk factors that are the components of the famous Fama-French model (named for University of Chicago finance professor and Nobel laureate Eugene Fama and Dartmouth College’s Ken French). Based on the experience of the past five decades, I found that the equal-weight S&P 500 tends to outperform when:

- The overall U.S. stock market is rising

- Stocks with the lowest market caps are outperforming those with the largest

- Value stocks (those with low price/book ratios) are beating growth stocks (those with high price/book ratios)

- Stocks of conservative companies (those that invest a smaller proportion of their income in major new growth projects) are beating those of aggressive companies (those that invest a higher proportion)

- Contrarian strategies are beating momentum strategies (recent losers are proceeding to outperform recent winners)

Rarely do all five factors point in the same direction, which makes it even more difficult than usual to make predictions. But over the past decade, three of these five factors worked against the equal-weight version, and sure enough the cap-weighted index beat the equal-weight version by 1.2 annualized percentage points.

The bottom line? If you think the overall U.S. market will have a rougher ride in coming years than it did in the past decade, or that small-cap stocks will beat the large caps, conservative value stocks will beat aggressive growth stocks, or that contrarian strategies will outperform momentum approaches, you should consider favoring an equal-weight index fund.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Meta stock hits 52-week low as European leaders buck at threats to shutter Facebook and Instagram

Also read: Stock-market bounce: Why it’s ‘too soon to go all in’ on buying the dip