This post was originally published on this site

Bond market pessimism has become so extreme that a rally is a distinct possibility.

Pessimism about bonds has been at extreme levels for several months now and the market has stubbornly refused to rally. What’s different now is the willingness of a few (though a growing number of) brave advisers to buck the consensus. Rather than falling over themselves proclaiming how awful bonds’ prospects are, more and more bond advisers are beginning to tiptoe in the direction of being less bearish — if not outright bullish.

In focusing on the potential power of this emerging narrative, I have in mind research from Yale University finance professor (and Nobel laureate) Robert Shiller. In his latest book, Narrative Economics, Shiller argues that the stories that we tell ourselves affect not only our individual behavior but our collective behavior as well. By paying attention to these narratives, we can improve our ability to forecast the markets.

The emerging bullish narrative about bonds has hardly gone viral — at least not yet. Most of the bond market headlines in the financial press still focus on how awful the year-to-date period has been for fixed-income investors. Nevertheless, in recent days I’ve noticed a distinct shift among the bond market advisers I monitor.

Their bullish arguments fall into four major categories:

- Inflation: A growing number of advisers are now referring to “peak inflation.” Earlier this week, in fact, even Fed chairman Jerome Powell acknowledged that the Consumer Price Index’s trailing 12-month rate of change may have peaked with the U.S. Labor Department’s Apr. 12 report — at 8.5%. If inflation does decline, the Federal Reserve would feel less pressure to raise interest rates as aggressively as the market currently expects.

- Economy: The odds of a recession have grown in recent weeks. One of many straws in the wind suggesting a recession is the inversion (or near-inversion) of the yield curve. Goldman Sachs now puts the odds of a recession at 35% within the next 24 months. If a recession were to occur, bonds almost certainly would rally.

-

Technical: When judged according to past rate-hike cycles, interest rates may have already risen enough, according to Joe Kalish, chief global macro strategist at Ned Davis Research. Since March 16, when the Fed began the current rate-tightening cycle, the 10-year Treasury yield

TMUBMUSD10Y,

2.914%

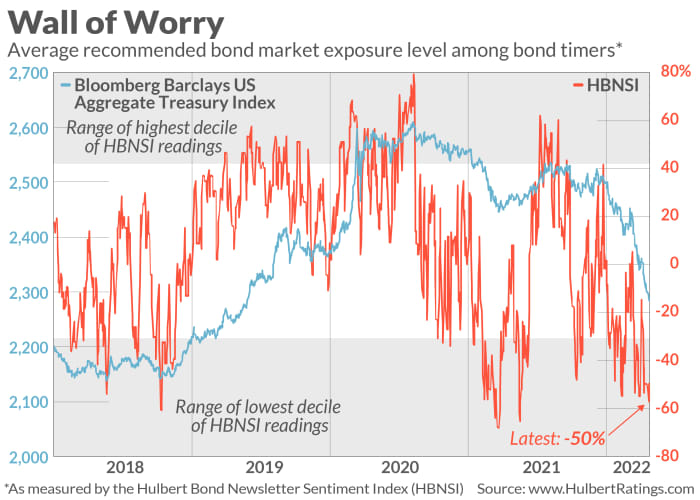

has risen 75 basis points, or 0.75%. That exceeds the median increase of 61 basis points during the entirety of previous Fed tightening cycles, according to Kalish’s calculations. Technical analysts Mary Anne and Pamela Aden reach the same conclusion through their analysis of interest rates’ long-term trends. They predict that “long-term interest rates are unlikely to rise much further and they’ll soon turn down.” - Sentiment: Though bond-market timers have been incredibly pessimistic for several months now, it’s important to acknowledge their pessimism since it means that when the bond market turns up, the rally will be resting on a solid sentiment foundation. The chart below plots the average recommended bond-market exposure level among a subset of several dozen bond market timers my firm monitors (as measured by the Hulbert Bond Newsletter Sentiment Index, or HBNSI). Notice that the HBNSI has been low for some time now. For a couple of months straight it has remained in, or close to, the bottom decile of the historical distribution—the range that in previous columns I have used to identify excessive bearishness.

The bottom line? The bond market has absorbed an enormous amount of bad news. The tide may soon turn.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com