This post was originally published on this site

Would you like to have advance knowledge of what the S&P 500’s earnings per share will be for the quarter ending Dec. 31? Of course you would.

With such foresight you’d have a big jump on the rest of the market. It will be February 2022 before we know what the S&P 500’s

SPX,

EPS will be for the fourth quarter. We still don’t yet know what the S&P 500’s EPS were for 2021’s third quarter.

In fact, though, according to a study I conducted of the S&P 500 since 1871, such advance knowledge would have done you little good. It’s not clear that it would have enabled you to beat a simple S&P 500 index fund.

The reason I conducted the study was to provide a reality check on a recent narrative that is gaining traction: the stock market won’t suffer a major decline so long as the U.S. economy and the S&P 500’s earnings per share are growing.

This certainly is a convenient narrative for the bulls, since both the U.S. economy and EPS are increasing. Standard & Poor’s, for example, projects that the S&P 500’s trailing four-quarter EPS will grow uninterrupted through at least the end of 2022.

Unfortunately for the bulls, a growing U.S. economy and rising EPS do not immunize them against a decline or bear market.

Consider first what I found upon correlating yearly changes in the inflation-adjusted S&P 500 and real U.S. GDP. It turns out that there have been 36 calendar years since 1871 in which the stock market declined even though the economy was growing — 24% of the years. Equity investors therefore are kidding themselves if they think a growing economy protects them from losses.

The deflation of the internet bubble is a perfect example. Real GDP grew in each of the years 2001 and 2002, and yet both the inflation- and dividend-adjusted S&P 500 suffered double-digit losses in each.

I found something similar when looking at earnings. Since 1871 there have been 22 calendar years in which the U.S. stock market declined even though inflation-adjusted earnings per share grew — 15% of the time.

Why would the stock market decline if the economy and EPS are growing? The answer traces to fluctuations in the price/earnings ratio: The stock market’s level is a function not just of EPS but also of its P/E multiple. Needless to say, if that multiple decreases, the stock market can go down even if EPS increase.

Market timing

This also explains why a market timer with advance knowledge of EPS would have difficulty beating the market.

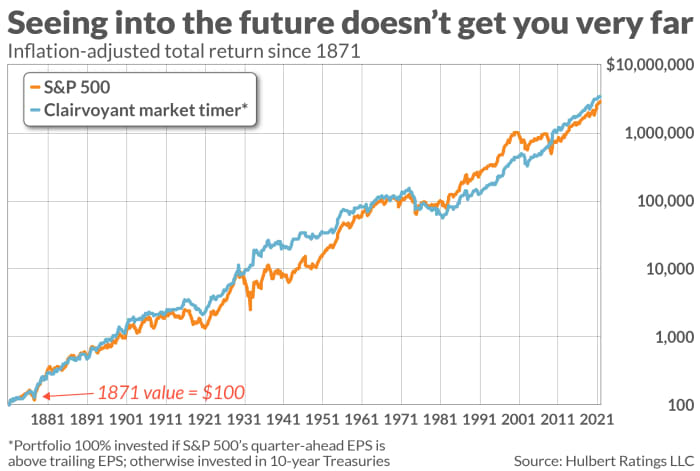

Consider a hypothetical portfolio that switched between the S&P 500 and 10-year Treasurys

TMUBMUSD10Y,

according to whether the S&P 500’s quarter-ahead EPS would be higher or lower than its trailing EPS. Portfolio switches occurred only once per quarter, at the quarter end.

The chart below reports this hypothetical portfolio’s return alongside that of the S&P 500. Notice that the two return series are neck-and-neck over the 150-year period: the S&P 500 produced an inflation-adjusted total return of 7.1% annualized, in contrast to a 7.2% annualized return for the hypothetical portfolio.

Given that I didn’t make any adjustment for transaction costs, I’m confident that the hypothetical market timing portfolio did not come out ahead of buying and holding— and most likely came in well behind.

None of this discussion implies that the economy and corporate profits are not important. But they are only a piece of the puzzle, and sometimes a surprisingly small one. For example, the S&P 500’s P/E ratio a decade ago was half of where it stands today. So this index would be trading at around 2,200 today but for the P/E’s expansion — despite robust growth in EPS along the way.

The bottom line? There’s a superficial believability about the narrative that the stock market can’t suffer a significant decline if the economy and corporate profits are growing. But like so many Wall Street tales, this one can’t withstand historical scrutiny.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: The 2021 stock-market highs are ‘almost certainly’ in, unless earnings clear this bar