This post was originally published on this site

Wall Street is wobbling as we close in on earnings season, which begins in earnest tomorrow. Barring supply-chain woes and labor problems, companies could add to a record-breaking year, but that’s a big “if.”

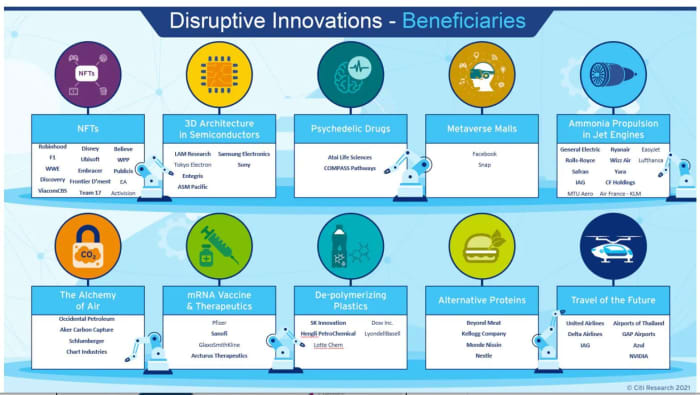

Our call of the day from a team of more than 20 Citigroup strategists led by Michael Ashford takes us into the hopeful future, with 10 new innovation ideas and accompanying long-term stock ideas to think about.

“A few of the “new” concepts may not seem quite that new — e.g., alternative proteins and psychedelic drugs — but new technology and increased acceptance could make them game-changers,” says the report.

-

3-D architecture in semiconductors. Citi says technical complexity in the fabrication— manufacturing of those devices process may, strengthen market leaders’ edge. Its top pick here is Samsung Electronics

005930,

-3.50% ,

with LAM Research

LRCX,

+0.41%

and Entegris

ENTG,

+1.13%

also exposed. -

AI airline surveillance. Artificial intelligence coming to your next flight could gauge temperature, pulse rates, etc. to detect contagious infections or intoxication. Global network airlines, with high international exposure relative to low-cost peers, should be at the forefront. Citi’s long-term picks include Delta Air Lines

DAL,

-0.44%

and Azul

AZUL,

-2.66% . -

Alternative proteins. Over time, Citi sees more consumers shifting to alternative meats for health or climate change reasons. Beyond Meat

BYND,

+1.12%

and Kellogg

K,

+0.11%

are most exposed to growth of alternative meats, says the bank. -

Ammonia propulsion in jet engines. In the race to reduce aviation emissions, ammonia is one solution that’s cheap and feasible. Green ammonia is still some ways away, and Citi sees several zero/low emissions solutions as winners. Its future ammonia plays include Yara

YAR,

-1.18% ,

CF Holdings

CF,

+1.77% ,

GE

GE,

-0.61%

and International Consolidated Airlines

IAG,

-3.33% . -

De-polymerizing plastics. Advanced chemical recycling systems is seen as a solution to help eliminate plastic waste from landfills, replacing current mechanical recycling systems. Citi sees opportunity for plastic resin producers Dow

DOW,

-0.82% ,

LyondellBasell

LYB,

-0.55%

and Arkema

AKE,

-0.27% . -

Direct air capture. Citi expects the process that captures carbon straight from the air to be a key party of energy transition strategies, and require governmental support. Top picks here include Occidental Petroleum

OXY,

-0.71%

and Aker Carbon Capture

ACC,

-1.68% . -

Metaverse malls. In the future of the internet, virtual stores will sell both digital and physical products to consumers who divide their time in both worlds, thanks to smartphones, virtual reality headsets and augmented reality glasses. Facebook

FB,

-1.39%

and Snap

SNAP,

-1.96%

are two ways to play this, says Citi. -

mRNA vaccines. A year ago, the leading technology for COVID-19 vaccines was viewed as largely unproven, and now trials are under way to treat several infectious diseases, with genetic diseases and even cancer among future possibilities. Sanofi

SNY,

-0.67% SAN,

-0.94% ,

Arcturus

ARCT,

+1.56%

and Pfizer

PFE,

-0.92%

are among Citi’s top picks. -

Nonfungible tokens – NFTs. Beneficiaries include companies or individuals whose main business is selling content or branded goods, one that enables the creation, minting, staking, sharing or trading of NFTs in the secondary market, and service companies that help content creators navigate this new ecosystem. Beneficiaries include Robinhood

HOOD,

+0.69% ,

Discovery

DISCA,

-2.78% ,

Disney

DIS,

-1.82% ,

WPP

WPP,

+0.21% WPP,

-0.43%

and Publicis

PUB,

-1.09% . -

Psychedelic drugs is Citi’s last disruptive idea. “Despite their checkered history, psychedelic drugs such as LSD, psilocybin (“magic mushrooms”), and DMT (ayahuasca) are making a comeback, and could revolutionize the mental-health treatment paradigm. Top picks include ATAI Life Sciences

ATAI,

+0.24%

and COMPASS Pathways

CMPS,

-1.21% .

Here’s a visual on all that:

The buzz

CureVac shares

CVAC,

are tumbling after the German biopharmaceutical group said it’s scrapping plans for a COVID-19 vaccine and will focus on developing second-generation mRNA shots with GlaxoSmithKline

GSK,

Tesla

TSLA,

reportedly sold a record number of its electric cars in China last month.

On the earnings front, industrial distributor Fastenal

FAST,

reported earnings in line with expectations and just beat on sales. JPMorgan

JPM,

hitting Wednesday and more big names throughout the rest of the week.

A short selling research firm says it has covered its bet against movie-theater chain AMC Entertainment

AMC,

at a profit, but it may not be done placing bets.

Dogged by labor shortage worries, a closely watched small-business confidence gauge hit a six-month low in September. We’ll also get job openings and the International Monetary Fund’s world economic outlook. Consumer prices are coming Wednesday and retail sales Friday.

Read: The 2021 stock-market highs are ‘almost certainly’ in, unless earnings clear this bar

Beijing is probing whether financial firms and regulators have been getting too cozy with private companies such as Alibaba’s

BABA,

Ant Group and ride-hailing group Didi

DIDI,

And another China property company, Sinic Holdings, may be veering into default.

Meanwhile, China’s coal futures hit another record amid massive, deadly floods in the country’s important northern mining region.

Listen to MarketWatch’s new podcast — The Best New Ideas in Money.

The markets

Stock futures

ES00,

NQ00,

are on the fence, following losses across Asia

000300,

HSI,

U.S. crude remains above $80 a barrel. Bitcoin is trading just over $57,000, brushing off JPMorgan CEO Jamie Dimon’s “bitcoin is worthless” comments.

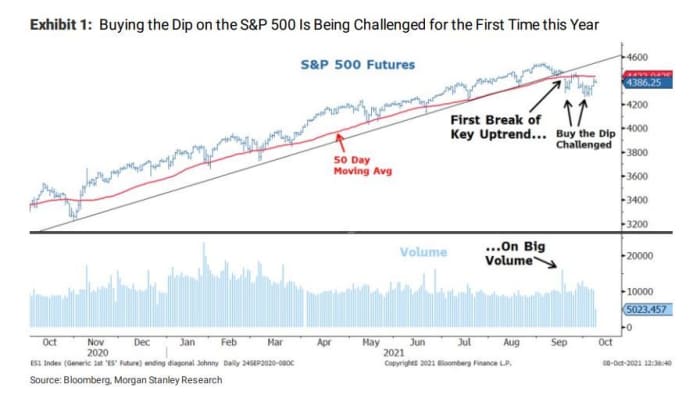

The chart

Buying the “Evergrande dip is the first one this year that has immediately paid off,” for investors, notes Mike Wilson, Morgan Stanley’s equity strategist, who provides the above chart in a note to clients. And it’s a key question to ask going forward — will the retail community keep buying that dip, he says.

“We think it depends on how fast the market can reclaim prior support. The sooner the better because earnings season is unlikely to provide the necessary catalyst,” he says.

Random reads

A Colorado elk with a tire around his neck is finally free of it after four years.

How is life for Americans under President Joe Biden? Thousands respond to this Redditor’s question.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.