This post was originally published on this site

Labor is back. While familiar political feuding is a result —the left elated, the right dejected — investors are taking note and corporate America should make the most of it.

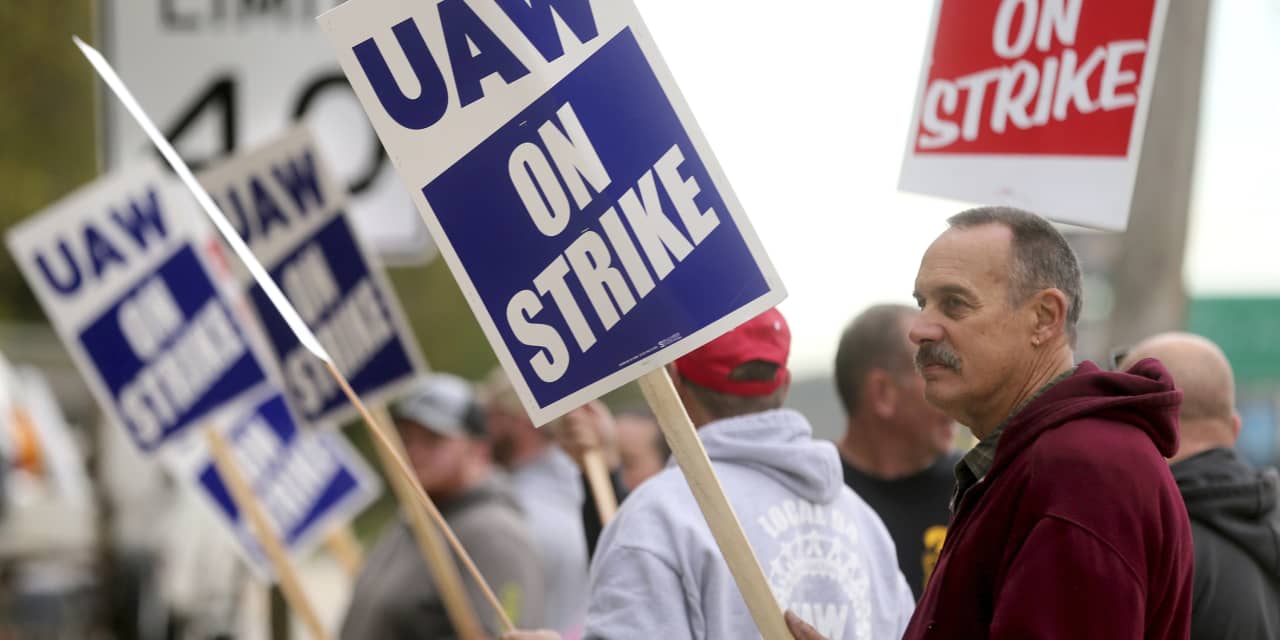

Unions are mounting strikes nationwide, from large employers such as Deere

DE,

Kellogg, and Volvo to niche groups such as Connecticut group home workers, Seattle carpenters and Reno bus drivers. Nonunion workers from Amazon.com

AMZN,

to Starbucks are winning too, on topics spanning job training to college tuition.

Labor is flexing this muscle amid an unusually favorable job market. Employers face labor shortages as companies are having a hard time getting replacements while employees are easily finding other jobs.

Participants assert different viewpoints about the economics of such labor advances. Unions complain that corporate America funnels an unfair share of corporate profits to stockholders. Companies counter that pay raises hurt customers since higher wages result directly in higher prices.

Such positions erroneously declare corporate life to be a zero-sum game with all constituents antagonizing each other. But the opposite is more often true. At some of America’s best companies, well-treated employees increase the value of a company’s products, customers willingly pay for the added value, and resulting increased profits add shareholder value.

Companies known for practicing such a triple-value business model include these top performers:

· First Republic Bank

FRC,

whose relationship managers take personal banking to the highest levels.

· Nordstrom

JWN,

the department store whose clerks are famous for customer service.

· Sherwin Williams

SHW,

the paint company whose staff cultivate valuable long-term relationships with customers.

The triple play at such companies delivers for shareholders. These companies all rank highly for attracting quality shareholders — the most patient and focused investors.

While each company is unique, those completing the triple play all tend to boast a variety of intangibles that add substantial value. For customers, intangibles include brand quality, product guarantees and supportive service, which even the price-conscious pay up for. Among workers, intangibles include job satisfaction, skills training and promotion opportunities, advantages some even trade for lower pay.

Quality shareholders, who discern competitive advantages, have long focused on such distinctively valuable corporate cultures. When workers align to deliver for customers, both win, as do shareholders.

The triple play holds lessons for the current labor discourse. Employers can improve their attractiveness by developing a culture that appeals to particular employees, so that factors beyond pay and benefits matter. Employees can highlight the intangibles that would support such an alignment. Some examples:

· Volvo

VLVLY,

: At a car maker famous for safety, the triple play could mean factories boasting the best safety records in industry. In their recent contract renewal the sides settled on hourly wage increases while also boasting that the contract gives workers “great quality of life.” Aligning worker safety to product safety would be an obvious way to deliver on that boast.

· Kellogg

K,

: In a recent standoff, the food company touted annual pay of $120,000 while the union observed that includes overtime from 80-hour weeks, with base pay half that. For a company needing to cater to today’s health-conscious food customer, it may be more valuable to cultivate and reward a healthy workforce —cap overtime and add perks like exercise breaks, gyms or yoga classes.

· Starbucks

SBUX,

: Some staffers at the coffee shop chain are agitating to form a labor union, seeking both higher pay and stronger training. For a company whose business strategy is to promote its shops as recognized gathering spots, interest in employee training is a natural part of the triple play. Train baristas in community-building customer service, get them to love their jobs, and thereby entice more customers, sell more goods, and earn more profits.

The list could go on, from meeting the requests of Reno bus drivers and letting them help determine the best route schedules or giving Hollywood production staff downtime during shows to reflect and develop their talents. Anywhere companies can align employee culture with corporate mission, the triple play awaits.

Not since the 1970s has labor been so volatile. Managers should consider this an opportunity to engage their workforces on a new level and embrace the triple play, not talk as if business is zero-sum. While labor strife at a company can still be a red flag of caution for investors, quality shareholders are likely to reward companies that do so. Investors have long been beneficiaries of the triple play, and a labor revival may make that business model more important than ever.

Lawrence A. Cunningham is a professor at George Washington University, founder of the Quality Shareholders Group, and publisher, since 1997, of “The Essays of Warren Buffett: Lessons for Corporate America.” For updates on Cunningham’s research about quality shareholders, sign up here.

More: Stock investors want companies on board with ESG — but principles have a price