This post was originally published on this site

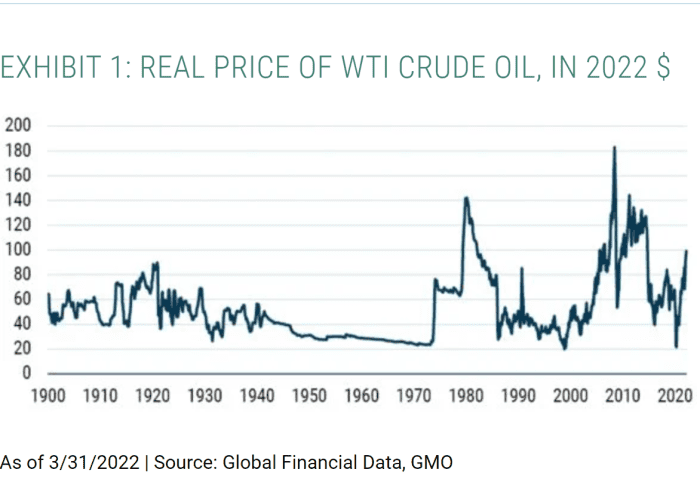

“‘In the West, historically, major spikes in the price of oil like today’s have always preceded or triggered recession. A recession would likely interrupt the rise in commodity prices temporarily, but in the longer term it seems nearly certain that the trend in resource prices will continue to rise.’”

That’s legendary investor Jeremy Grantham, co-founder of GMO, sounding a warning on recession in a Wednesday note. Grantham, who is credited with foreseeing the collapse of the dot-com bubble and the 2008 financial crisis, warned earlier this year that the U.S. economy was approaching the end of a “superbubble” spanning stocks, bonds, real estate and commodities.

Read: Here’s the first Wall Street recession call of the new inflation era

Oil futures had already risen sharply since last fall to trade at their highest levels since 2014 before Russia’s Feb. 24 invasion of Ukraine. Crude shot higher on fears of supply disruptions from Russia, with the U.S. benchmark

CL.1,

briefly trading above $130 a barrel in early March as it and global benchmark Brent crude

BRN00,

traded at 14-year highs.

GMO

Russia is one of the world’s largest producers. Western nations levied sanctions against Moscow and market participants increasingly avoided Russian crude even though measures were designed to spare the country’s energy flows. The U.S. and U.K. subsequently moved to block imports of Russian oil, while the European Union has dragged its feet given the continent’s outsize reliance on Russian supplies. The oil market has remained volatile, featuring wide price swings.

West Texas Intermediate crude traded Wednesday near $96.26 a barrel, while Brent crude changed hands near $101 a barrel. WTI closed at $92.10 the day before Russia’s invasion, while Brent had finished at $94.05. Surging commodity prices have stoked worries over inflation that was already running at nearly 40-year highs.

U.S. stocks have lost ground in 2022 as the Federal Reserve has signaled it will move aggressively to further raise interest rates and otherwise tighten monetary policy. The Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

were on track for a third straight losing session Thursday as investors digested the central bank’s plans to begin shrinking its balance sheet as early as next month.

Grantham’s warning on oil prices and recession was part of a broader discussion of commodity prices and what he termed the destructive growth in the use of physical assets. He noted that an equal-weighted index of 36 key commodities had seen a 100-year trend of declines, before reversing.

Need to Know: The stock market is behaving a lot like it did during the Iraq war. Here’s the future if the pattern continues.

“After the year 2000, the trend changed and prices began to rise under the pressure of unrelenting growth in China, whose global share of important commodities, such as iron ore, cement, and coal, rose to 50% by 2013 from around 5% in 1980, by far the most impressive leap in history,” he wrote, adding that “the long demand surge of global development will drive repeated commodity boom cycles for many decades to come.”

And as humanity faces the “urgent, even existential need to decarbonize the economy, we should realize a major and unexpected irony: large-scale deployment of windmills, solar farms, and transmission lines will be spectacularly resource intensive,” he wrote.

But Grantham isn’t without hope.

“We need to develop a much-increased emphasis on the quality of life, including enhanced protection for what is left of our natural systems, and an emphasis on the quality of our products as opposed to the quantity,” he wrote. “Quality goods will emphasize long life, repairability, and recyclability by design. With this shift in emphasis, together with a new level of innovation, we might make it to real sustainability.”