This post was originally published on this site

Escalating pricing pressures, stemming partly from the COVID-induced supply-chain bottlenecks, are rippling around the globe and forcing central banks to adopt a more combative monetary-policy stance, and the recent surge in prices isn’t lost on those in corners of the market who ordinarily would ignore macroeconomic trends.

On Wednesday, technology luminary and bitcoin evangelist Jack Dorsey quipped that U.S. inflation seemed far from transitory in the most recent report issued by the government.

Dorsey’s tweet, in response to another from macroeconomic specialist and cryptocurrency enthusiast Lyn Alden, featuring a chart of the surge in consumer prices, comes after a reading of consumer inflation hit 7%.

The Labor Department said the consumer-price index—which measures what consumers pay for goods and services—rose 7% in December from the same month a year ago, up from 6.8% in November, marking the fastest pace since 1982 and the third straight month in which inflation exceeded 6%.

Dorsey’s comments may be a not-so veiled reference to Federal Reserve Chairman Jerome Powell and other policy makers and economists, who had persistently referred to this current bout of inflation as a pandemic-led phenomenon that was going to be “transitory” or short-lived.

In testimony in front of the Senate Banking Committee back in November, however, Powell declared it high time to retire the word “transitory,” which had become a vexation for the U.S. central banker because its meaning wasn’t clearly articulating how Fed viewed transitory.

“We tend to use [ transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Powell told Senate lawmakers back in November. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

Average Americans, however, are increasingly homing in on the term and trying to discern its impact.

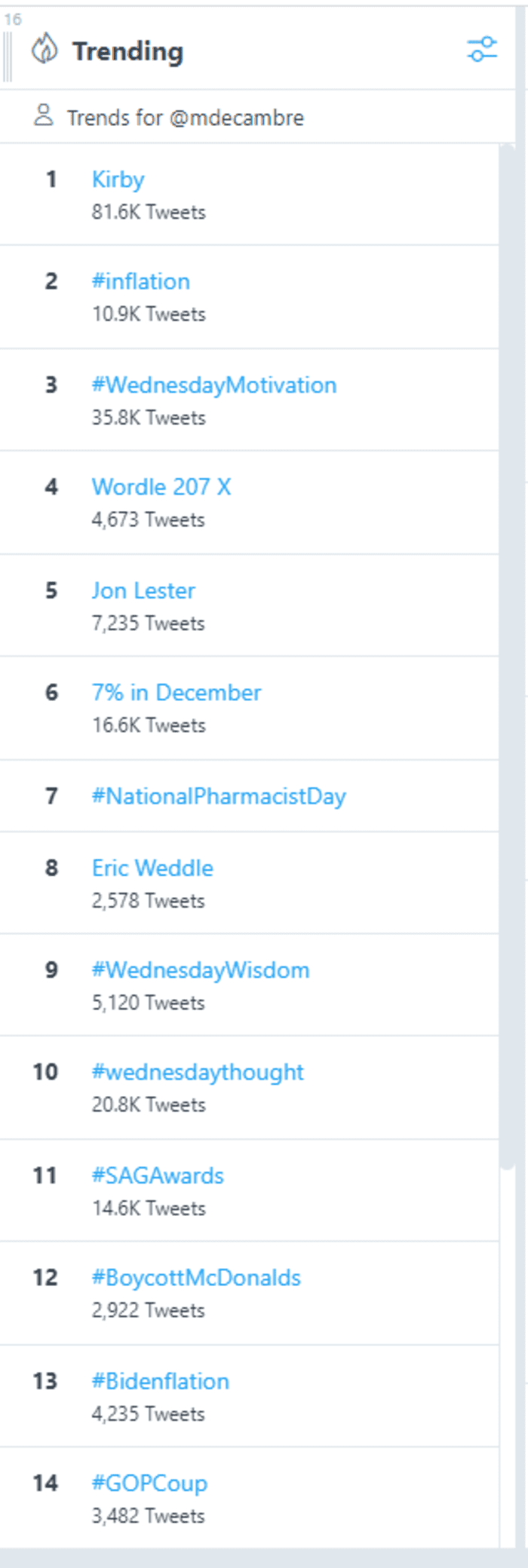

On Tuesday, the term inflation was one of the top trending terms on Twitter, within the top 2, at last check:

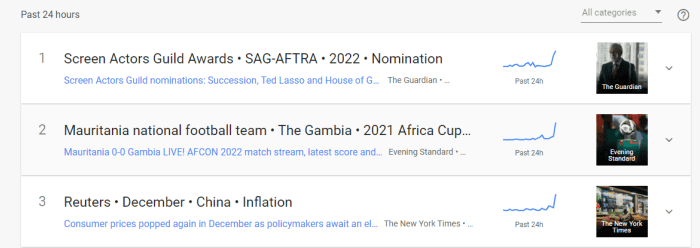

And it was a top three trending search term on Google over the past 24 hours as well.

Dorsey, who runs Block Inc.

SQ,

(nee Square Inc.), is a booster of digital currencies such as bitcoin and ether

ETHUSD,

with many sharing the view that those virtual assets could help to mitigate the impact of inflation.

Meanwhile, the market was finding it hard to find its footing, with many investors betting that the Fed will lift interest rates at least four times in 2022 as it wrangles with inflation. The Dow Jones Industrial Average

DJIA,

the S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

have been flipping between gains and losses on Wednesday, while Dorsey’s company Block Inc. also has seen lackluster trade on the session.

Bitcoin was changing hands at around $43,600, up nearly 2%, while Ether on the Ethereum network was enjoying a nearly 4% rise to about $3,370.

Dorsey in October tweeted that “hyperinflation” — defined as rapid and unrestrained price increases running at a rate of 50% a month or higher — would “change everything.” Those remarks got pushback from economists and others, including a detailed rebuttal from Ark Invest founder Cathie Wood.

See: Cathie Wood says Jack Dorsey’s ‘hyperinflation’ call is off the mark