This post was originally published on this site

AMC Entertainment Holdings Inc. Chief Executive Adam Aron let everyone know his New Year’s resolution for the company, and while he wasn’t sure he could follow through with it, he said he would “try very hard.”

““If we can, in 2022 I’d like to refinance some of our debt to reduce out interest expense, push out some debt maturities by several years and loosen covenants.””

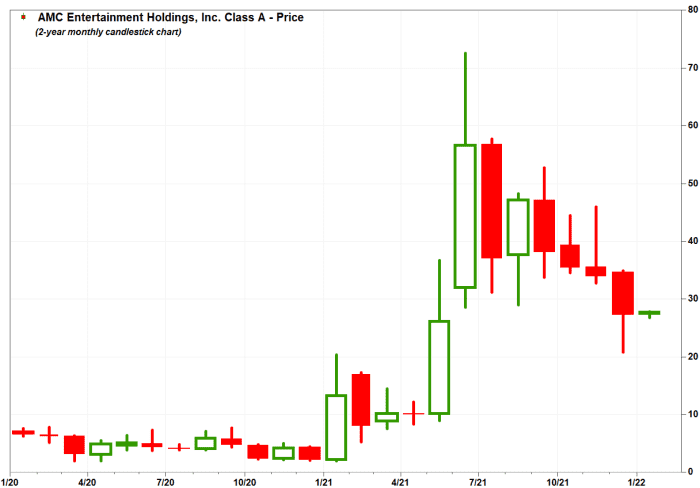

The meme stock

AMC,

rallied 2.2% in morning trading Monday, after dropping 19.9% in December, and tumbling 42.3% amid its current four-month losing streak.

Aron said that in early 2021 and 2020, the movie theater operator “took on debt at high interests to survive,” but with the company in an “improving financial position,” one of the goals for 2022 is to strengthen its balance sheet.

That said, Aron admitted there was a possibility he will not be able to keep to his resolution.

“There is no guarantee of success, but we will try very hard to get this done,” Aron said. “We are always thinking of creative ways to make AMC’s future more secure.”

The latest quarterly filing showed that AMC had $5.5 billion in corporate borrowings and lease obligations as of Sept. 30. That included a senior secured credit facility-revolving credit facility due 2024 with a 10.75% interest rate in year one, and first lien notes due 2025 and 2026, both with interest rates of 10.5%.

Credit rating agency S&P Global Ratings currently rates AMC at CCC+, which is seven notches deep into speculative grade, or “junk” status.

FactSet

AMC’s stock has rocketed 1,211% over the past 12 months, while shares of fellow movie theater operator Cinemark Holdings Inc.

CNK,

have lost 1.5% and the S&P 500 index

SPX,

has gained 27.4%.