This post was originally published on this site

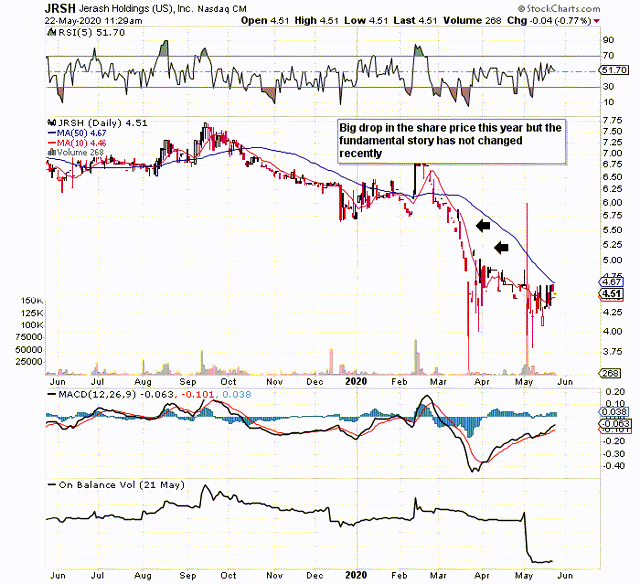

We wrote about Jerash Holdings (NASDAQ:JRSH) back in January before the coronavirus virus pandemic spread throughout the world. At the time, shares were trading for $6.44 per share, and the firm had already reported second-quarter earnings for fiscal 2020. Fast forward almost four months now and the share price has dropped to approximately $4.60 per share, which is a drop of approximately 29% in value.

Jerash Holdings manufactures custom, outwear and ready-made sporting products for the likes of V.F. Corporation (NYSE:VFC), Walmart (NYSE:WMT) and Costco (NASDAQ:COST). Due to sustained demand for the firm’s products, Jerash has increased the capacity of its manufacturing significantly in recent times to the tune of more than 8 million pieces per year.

What attracted us to this stock from the outset was its very strong cash position, its keen valuation, its strong profitability metrics as well as its viable dividend. Many companies as well as sectors alike have seen their valuations absolutely crippled during this pandemic. Being value investors, the critical component from our perspective is that we continue to favour beaten-down companies where the fundamental story has not significantly changed.

For example, in the third quarter, Jerash reported earnings per share of $0.18 and revenues of $25.45 million. Both figures exceeded expectations. Despite the turmoil companies have witnessed since March, Jerash is still expected to report $0.07 for the final quarter. If this number comes in on target, the firm will have done $0.69 per share in earnings for fiscal 2020 – almost a 50% increase over fiscal 2019.

Presently, the firm’s market cap is just north of $52 million. At the end of the third quarter, Jerash’s cash position increased to $27.8 million. This means that shares are trading for less than two times their cash position at present. Considering the earnings profile this firm has, we continue to believe shares are a steal at this price.

Furthermore, any significant intangible assets remain absent on the balance sheet. In fact, assets are primarily made up of the firm’s cash, receivables, inventories and property, plant and equipment. Jerash’s asset-take grew to $67.1 million in Q3. The firm’s new Paramount facility in Jordan (where all manufacturing is done) is expected to really add to the firm’s sales volumes over the new quarters and beyond. In fact, this facility is expected to add an additional 20% to 25% of the firm’s output. A successful ramp-up here would bode very well with respect to the firm being able to accommodate significant future demand.

Growing net earnings is predominantly what moves share prices, and this is maybe the one area in which Jerash has been found wanting over the past while. Operating income for example is down over 11% on average over the past three years. The net income trend is even worse. However, investors need to look past these numbers and see how the company has been investing heavily since its inception.

Because of these investments, revenue has more than doubled since 2015. Sales over a trailing average come in at $93 million at present. Although management initially thought that sales would hit $100 million this fiscal year, we now will most likely see approximately $96 million in sales which would be around an $11 million increase over the previous year. Remember, this number incorporates the closure of factories in Jordan over the past few months. Only at the beginning of this month were factories permitted to reopen.

From a dividend standpoint, we see no risk at present due to how earnings are expected to grow and how low the dividend remains as a percentage of the firm’s net profit. To put things in perspective, the company has enough cash on hand on its balance sheet to pay its dividend for the next 10+ years irrespective of how earnings shape up over the next few years. The present annual payout of $0.20 per share equates to a yield of 4.43%.

From a trade point of view, Jerash has free-trade agreements in place in both the US and Europe. These agreements bring stability to the situation with respect to the firm’s present customers in the US as well as offers scope for ramping up sales in Europe.

Source: Company Website

Therefore, to sum up, shares of Jerash Holdings have already managed to turn their 10-day moving average up. The next objective is to do the same to the 50-day moving average. The state of the balance sheet, the firm’s valuation and the earnings profile definitely have us interested here. We will make a decision here shortly.

———————-

Elevation Code’s blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

———————–

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JRSH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.