This post was originally published on this site

Welcome to the May 2020 cobalt miner news. The past month saw cobalt prices flat and a quiet month of news from the cobalt producers. The cobalt juniors made some excellent progress.

Cobalt price news

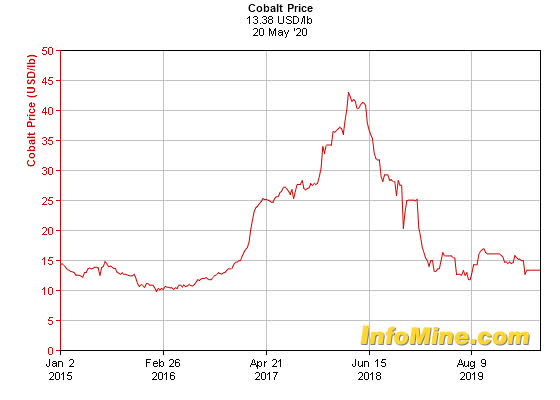

As of May 20, the cobalt spot price was US$13.38/lb, the same as US13.38/lb last month. The LME cobalt price is US$29,500/tonne. LME Cobalt inventory is 603 tonnes, about the same as last month (606 tonnes). More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices – 5-year chart – USD 13.38

Source: InfoMine.com

Cobalt demand and supply

On May 11 Argus Media reported:

Higher demand boosts China’s battery material output. China’s battery materials production rose in April as demand recovered across downstream sectors after the Covid-19 outbreak eased in China. Higher demand from the consumer electronics battery sector, particularly tablet computers and body temperature testers since late March, has raised output for cobalt tetroxide and lithium cobalt oxide. The country produced 4,900t of cobalt tetroxide in April, up by 7pc from a year earlier and by 25pc from March, according to data from China’s nonferrous metals industry association (CNIA). Lithium cobalt oxide output in April increased by 5pc on a yearly basis to 5,760t, up by 29pc from March. China’s production of nickel-cobalt-aluminium/nickel-cobalt-manganese (NCM/NCA) ternary precursors totalled 20,000t in April, down by 16pc from a year ago, but up by 3pc from March. April’s NCM/NCA battery materials output declined by 24pc from a year ago, but inched up by 0.44pc from March to 13,700t.

On May 12, Fastmarkets reported:

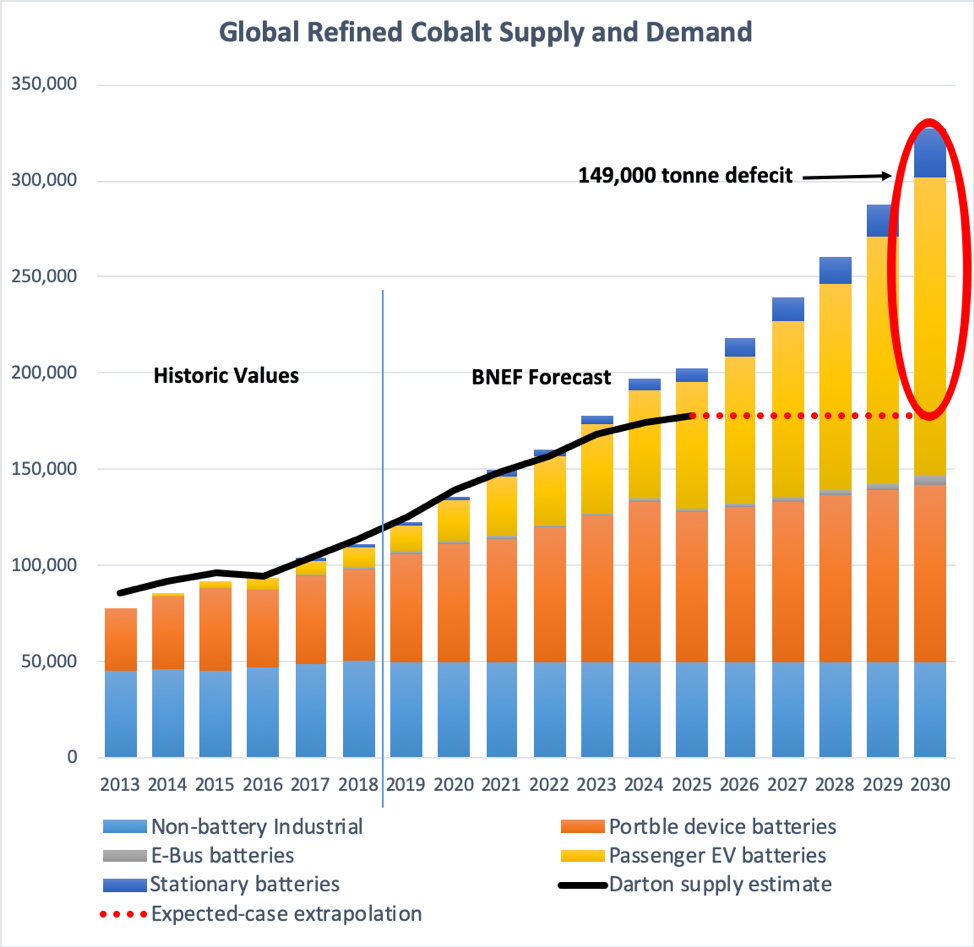

Cobalt demand in clean energy tech seen up 460% by 2050, World Bank says. The production of cobalt may need to increase by 460% from 2018 levels over the next three decades to meet the growing demand for clean energy technologies. Cobalt demand in clean energy technologies is seen rising from 140,000 tonnes to 644,000 tonnes by 2050, the report estimated.

The BNEF cobalt supply and demand forecast – Deficits widening after 2022

Source: Bloomberg New Energy Finance

Cobalt market news

On May 1 Business Human Rights reported:

DRC: Mining minister warns against the social and economic impact of mine closures during the Covid-19 pandemic. “Congo mine closures would cause economic and social crisis, minister says”. Congo…is highly reliant on mining, with the industry contributing 32% of its GDP and 95% of export revenue in 2018.

On May 7 Investing News reported:

Cobalt Market Update: Q1 2020 in Review. Roskill has so far recorded closures or scale backs at 21 operations as a result of the outbreak; that represents US$48 million of lost cobalt production value over Q1 and Q2 to date. Around 44 percent of this is being attributed to Vale’s (NYSE:VALE) Voisey’s Bay operation, which is now planned to be offline for up to three months. Rawles said…..“We have seen a lot of companies in the supply chain take a ‘wait-and-see’ approach, which means everything is on hold,” he said. ”I guess one of the major challenges of this is can these companies weather the storm financially?” For Woodmac’s Montgomery there’s still a bright side for explorers and developers of cobalt. “One positive note is that we are seeing increasing interest in regionalized supply chains, which could prove a boon to cobalt projects in North America for example,” he said…..“Cobalt demand is also being hit by weaker demand from consumer electronics, superalloys (as the aerospace sector contends with worst conditions in history) and catalysts as the refining sector is disrupted by low demand.”….. Considering all the shutdowns and suspension seen so far, at this point cobalt supply is expected to fall by 7 percent in 2020, according to Benchmark Mineral Intelligence.

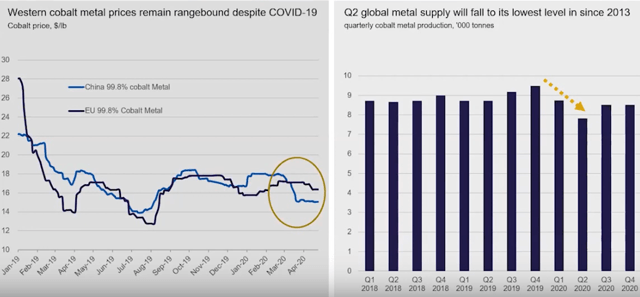

On May 13 CRU’s George Heppel gave a good presentation titled: “Analysis of the material upside and downside risks in the cobalt market.” The presentation discusses the COVID-19 supply disruptions and current state of play of the cobalt market.

Cobalt prices have only weakened slightly due to COVID-19 as supply fell as well as demand

Source (Youtube video)

On May 20 Reuters reported:

Sulfur squeeze spells trouble for Congo’s copper and cobalt miners. Disruptions caused by the coronavirus crisis have pushed up prices for sulfur by about 10% this year in the Democratic Republic of Congo, driving up costs of a vital ingredient for mining cobalt and copper in the African nation.

A copper-cobalt mine in the DRC

On May 20 SP Global reported:

The European Commission plans draft EU green battery rules by October ahead of EV surge. The European Commission plans to propose EU sustainable battery rules by October in a bid to challenge China’s dominance of the global battery market, which is projected to grow to Eur250 billion per year ($274 billion) by 2025. The EC hopes the rules will become binding by 2022, in time for an expected surge in electric vehicle output in 2023. The rules aim to give the EU a competitive edge in battery sustainability, performance and safety, and to develop a circular economy for all batteries produced or sold in Europe. A key issue is access to raw materials…..The EU is expected to need up to 18 times more lithium and five times more cobalt by 2030 to meet demand from renewable energy, e-mobility, defense and space sectors.

Cobalt company news

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

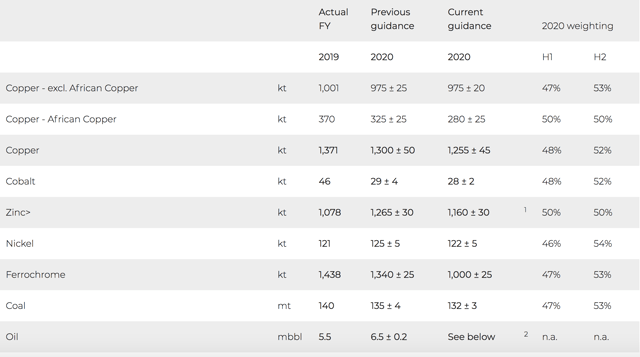

On April 30, Glencore announced:

First quarter 2020 production report and general update. Glencore Chief Executive Officer, Ivan Glasenberg: “The global impact of the COVID-19 pandemic is an unprecedented challenge for individuals, governments and companies alike. Disruptions to our business have, to date, been manageable and the majority of our assets are operating relatively normally, a credit to our people that have stepped up to the challenge of a changed working environment, especially those who continue to carry out their work on site at our industrial assets – Glencore’s frontline. Some industrial assets have been temporarily suspended, generally in line with national and regional lockdowns. Our updated full year production guidance reflects these impacts. We also expect a c$1.0 to $1.5 billion reduction in 2020 capex compared to our original 2020 guidance of $5.5 billion. Furthermore, notwithstanding global macroeconomic/demand headwinds, the volatile and complex commodity trading environment has provided opportunities for our Marketing business, such that, to date, we have generated annualised earnings within our $2.2 to $3.2 billion p.a. long-term guidance range. Given our strong liquidity position and resilient business model, we are well positioned to navigate the current challenges. We recognise the uncertainty caused by the current environment and endeavour to support our stakeholders, as appropriate.”

Katanga Mining [TSX:KAT] (OTCPK:KATFF)

On May 13, Katanga Mining announced: “Katanga Mining postponing the filing of its 2020 first quarter financial results due to covid-19.”

Note: Last month it was announced that Glencore would take Toronto-listed Katanga Mining private, with an offer of C0.16 per share.

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)

No news for the month.

Zheijiang Huayou Cobalt [SHA:603799]

No news for the month.

Jinchuan Group International Resources [HK:2362]

On May 8, Jinchuan Group International Resources announced:

Operational update for the three months ended 31 March 2020. During the First Quarter, the Group’s mining operations produced 17,209 tonnes of copper(three months ended 31 March 2019: 18,210 tonnes) and 1,333 tonnes of cobalt (three months ended 31 March 2019: 1,355 tonnes).

Jan-March 2020 summary

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE: 002340]

No significant news for the month.

Investors can read more about GEM Co in my Trend Investing article: “A Look At GEM Co Ltd – The World’s Largest Battery Recycling Company.“

Eurasian Resources Group (“ERG”) – private

ERG own the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

No news for the month.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

No cobalt related news for the month.

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

On May 8, Sumitomo Metal Mining Co. announced: “Consolidated Financial Results for the Year Ended March 31, 2020.” Also their FY2019 Progress of Business Strategy. The later gives a good summary and shows their 2019 profit of 79,000m Yen (expressed as 790 (JPY 100M)), compared to 89,400m Yen in 2018.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY)

On April 30, MMC Norilsk Nickel announced:

Nornickel’s project acclaimed internationally. Nornickel has been declared a winner of the SAP Quality Awards 2019 for EMEA (Europe, Middle East and Africa). Its project to roll out SAP software in the Norilsk Industrial District received a gold medal.

On May 14, MMC Norilsk Nickel announced:

Shareholders of Nornickel approved the final dividend for the FY 2019. Shareholders of Nornickel held the Annual General Meeting [AGM] in absentia on May 13, 2020. The AGM approved the final dividend for the financial year 2019 in the amount of RUB 557.2 per ordinary share (approximately USD 7.3 at the RUB/USD exchange rate set by the Russian Central Bank as of April 7, 2020, the date when the Board of Directors made a recommendation on the final dividend). The final dividend will amount to a total of RUB 88.2 bn (approximately USD 1.2 bn at the RUB/USD exchange rate set by the Russian Central Bank as of April 7, 2020). The total dividend distribution for the FY 2019 will amount to USD 4.8 bn, including the interim dividends for six and nine months of 2019 which have been already paid to shareholders (for a total amount of approximately USD 3.6 bn).

Investors can also read my article “An update on Norilsk Nickel.”

Sherritt International [TSX:S] (OTCPK:SHERF)

On April 30, Sherritt International announced: “Strong operational performance drives Sherritt’s Q1 2020 results.” Highlights include:

Summary of key Q1 developments:

- “……Although the pandemic has had limited impact on nickel, cobalt, power and oil production to date, and while production activities continue, Sherritt has withdrawn its guidance for 2020 due to a number of market and economic uncertainties caused by COVID-19. As a result of this uncertainty and lack of near-term visibility, Sherritt has also implemented a number of austerity measures, identifying opportunities to reduce or defer budgeted expenditures for the Moa Joint Venture (100% basis), Sherritt’s Oil and Gas and Power operations, and Corporate Office for 2020 by approximately $90 million……

- Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) in Q1 2020 were 3,836 tonnes and 400 tonnes, respectively. Finished production totals were impacted by the reduced availability of mixed sulphides as a result of heavy rains at Moa in January, and by the disruption of deliveries to the refinery in Fort Saskatchewan caused by rail blockades in Canada and by extended transit times for shipping vessels from Cuba.

- Secured a $16 million prepayment against future nickel deliveries in 2020 as part of efforts to enhance the Corporation’s liquidity.

- Excluding $86.2 million of cash and cash equivalents held by Energas, Sherritt ended Q1 2020 with cash and cash equivalents of $107.2 million. Sherritt’s consolidated cash position of $193.4 million at the end of Q1 was up from $166.1 million at the end of Q4 2019…..

- …..In Q1 2020, Sherritt received US$19.0 million in Cuban energy payments, including US$18.0 million related to the overdue receivables agreement and US$1.0 million attributable to Sherritt’s Oil and Gas operations.

- Excluding depreciation and share-based compensation, administrative expenses declined by an additional $600,000, or 6%, from $9.3 million in Q1 2019.

- Began preliminary testing on Block 10 following the completion of additional work on the well and recertification of specific pieces of equipment. The onset of COVID-19 and travel restrictions imposed in Cuba have delayed test samples from being analyzed in a lab setting. All Block 10 operations are currently suspended.”

Developments subsequent to the quarter end

- “Sherritt agreed to an extension for the maturity of its $70 million credit facility from its senior lenders to August 31, 2020 to allow for completion of the balance sheet initiative launched in Q1……”

Conic Metals Corp. [TSXV:NKL]

Conic Metals was formed from the Cobalt 27 spin-out. Conic Metals offers broad exposure to nickel and cobalt through a 8.56% JV interest in Ramu, 11 royalty investments, and an equity share of ~7% of Giga Metals Corporation.

No news for the month.

Investors can view my recent CEO interview here.

Possible mid-term producers (after 2022)

First Cobalt [TSXV:FCC] (OTCQB:FTSSF)

On May 4, First Cobalt announced: “First Cobalt announces positive feasibility study results for Canadian cobalt refinery expansion.” Highlights include”

- “Annual production of 25,000 tonnes of battery grade cobalt sulfate from third party feed, representing 5% of the total global refined cobalt market and 100% of North American cobalt sulfate supply.

- Initial capital estimate of $56 million and an operating cost estimate of $2.72/lb of cobalt produced, which is competitive with global markets.

- $37 million in undiscounted pre-tax free cashflow to the Project forecasted during the first full year of production.

- $139 million after-tax net present value [NPV] using an 8% discount and 53% after-tax internal rate of return [IRR], representing a payback period of only 1.8 years.

- Discussions underway with Glencore on commercial arrangements, financing and allocation of project economics; third party and government funding opportunities also under review.

- Several EV manufacturers have expressed an interest in purchasing a North American cobalt sulfate.

- Several opportunities will be evaluated over the coming months that could enhance project economics further, including alternative approaches to managing elevated sodium concentrations prior to returning process water to the environment.

- Prefeasibility-level study also completed on an early ramp-up scenario using existing permits and equipment to conduct trial runs processing a different type of feedstock.”

On May 13, First Cobalt announced:

First Cobalt announces $2 million work program to advance cobalt refinery plans……. Prepare and submit permit amendments to expand the refinery to its design rate of 25,000 tonnes per annum of cobalt sulfate….. Scoping studies in progress to assess three early commissioning strategies to operate as a demonstration plant and produce sample product for EV manufacturers…..Target substantial completion for most of the work program within 90 days.

Site Rendering of the expanded First Cobalt Refinery

Upcoming catalysts include:

- late 2021 or 2022 – Possible to have their North American cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here.

Jervois Mining [ASX:JRV] [TSX-V: JRV] (OTC: JRVMF) [FRA: IHS] (merged with eCobalt Solutions [TSX:ECS] (OTCQX:ECSIF))

No cobalt related news for the month.

Upcoming catalysts include:

- Q2 2020 – BFS due.

- 2020 – Off-take agreements, project funding.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

On May 7, Fortune Minerals announced:

Fortune Minerals provides NICO Project update….Fortune is complying with government protocols, including temporary closure of the Company’s head office, prohibiting non-essential travel, and employees are social distancing and working remotely from their homes. Technical work has advanced on the NICO Project during this period, primarily by employees with some assistance from engineering consultants. Fortune has also received financial assistance through government programs available to it, and has outstanding applications pending for additional support. The Company is also reducing costs where it can to preserve cash until confidence returns to the capital markets, which it normally depends upon for its source of working capital……The Canadian and U.S. governments have signed a Joint Action Plan on Critical Mineral Collaboration to enable more North American production of minerals identified as critical to economic and national security, The Mineral Reserves for the NICO Project also contain more than one million ounces of gold, a highly liquid and counter cyclical co-product that makes this project stand out relative to other cobalt producers and development projects…….Fortune is now developing a new mine plan and schedule based on the Updated Mineral Resource model, open pit optimization, and preliminary underground stope designs.

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2020 – Possible off-take or equity partners, project financing.

Clean TeQ [ASX:CLQ] [TSX:CLQ] (OTCQX:CTEQF)

Clean TeQ has 132kt contained cobalt at their Sunrise project.

On April 27, Clean TeQ announced: “Quarterly activities report –March 2020.” Highlights include:

- “Sunrise Project Execution Plan progressing on schedule.

- Key approvals and Crown land access agreement secured for Sunrise.

- Strong progress made towards securing Townsville water treatment project.

- Approximately $4.4 million cash received for Research and Development Tax Incentive for FY19in April 2020.”

Investors can also read the latest company presentation here.

Upcoming catalysts include:

2020 – Possible further off-take agreements and project funding/partnering.

Australian Mines [ASX:AUZ] (OTCQB:AMSLF)

On May 15, Australian Mines announced:

Additional nickel and cobalt targets identified at Sconi Project, North Queensland Advanced battery materials company, Australian Mines Limited is pleased to announce that an independent review has identified fourteen new nickel and cobalt exploration target areas within, and adjacent to, the Company’s flagship and 100%-owned Sconi Cobalt-Nickel-Scandium Project (“Sconi”) in North Queensland, Australia.

Investors can read my update article here, my CEO interview here, or view the latest company presentation here.

Upcoming catalysts include:

- 2020 – Thackaringa drill results. Possible Sconi off-take partners or financing.

Ardea Resources [ASX:ARL] (OTC:ARRRF)

In total, Ardea has 405kt of contained cobalt and 5.46mt of contained nickel at their KNP Project near Kalgoorlie in Western Australia.

On May 14, Ardea Resources announced:

Maiden Resource for Big Four Gold Project, WA. Ardea Resources Limited [Ardea, ARL or the Company] is pleased to announce a maiden Inferred Mineral Resource estimate…..within the Goongarrie Nickel Cobalt Project [GNCP] 70 kilometres north of the City of Kalgoorlie-Boulder….Initial JORC 2012 Inferred Mineral Resource at Big Four Gold of 178 kt at 2.7 g/t gold, (0.5 g/t Au cut off) for 15,300 oz gold. Gold mineralisation starts within 5 m of surface. Mineralisation open down plunge.

Investors can view their latest company presentation here, my update Ardea article here, and CEO interview here.

Upcoming catalysts include:

- 2020 – Possible off-take partner and funding for the KNP Project.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

In total Cobalt Blue currently has 79.5kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On April 28, Cobalt Blue Holdings announced: “Mixed Hydroxide Product [MHP] testwork delivers premium product.” Highlights include:

- “Significant testwork outcome – strong hydroxide results ~37% cobalt and ~7% nickel content with low impurities = a premium product.

- Large scale furnace work scheduled for May 2020.

- Pilot Plant – expecting commissioning Q4 2020.

- Ore Reserve Statement update on track for mid-year release.”

Upcoming catalysts include:

- Mid 2020 – Pilot plant commissioning. Ore reserve estimate update.

- Q1 2021 – Demonstration plant.

- Q1 2022 – Feasibility Study & project approvals. Final Investment decision.

Havilah Resources [ASX:HAV] [GR:FWL]

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-cobalt project, as well as a potentially large iron ore project at Grants.

No cobalt related news for the month.

Note: Investors can learn more by reading my article “Havilah Resources Has Huge Potential and/or my update article. You can also view my CEO interview here, and the company presentation here.

Upcoming catalysts include:

- Q2 2020 – Kalkaroo – Updated PFS due.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

On April 29, Aeon Metals announced: “Quarterly activities report for the period ending 31 March 2020.” Highlights include:

- “Pre-Feasibility Study [PFS] on the Walford Creek Project continued with key activities including: Updated optimisation shows that open pit mining continues for approximately 8 years with underground mining starting in Year 4 and reaching full production in Year 8. Processing testwork and assessment including: Flotation Pilot Plant-results to date in line with Scoping Study1. Bioleach Pilot Plant-results to date better than Scoping Study1. Heap Leach Bottle Roll Testwork-results to date in line with Scoping Study1. Product Purification Pilot Plant-product quality in line with Scoping Study1. Option to source power from grid connection at Century Mine is being investigated.

- Expected Walford Creek PFS completion now 3Q 2020; impact of COVID-19 related operating restrictions and associated timeframes in finalising several work streams.”

For more information you can read my article: “Aeon Metals May Have A World Class Copper And Cobalt Sulphide Resource In Northern Australia.“

Investors can view the latest company presentation here.

Upcoming catalysts include:

- Q3 2020 – PFS due.

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On April 28, GME Resources announced:

Quarterly activities report March 2020. The NiWest Nickel Cobalt laterite Project hosts one of the highest grade undeveloped nickel laterite resources in Australia estimated to contain 81 million tonnes averaging 1.03% Nickel and 0.06% Cobalt…..Over 75% of the resource falls within the Indicated and Measured categories. The Company has completed extensive testing on a novel development approach that focuses on a fully integrated process flow sheet commencing with Heap Leaching of the ore followed by Direct Solvent Extraction [DSX] for the removal of impurities through to refining pure nickel sulphates and cobalt carbonate suitable for the high growth lithium-ion battery market. An extensive Prefeasibilty Study completed in September 2018 indicated a capital requirement of A$900m and operating costs of US$ 3.24/lb nickel based on production of 456kt nickel and 31.4kt cobalt over a 27 year mine life. The Company has invested significant funds on the design of a technical and economic flow sheet over the past 12 years.

Investors can read a company investor presentation here.

Cassini Resources [ASX:CZI] [GR:ICR] (OTC:CSSQF)

Cassini’s flagship is the West Musgrave Project hosting over 1.0 million tonnes of contained nickel and 2.0 million tonnes of contained copper in resource. The company has a buy in JV with OZ Minerals [ASX:OZL] (OTCPK:OZMLF) for West Musgrave in Western Australia. The company also has several other promising projects.

No cobalt related news for the month.

Investors can read the latest company presentation here.

Upcoming catalysts include:

- Early 2020 – PFS due.

Castillo Copper [ASX:CCZ]

On April 30, Castillo Copper announced: “March quarterly activities report.” Highlights include:

Mt Oxide Pillar

- “Historic drill data verifies grades up to 28.4% Cu from <50m in supergene ore at the Mt Oxide pillar…… IOCG target….”

Broken Hill Alliance:

- “MOU to develop sizeable Broken Hill project that is highly prospective for base metals.”

Zambia

- Mkushi soil sampling materially extends potential strike lengths…..

Corporate:

- “Acquisition of four high-quality projects in Zambia completed.

- Dual listing on the London Stock Exchange approved.”

Subsequent to the period close:

- “Reduction in Board compensation.”

Investors can view my CEO interview here, and an investor presentation here.

Celsius Resources [ASX:CLA] [GR:FX8]

Celsius owns 100% of Opuwo Cobalt Pty Ltd, which in turn holds the right to earn up to 76% of the Opuwo Cobalt (sulphide) Project in Namibia.

On April 30, Celsius Resources announced:

Quarterly activities report March 2020. During the Quarter, the Company continued work programs which keep the Opuwo Project in good standing in terms of in country expenditure and reporting including Corporate Social Responsibility [CSR] programs, government consultation regarding the current status of the Project and limited on ground activities assessing targets generated from data review and collecting baseline environmental data. In addition the Company continued reviewing potential acquisitions and investments in commodities which complement or diversify the Company’s current commodity exposure. Specifically, the Company has reviewed projects in commodities including nickel, copper-gold, copper, cobalt, manganese, gold, uranium, high-purity alumina [HPA]. As at today’s date a transaction is yet to be completed, although detailed due diligence and ASX engagement has been completed on a number of opportunities. At the end of the Quarter, the Company held approximately $5.9 million in cash. During the Quarter HiSeis Pty Ltd completed field trials at the Opuwo Cobalt Project including over 600 measurements of specific gravity and sonic velocity on existing drill core samples and reconnaissance of the project area……Further interpretation of the data collected will be completed during the forth coming quarter…..

Investors can view the company presentations here.

Barra Resources Ltd. (OTC:BRCSF) [ASX:BAR] / Conico Ltd [ASX:CNJ]

Barra is developing the Mt Thirsty project, which is a 50/50 joint venture with Conico, to produce cobalt suitable for the metal, chemical and battery markets. Barra is has two promising gold projects in Western Australia.

On April 30, Barra Resources Ltd. announced:

Burbanks exploration and mining JV. Barra Resources Limited (“Barra”) is pleased to advise that it has entered into an exploration and mining joint venture at the Burbanks Gold Project with mining and processing company, FMR Investments Pty Ltd (“FMR”). This agreement provides a platform for Barra to unlock the potential at Burbanks on a zero risk basis with FMR funding initial drilling and mining costs at the shallower Mainlode deposit, with profits going into a future fund for deep exploration drilling below historical workings and where high grade mineralisation is known to continue. Should Barra wish, it has the ability to increase its interest at mining stages by funding in excess of its 20% free carried position to a maximum of 50%.

On April 30, Barra Resources Ltd. announced: “ASX quarterly report quarter ending 31 March 2020.” Highlights include:

MT Thirsty Cobalt Nickel Project

- Mt Thirsty now assumes the mantle of Australia’s most advanced genuine cobalt project with a completed Pre-Feasibility Study [PFS]

- Hydrometallurgical process is at atmospheric pressure and 70-90ºC utilising sulphur dioxide [SO2] as the main reagent.

- Maiden JORC 2012 Probable Ore Reserve of 18.8 Mdt at 0.13% cobalt and 0.54% nickel estimated for the project.

- Positive economics returned over a 12 year mine life with a pre-tax NPV of A$44.4M (A$25.7M post-tax).

- Capital Expenditure of A$371M including 10% indirects, 9% growth allowance, 4% owner’s costs, and 10% contingency.

- All in Sustaining Costs of US$35,400/t contained cobalt.

- The direct project expenditure for the MTJV now reverts to a minimum while the partnering strategy for the project is pursued as planned.”

Corporate

- “In response to contracting global financial markets, cash outflows have been substantially cut including a reduction in staff and office expenses.

- All Non-Executive Directors are working for nil fees…..

- As at the end of the quarter, Barra has $637,000 in cash.”

On May 11, Barra Resources Ltd. announced:

First JV drilling commences at Burbanks. Barra Resources Limited [Barra] is pleased to advise that drilling is now underway at the Burbanks Gold Project. The drilling is fully funded by mining and processing company, FMR Investments Pty Ltd [FMR] as the first stage of the exploration and mining JV Barra announced to the market on 30th April 2020….

Investors can view the company presentations here.

Canada Nickel [TSXV:CNC]

On May 6, Canada Nickel announced:

Canada Nickel Company Inc. closes private placement of $4.4 million. Mark Selby, Chair & CEO of Canada Nickel commented “With the completion of this financing which was upsized by 80% to $4.4 million despite challenging market conditions, Canada Nickel is well positioned to advance its Crawford Nickel-Cobalt sulphide project. We appreciate the support from our existing investors and welcome a number of new investors to Canada Nickel.”

On May 19, Canada Nickel announced:

Canada Nickel Company announces discovery of multiple palladium-platinum zones, extends PGM zone by 1.5 km, and second nickel discovery doubles total nickel mineralization along strike by 1.7 km to 3.4 km at Crawford nickel-cobalt-palladium Project….

Other juniors and miners with cobalt

I am happy to hear any news updates from commentators. Tickers of cobalt juniors I will be following include:

African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCPK:ARTTF), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTC:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Blackstone Minerals [ASX:BSX], BHP (NYSE:BHP), Carnaby Resources [ASX:CNB], Bluebird Battery Metals Inc. [TSXV:BATT] (OTCPK:BBBMF), Brixton Metals Corporation [TSXV:BBB](OTC:BXTMD), Canadian International Minerals [TSXV:CIN], Canada Silver Cobalt Works Inc [TSXV:CCW], Centaurus Metals [ASX:CTM], Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Cobalt [CUZ] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], Dragon Energy [ASX:DLE], European Cobalt Ltd. [ASX:EUC], First Quantum Minerals (OTCPK:FQVLF), Fuse Cobalt Inc [CVE:FUSE], Galileo [ASX:GAL], Global Energy Metals [TSXV:GEMC] (OTC:GBLEF), GME Resources [ASX:GME] (OTC:GMRSF), Global Energy Metals [TSXV:GEMC] [GR:5GE1] (GBLEF), Hinterland Metals Inc. (OTC:HNLMF), Hylea Metals [ASX:HCO], Independence Group [ASX:IGO] (OTC:IIDDY), King’s Bay Res (OTC:KBGCF) [TSXV:KBG], Latin American Resources, LiCo Energy Metals [TSXV:LIC] (OTCQB:WCTXF), M2 Cobalt Corp. (TSXV: MC) (OTCQB: MCCBF), MetalsTech [ASE:MTC], Metals X (ASX:MLX) (OTCPK:MLXEF), Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTC:NMREF), Northern Cobalt [ASX:N27], Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (NYSEMKT:PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Regal Resources (OTC:RGARF), Hylea Metals (ASX:HCO), Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), US Cobalt [TSXV:USCO] (OTCQB:USCFF), and Victory Mines [ASX:VIC].

Conclusion

May saw cobalt prices flat and LME inventory also flat.

Highlights for the month were:

- Both cobalt demand and supply have both been down in Q1, 2020 due to COVID-19; resulting in cobalt prices only slightly lower.

- Higher demand boosts China’s battery material output.

- Cobalt demand in clean energy tech seen up 460% by 2050, World Bank says.

- Glencore CEO states “Disruptions to date, been manageable and the majority of our assets are operating relatively normally.”

- Fortune is now developing a new mine plan and schedule based on the Updated Mineral Resource model.

- Ardea Resources announces Initial JORC 2012 Inferred Mineral Resource at Big Four Gold of 178 kt at 2.7 g/t gold, (0.5 g/t Au cut off) for 15,300 oz gold.

- Cobalt Blue – Mixed Hydroxide Product [MHP] testwork delivers premium product – Strong hydroxide results ~37% cobalt and ~7% nickel content with low impurities.

- First Cobalt announces positive FS results for Canadian cobalt refinery expansion. Post-tax NPV8% of $139 million and 53% after-tax IRR, representing a payback period of only 1.8 years.

- Barra Resources and FMR Investments form JV to explore for gold at the Burbanks Gold Project.

- Canada Nickel Company announces discovery of multiple palladium-platinum zones, extends PGM zone by 1.5 km, and doubles total nickel mineralization along strike by 1.7 km to 3.4 km.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long GLENCORE (LSX:GLEN), KATANGA MINING [TSX:KAT], NORSILK NICKEL (LME:MNOD), AUSTRALIA MINES [ASX:AUZ], FORTUNE MINERALS [TSX:FT], RNC MINERALS [TSX:RNX] , ARDEA RESOURCES [ASX:ARL], COBALT BLUE [ASX:COB], AEON METALS [ASX:AML], HAVILLAH RESOURCES [ASX:HAV], CASSINI RESOURCES [ASX:CZI], CONICO LTD [ASX:CNJ], FIRST COBALT [TSXV:FCC], POSEIDON NICKEL [ASX:POS]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.