This post was originally published on this site

An unsexy option — wine in a box — could gather new steam as inflation and war in Eastern Europe increase prices for everything from wheat

W00,

to oil to the glass bottles used for centuries in winemaking.

With oil prices

CL00,

surging 70% in the past year, cost pressures have been leeching into the energy-intensive process of making glass bottles for wine, resulting at times in dramatically higher prices, according to Rabobank’s second-quarter wine outlook.

10 Things (August 2014): 10 things winemakers won’t tell you

“The cost of glass bottles in the U.S. has risen by as much as 20%, according to some brand owners, although most operators have seen much more modest price increases,” Stephen Rannekleiv, global strategist in the beverages division of Rabobank, wrote in the bank’s outlook.

“However, we would not be surprised to see some glass suppliers implement additional price increases as the year progresses. Nor would we be surprised if the extent to which their input costs are increasing turns out to be structural rather than transitory.”

Weekend Sip (April 2021): Just in time for Earth Day, a wine bottle that’s friendlier for the environment

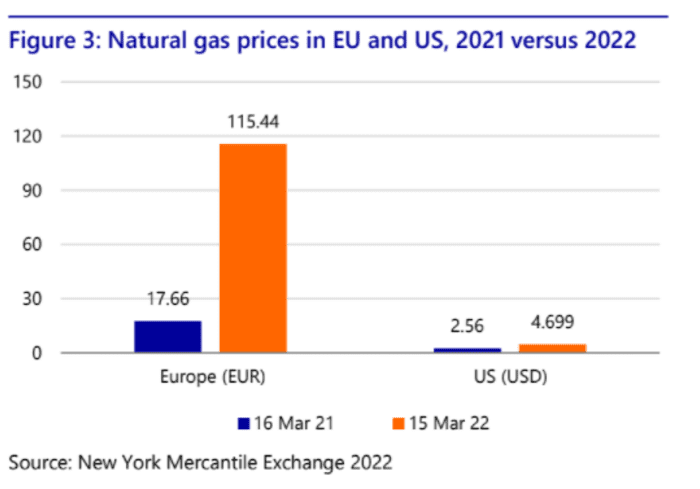

Wineries in Europe, many reliant on Russian oil and energy products, have felt the sharpest pain of soaring fuel costs (see chart) as natural-gas prices

NG00,

were up more than 550% in March from a year earlier amid Moscow’s unprovoked invasion of Ukraine.

European wine producers hit harder by energy spike from Russia’s war in Ukraine.

Rabobank/New York Mercantile Exchange

In the U.S., the increase in the price of natural gas has been closer to 84%.

“One European glass supplier recently told us that the rising cost of fuel has forced them to pass on a surcharge to their clients, which has effectively doubled the cost of bottles,” Rabobank’s Rannekleiv wrote.

The potential need for a “complete rethinking of packaging” due to costlier glass bottles isn’t the only pressure wine producers face after two years of pandemic, devastating 2020 wildfires and drought in California, snarled supply chains, hot inflation, and, since late February, Russian President Vladimir Putin’s unprovoked attack against Ukraine.

Rannekleiv called the situation “a study in Murphy’s Law: absolutely everything that could go wrong, has.”

Potential solutions other than boxed wine? Adopting reusable bottles akin to those used in some of the beer industry and regionalizing supply chains, including perhaps exporting more wine in bulk rather than in bottles.

“Suffice to say here that while pricing actions will be necessary, wineries may also need to consider additional measures to help maintain margins and mitigate risks moving forward,” the Rabobank analyst wrote.