This post was originally published on this site

Two government reports in the past two days are pointing to the highest annual U.S. inflation rates in four decades, yet many traders and investors are looking past the hot readings and focusing instead on prospects that the trend will soon reverse.

U.S. stocks and bonds rallied on Wednesday, despite the headline data. The starting point for the market’s optimism about inflation was one soft number in Tuesday’s consumer-price index report for March: the 0.3% monthly core CPI reading, which kicks out food and energy and came in below expectations. That gauge was no more than “a head fake” since much of the reading’s weakness came from a 3.8% drop in used-car prices, according to B. of A. economists Ethan Harris and Anna Zhou.

The core reading’s moderation overshadowed bigger dynamics that are still at play. Underlying inflation remains “very high,” Harris and Zhou wrote in a note Wednesday. Indeed, Wednesday’s release of the producer-price index showed the cost of wholesale goods and services jumped 1.4% in March and 11.2% over the past year. This comes after Tuesday’s CPI showed the annual headline inflation of 8.5%, the highest rate since 1981.

“We think it is a mistake to focus on the traditional measure of core inflation that excludes food and energy,” Harris and Zhou said. “Clearly the traditional core is being buffeted about by temporary price swings related to supply-chain issues and reopening. A popular approach is to trim the core further by plucking out offending items like used-car prices. The problem with this approach is that depending on what you pluck out you can come up with almost any number.”

On its own, a 0.3% monthly reading in core CPI isn’t all that historically significant. In the decade prior to COVID-19, readings of 0.1% to 0.2% were the norm. Policy makers like to emphasize core readings, though, because they exclude volatile components.

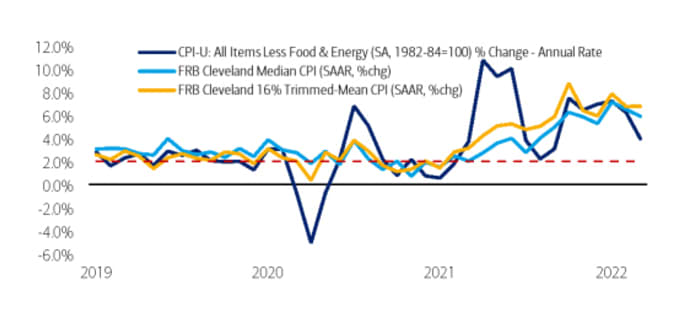

The “real” news came later on Tuesday, when the Federal Reserve’s regional bank in Cleveland reported its own median CPI, which eliminates “unusually high and low components to come up with a better, unbiased measure of underlying inflation,” Harris and Zhou wrote. The Cleveland Fed’s median and trimmed-mean CPI inflation readings are stuck between 6% and 7%. This compares with a 4% annualized growth rate in the core CPI as of March, the economists said.

Source: BLS, Cleveland Fed, BofA Global Research

Like Tuesday’s initial market reaction to CPI, Wednesday’s release of U.S. producer prices also saw financial-market participants focus on the idea that inflation might soon be set to ease up.

All three major U.S, stock indexes

DJIA,

COMP,

were higher as of Wednesday afternoon, with the Dow industrials up by more than 200 points. However, some analysts contend that the relative performance of the energy sector versus healthcare indicates stock-market investors aren’t convinced inflation has peaked.

Read: This indicator says stock-market investors don’t believe inflation has peaked: analyst

Meanwhile, Treasury yields were broadly lower for a second session on Wednesday as traders continued to factor in the prospects of lower inflation down the road. The 10-year rate

TMUBMUSD10Y,

dropped below 2.7%, while its spread to the 2-year yield

TMUBMUSD02Y,

briefly widened to as much as 38 basis points — a sign of market optimism in the economic outlook.

“The PPI print looks somewhat hot, but some investors were looking for an even bigger number than what they got, and are not acknowledging the persistency of inflation as much as they should,” said head trader John Farawell with Roosevelt & Cross, a bond underwriter in New York.

“They are interpreting this as though we are going to have a soft landing and maybe we are going to not have a recession. This could definitely flip-flop, but this is how they are interpreting it for now,” he said.

Jeffry Bartash contributed to this report.