This post was originally published on this site

It’s Fed decision day on Wall Street and investors are awaiting the latest policy statement and outlook for interest rates with bated breath.

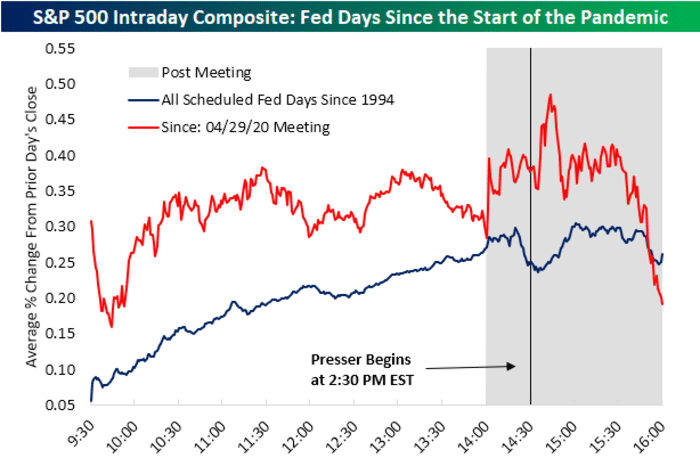

And as it turns out, Fed days have been tilting bullish for the stock market intraday since 1994, at least until the Fed instituted a press conference following the release of its policy statement, which it began to do under Ben Bernanke in April of 2011.

Since the start of the news conferences, which kicks off at 2:30 p.m., a half-hour following the usual release of the central bank’s statement, the market has been seeing intraday weakness.

The weakness has become more pronounced during current Fed Chairman Jerome Powell’s tenure, according to data compiled by Bespoke Investment Group.

Bespoke Investment Group

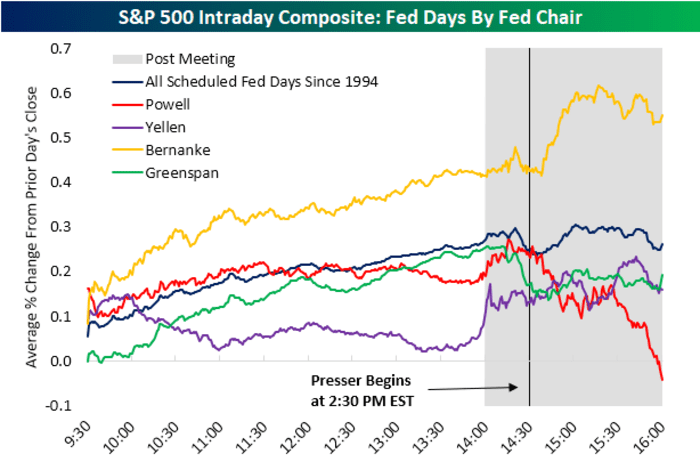

“When it comes to the late-day weakness on Fed Days, much of it has come during Fed Chair Powell’s tenure,” the researchers at Bespoke wrote in a note published Wednesday.

“Since Powell became chair, the S&P 500 has averaged the worst performance on Fed Days of any other chair since Greenspan,” the data analysts wrote.

Bespoke Investment Group

As MarketWatch has reported before, Federal Chairman Jerome Powell’s record with the stock market hasn’t been a stellar one, in any case. Data has indicated that the S&P 500

SPX,

has declined on average more times than not during Powell’s chairmanship of the Fed, compared with those led by Janet Yellen, now U.S. Treasury Secretary, and Bernanke. The Dow Jones Industrial Average

DJIA,

and the Nasdaq Composite Index

COMP,

also have shown weakness.

Later Wednesday, investors will be focus on any news from Powell & Co. on monthly buying $80 billion of Treasurys and $40 billion of mortgage-backed securities, which the Fed has done since last June to keep long-term interest rates low and bolster demand.

Since the summer, the Fed has been talking about slowing down and eventually ending these purchases. Officials have tried to stress that this question is “divorced” from the separate question of when to raise interest rates, which currently stand at a range between 0% and 0.25%. Investors also will be watching the Fed’s projections for interest rates for clues on when and how quickly the central bank will aim to normalize benchmark rates, which will likely also prove market-moving.

To be sure, stock-market performance isn’t high on the central banker’s priority list Wednesday — maximum employment and price stability are the Fed’s dual mandates — but investors may be preparing for a bit of choppiness in stocks nonetheless.