This post was originally published on this site

After a woeful September for optimists, the stock market’s bullish patina is being further chipped away to start October, with at least one main benchmark and a number of sectors perilously close to a correction.

Indeed, the Nasdaq Composite Index

COMP,

which was down 2.4% on Monday, as social-media company Facebook Inc.

FB,

tumbled over 5% on the session, bringing the technology-laden index about 7.5% from its Sept. 7 record close, according to Dow Jones Market Data.

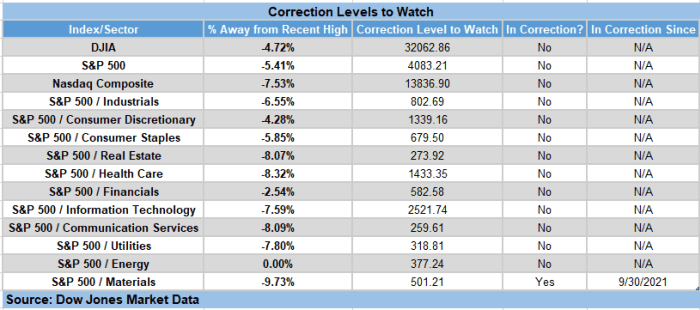

Market technicians usually define a correction as a drop of at least 10%, but no more than 20%, from a recent peak. A market is considered in a bear market when it declines by at last 20% from its peak.

The Nasdaq Composite needs to close below 13,836.90 to reach correction territory, according to Dow Jones Market Data. The index last entered correction on March 8, 2021 and it exited correction on April 9, 2021.

Amazon.com Inc., a part of for the popular “FAANG” stocks, including Facebook, Netflix

NFLX,

Apple

AAPL,

and Google-parent Alphabet

GOOG,

was down 14.5% from its July 8 closing peak. Apple’s stock was down more than 11% from its recent peak and Google’s Class A shares

GOOGL,

were down 8.4% from a recent high put in early last month.

Here are the other levels to look out for if the market continues to lose altitude, something that it has been known to do in October. The S&P 500

SPX,

and Dow Jones Industrial Average

DJIA,

were about halfway to correction:

Dow Jones Market Data

The market has been under increasing pressure, with developments centered on those in Washington, D.C., where tense negotiations on the debt ceiling are playing out and negotiations on infrastructure spending and social spending have failed to achieve a resolution.

Investors also have been worried about potentially out-of-control inflation and the Federal Reserve’s likely responses to an overheated economy, with crude-oil

CL.1,

and natural -gas prices

NG00,

soaring to multiyear highs in recent action.