This post was originally published on this site

The Trump Organization’s longstanding accounting firm Mazars is quitting and says financials provided from 2011 to 2020 should no longer be relied upon, according to court documents filed Tuesday in New York.

The unusual retraction by Mazars concerning the accuracy of the Trump Organization’s financials spanning a decade comes as New York Attorney General Letitia James pushes forward with a multiyear civil investigation into former President Donald Trump’s property finances.

James’ office claims the Trump business used fraudulent and misleading asset valuations, and wants Donald Trump Jr. and Ivanka Trump to provide sworn testimony about their financial dealings on several real-estate transactions.

Here are five key Trump properties listed by the attorney general’s office in January as part of its probe, including the valuations it has in focus:

- 40 Wall Street in New York City’s financial district. Valuations range from $735.4 million to $257 million in 2015.

- Donald Trump’s triplex apartment in Trump Tower at 725 Fifth Avenue in Manhattan. The Trump Organization’s CEO admitted in testimony to the attorney general that the value of the apartment was overstated by “give or take” $200 million.

- Seven Springs in Westchester County, New York. Financial probe into a more-than 80% drop in property value, to $56 million in 2016 from a 2012 estimate.

- Trump International Golf Club Scotland. Valuation used in Trump’s 2011 financial statement was $161 million, climbing to $435.56 million in 2014, with the inclusion of unapproved development rights, per attorney general’s filing.

- Trump Park Avenue residential complex. Financial statements indicate property represented $135 million to $350 million of Trump’s assets from 2011 to 2020. James’ office claims unsold units represent much of the reported value.

“We have seen accounting firms come out with qualification statements, usually covering the last year,” Norm Miller, a professor of real-estate finance at the University of San Diego School of Business, told MarketWatch by phone. “I’m not aware of anyone going back 10 years.”

“What they are essentially saying is that ‘We are under pressure, and have been fed bad data for the past 10 years, and now we know it’s not to be trusted,’” Miller said. “It would normally be a very damaging statement, and would likely remove the ability to refinance properties from any American bank, for some time.”

The Trump Organization said it was “disappointed that Mazars has chosen to part ways,” in a statement to MarketWatch. It also claimed the investigations by James, and another from the Manhattan District Attorney, were rendered “moot” by the Mazars’ letter to the Trump Organization, indicating its review of all prior financial statements didn’t reveal any material discrepancies.

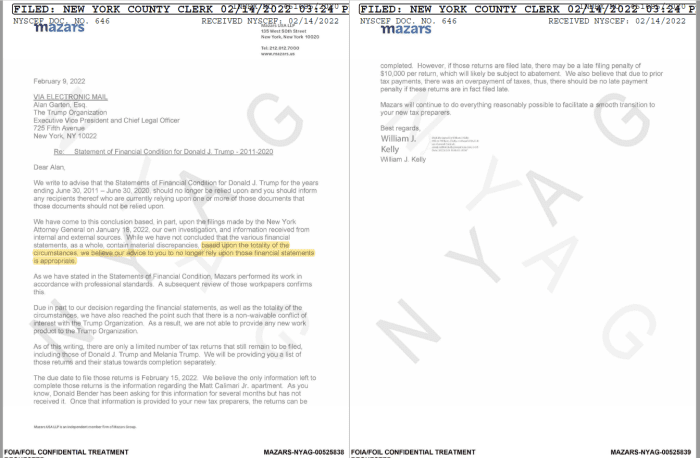

The Mazars’ letter (see highlighting provided by MarketWatch) specifically advised that “based on the totality of the circumstances, we believe our advice to you to no longer rely upon these financial statements is appropriate.”

Mazars letter pulling support for Trump Org. financial statements that cover a decade.

New York AG filing on Feb. 14, 2022

The Trump Organization did not respond when asked by MarketWatch how the Mazars’ letter revoking its support for a decade’s worth of financial statements might impact specific buildings, or overall future financing for Trump properties.

40 Wall Street in ‘distress’

About two months after Trump officially announced his presidential run in June 2015, he secured financing on a longstanding fixture of Wall Street, once briefly the tallest building in the world.

That year, the 71-story 40 Wall Street was appraised at $540 million, a valuation that helped Ladder Capital Corp.

LADR,

lend Trump $160 million on the office and retail tower, according to CredIQ, which tracks commercial property data.

Monthly updates to bondholders show that Trump still owes $132 million on the loan, according to CredIQ data, which indicates that payments have remained current, but that the loan has been classified as “distressed,” with occupancy falling to 86% as of November 2021, down from 98% when the loan was originated. Ladder didn’t respond to a request for comment.

The debt, which came with a personal guarantee of up to $26 million from Trump, comes due in July 2025.

But before that, the Trump Organization also has a $100 million mortgage coming due in September 2022 on the commercial portion of 725 Fifth Avenue in Manhattan, according to CredIQ, a building more commonly known as Trump Tower.