This post was originally published on this site

The Terex Corp. (NYSE:TEX) is a stock I frequently use to assess economic strength and to increase my long exposure during an economic upswing. However, in this article, I am doing things differently. I decided to increasingly focus on stocks with a lot of upside potential (hence the title). By that, I mean stocks with the potential to triple or quadruple without being penny stocks or dependent on a one in a million event. In this article, I will tell you why I started to buy the beaten-down industrial Terex and why I believe that the stock has the potential to triple.

Source: Terex Corporation

What’s Terex?

Normally, I skip this part in my quarterly reviews. However, as this is kind of a new type of article, I will include it going forward. That said, the Westport CT based company is a pretty straightforward company. Terex operates in two segments: aerial work platforms (AWP) and material processing (MP). So, right off the bat, the company can be characterized as a cyclical play as AWP products are mainly dependent on construction activity whereas material processing benefits from strong basic material capital expenditures. In addition to that, the company adjusts its products for military use as well. This includes the construction of barracks and other non-combat tasks.

Source: Terex Corporation

The company is currently worth roughly $1.0 billion and not a member of the S&P 500.

Why The Stock Could Triple

This is the most important part. I don’t like penny stocks, and I don’t like people who promise tremendous returns. I won’t promise anything either, but I will show you why the stock has high potential. The chart below shows two indicators. The black line displays the Terex stock price. As you can see, this stock price has a cyclical pattern. Since the recession of 2009, the stock had multiple ups and downs. In 2011, the stock peaked along with commodities. The same happened in 2014 when oil and other basic materials were dragged down due to economic weakness. Then, in 2018, another wave of weakness hit as a global trade war weakened earnings. Unfortunately, while it looked like we were at a bottom in Q1 of 2020, COVID-19 pushed the stock to levels not seen since 2011.

Source: TradingView

The red line in the graph above shows the ratio between basic material stocks (XLB) and utilities (XLU). If this ratio rises, it means that basic materials are outperforming utilities. This happens in periods of higher (expected) global growth and inflation. As a result, this ratio and the Terex stock price almost move in lockstep as higher growth and higher inflation are the perfect tailwinds for Terex investors.

With this in mind, while the Terex stock price is still close to its lows, the XLB/XLU ratio has improved significantly. This does not mean that Terex should rise to $22 within a matter of days, but it is a promising sign as we could be facing a sustainable bottom. If this were indeed the case and economic growth were to increase, we could be looking at a stock price move to at least $30. And even then, a further economic recovery comparable to 2012 or 2016 could push the stock much higher than that.

While this assessment is based on past movements during recoveries, let’s take a look at the company’s financials to assess if anything has changed that could prevent the stock from recovering as the company did in the past two cycles. Reasons could be too much leverage resulting in secondary stock offerings, divestments that hurt earnings potential or general distrust due to competition.

Q1 And Q2 Are ‘Lost’ Quarters

Let’s start this part by mentioning that all ‘possible’ reasons I just mentioned are nonsense in this case. The ‘only thing’ Terex is suffering from right now is slower economic growth. Unfortunately, this is hitting the company’s financials like a wrecking ball. In the first quarter, total sales fell by 26.7% to $833 million. The operating margin fell from 12.2% in the prior-year quarter to -0.8% as lower gross margins met higher SG&A expenses as a percentage of sales. Total income from operations took a dive from a $99.7 million profit in Q1 of 2019 to a $7.1 million loss in the Q1/2020 quarter. Official earnings per share fell from a $0.79 profit to a loss of $0.35.

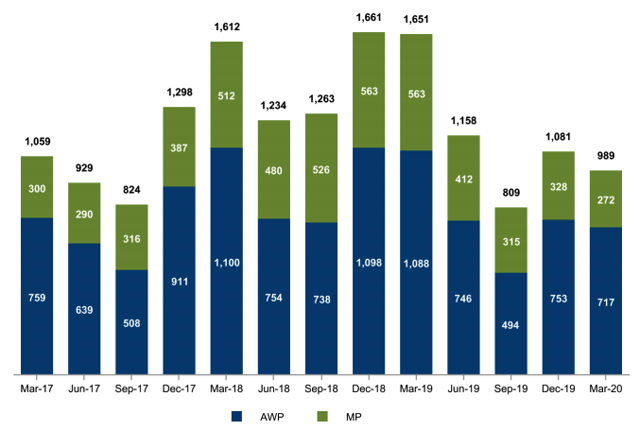

In the first quarter, global sales of aerial work platforms fell by 30%. This segment’s end market saw a sharp demand decline. While China saw rising demand in March, this is likely going to be offset by further weakness in the West as this is where the lockdown started in March. In other words, Q2 will more than likely be much worse than the first quarter. Anyhow, materials processing demand was down 23% as markets like India were hit by tight credit and the government shutdown. Additionally, lower scrap prices reduced demand for material handlers.

Additionally, when lower demand meets ‘normal’ production numbers, backlog tends to show even worse growth rate than sales. In this case, the first-quarter backlog fell by 40% to $989 million. Material processing backlog underperformed as the backlog value fell by 52% to $272 million – a new multi-year low.

Source: Terex Q1/2020 Earnings Presentation

Source: Terex Q1/2020 Earnings Presentation

The good news is that these numbers don’t have a lot of meaning. Everyone knew Q1 would be bad. Q2 will be worse. That’s a fact, and the stock price has priced this in. What matters more to be than backlog is financial stability. Some stocks tend to ‘break’ after a sell-off like this as financial instability is forcing companies to issue shares or to sell a large part of their business.

Terex is different. The company maintains a healthy liquidity position as current assets cover 253% of current liabilities. Even adjusting for inventories (quick ratio), this number is at 125%. Total debt is at 171% of total equity, meaning that the company is currently mainly debt-financed. Nonetheless, it’s still sustainable. Just like the total liabilities value. Right now, total liabilities are valued at 74.8% of total assets. While this is, without doubt, an elevated level, it is within the long-term range between 60% and 75%.

Game Plan

‘The economy will improve eventually’. While this statement is true, it might be one of the most dangerous sentences right now. Basically, it justifies buying everything that’s seriously down like airlines, rental car companies, Terex, automotive companies, etc. However, that would mean that a portfolio gets extremely volatile. What I have done is reserving a part of my portfolio for high-potential plays like Terex. I will buy as soon as I spot an opportunity and add as long as the bull case is turning out to be correct. Last week, I added a small number of Terex shares at $13.99. Right now, the company is a small part of my portfolio.

The company offers tremendous upside potential thanks to its cyclical characteristics. It’s a high-potential play without having to buy penny stocks or buying into companies waiting for a breakout product that may never come. In this case, the bull case is simple: it’s economic growth. Recovering economic growth will, without a doubt, end up pushing this stock much, much higher. The problem is that this might take a while and push this stock down a bit more. In other words, if you are buying, be aware of the risks and keep your position small. This can only become a profitable trade if you are prepared to risk some downside – even at these levels.

Stay tuned!

On a side note: my next article in this category will have a similar title starting with ‘home run potential’.

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below! My long-term investments are stated in my Seeking Alpha biography.

Disclosure: I am/we are long TEX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.