This post was originally published on this site

Target Corp.’s earnings and stock have suffered in recent months as the discount retailer started aggressively dealing with an inventory glut, likely leaving some investors to wonder why, and was it worth it.

With the report of fiscal second-quarter results on Wednesday, Target has now missed profit expectations by a wide margin in back-to-back quarters, following a 13-quarter streak of beating forecasts.

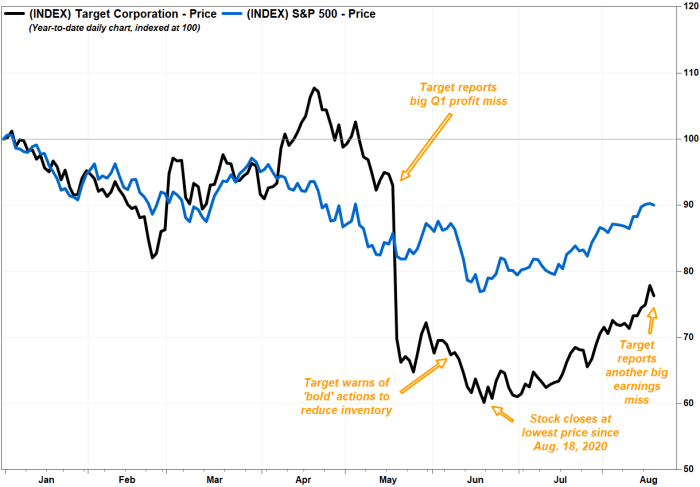

Throw in a warning in early-June of the negative financial impact from an “inventory optimization” plan, and the stock

TGT,

has tumbled nearly 19% since Target reported first-quarter results in mid-May, while the S&P 500 index

SPX,

has gained close to 5%.

Considering the consequences, Chief Executive Brian Cornell opened the post-earnings conference call with analysts on Wednesday with whether he still believed the “bold effort” announced in June to right-size inventory was a good idea:

““While this decision had a meaningful short-term impact on our financial results, we strongly believe it was the best path forward.” ”

Cornell also explained why it was so important to reduce inventory so aggressively.

“Consider the alternative. We could have held on to excess inventory, and attempted to deal with it slowly, over multiple quarters or even years,” Cornell said. “While that might have reduced the near-term financial impact, it would have held back our business over time.”

Since June 7, when Target issued the warning of “bold efforts” being taken to cut inventory, the stock has rallied 12.4% while the S&P 500 has tacked on 2.7%.

FactSet, MarketWatch

Here’s how excess inventory hurts business:

- Increases costs for storing and managing the excess inventory over a longer period.

- Degrades the customer experience, by cluttering the sales floor and by hampering the ability to present new, fresh and fashionable items.

- Presents an “ongoing burden” to the supply chain and store teams, as they are distracted by working around the excess inventory day after day. “For our team, this quarter’s inventory actions will enable them to focus on what they do best: Providing a great guest experience, while reducing the stress and distraction from overly crowded store back rooms and distribution facilities,” Cornell said.

- Reduces the ability to increase inventory in categories that are driving growth, such as food and beverage, beauty and essentials, as well as for back-to-school items.

- Reduces the ability to prepare for expected strong demand for items focused on “seasonal moments,” such as Halloween, and for upcoming holidays.

- Bogs down the supply chain.

Chief Operating Officer John Mulligan also explained on the call that over time, Target’s distribution centers (DCs) work best when they are operating at or below 85% of the maximum capacity, as “operational difficulties and costs rise significantly” when they move above that level.

For context, Mulligan said when the inventory actions were announced in June, the DC network peaked at well-over 90% of capacity.

At the end of July, DC capacity utilization was below 80%, meaning the physical space occupied by DC inventory was 20% lower than the June peak.

D.A. Davidson analyst Michael Baker reiterated his buy rating on Target’s stock while boosting his price target to $203 from $185, citing the progress made in reducing DC space occupied by inventory.

“This is helpful, as one of the main issues with being over-inventoried is that it clogs up the systems, both physically and financially,” Baker wrote in a note to clients.

The stock fell 2.7% on Wednesday in the wake of second-quarter results, but has run up 25.9% since closing at a two-year low of $139.30 on June 17. Over the same time, the S&P 500 has advanced 16.3%.