This post was originally published on this site

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.

How big of a deal is a vaccine for investors?

According to Goldman Sachs, “Despite investor focus on the prospective policy implications of the Biden presidency, the vaccine for COVID-19 is a more important determinant of the path of both the economy and stock market in 2021,” strategists led by David Kostin wrote in a note Wednesday. Meaning the report on Monday from Pfizer and BioNTech about the 90% efficacy of their late-stage coronavirus vaccine could mean big gains for stocks moving forward.

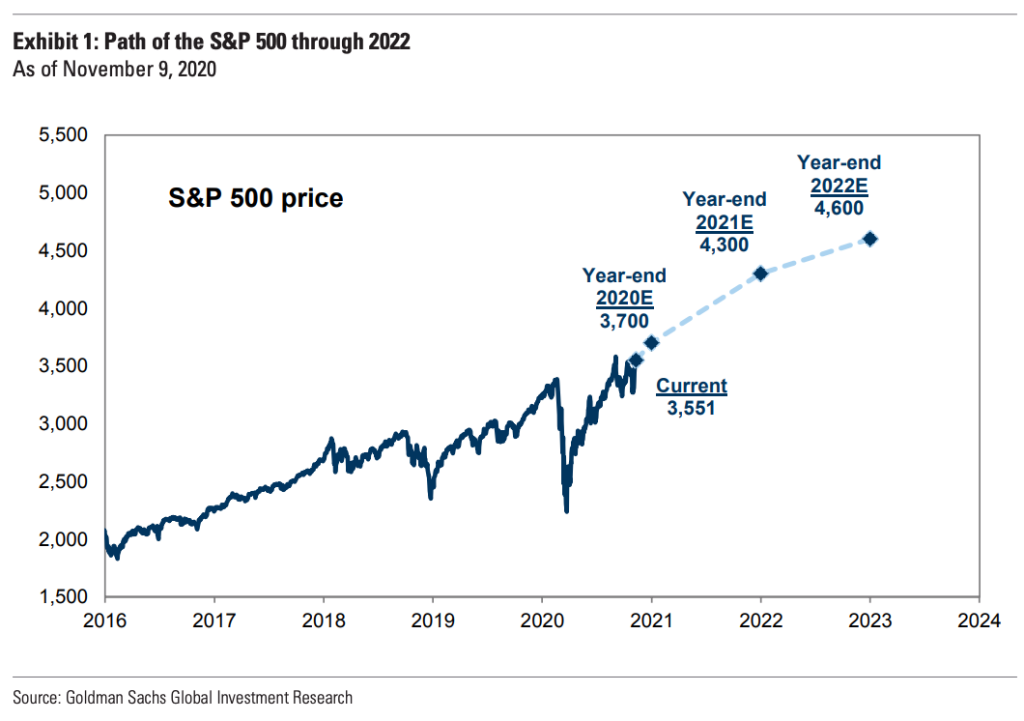

Goldman is now raising its year-end 2020 price target for the S&P 500 to 3,700. What’s more, analysts at the firm now expect stocks to rise 21% from Tuesday’s close to 4,300 by the end of 2021, and pop another 7% from there to hit 4,600 by year-end 2022. (The firm expects at least one FDA-approved and widely distributed vaccine in 2021.)

Indeed, in addition to the vaccine news, Wall Street got another boost this week from the resolution of the election, with President-elect Joe Biden securing the race for the White House over the weekend. Markets are now pricing in a split Congress that could prevent major policy changes, expecting Republicans to maintain control of the Senate after two runoff Senate elections in January.

“In a day, we went from no vaccine to possibly several, which took a big chunk of the pandemic worries out of the market. Markets soared on the substantial removal of two of the major concerns that held them back in October,” Brad McMillan, chief investment officer for Commonwealth Financial Network, wrote in a note Tuesday.

But not all stocks are benefiting from vaccine hopes. Notably the Big Tech stocks that have outshined the broader market so far in 2020 are lagging this week, while cyclical and value stocks are outperforming.

For some strategists, the market performance underlines the message that “investors need to diversify for the next leg, toward more cyclical parts of the market that have lagged behind in 2020, and away from big tech and the primary stay-at-home beneficiaries,” strategists led by Mark Haefele at UBS Wealth Management wrote in a note Tuesday.

But that doesn’t mean investors should ditch tech altogether: Strategists at Goldman argue that “although the combination of extreme valuation dispersion and a vaccine catalyst should create a powerful tactical rotation into Value stocks, from a strategic perspective Growth stocks should remain attractive,” adding that the “vaccine-driven Value trade is likely to resemble other Value rallies of the past decade, which have rarely lasted more than a few months.”

That’s why the firm is now recommending value stocks that “benefit from the vaccine and economic normalization” plus stocks with “long-term secular growth prospects that have high growth investment ratios,” the strategists wrote.

More must-read finance coverage from Fortune:

- Now that Pfizer is the vaccine front-runner, should you buy the stock?

- Will another $1,200 stimulus check ever come? Here’s what we know

- From mentorship to friendship to love: What I learned from three investing giants

- J.P. Morgan analysts call these 25 stocks “short” candidates as a COVID vaccine gets closer

- A journalist-turned-detective on how corporate America depends on private sleuths