This post was originally published on this site

Small- and medium-sized businesses started getting back to the office last year, even as many Fortune 500 companies continued to tweak plans to recall more staff on a regular basis.

The modest revival of office life in America as the pandemic enters a third year ranks high among the positive signs for hard-hit flexible office space in 2022, according to a new report by CBRE Research, a division of the global commercial real-estate services and investment firm.

The flexible-office sector “has grown up,” said Brandon Forde, president of CBRE’s client solutions advisory and transaction unit, in a media briefing Monday on the report’s findings.

Its coming of age follows high-profile missteps and the reboot of co-working giant WeWork Inc.

WE,

in 2021 as a public company, and as the pandemic has forced American corporations to begin rethinking the future of the office.

“The first ones back, making decisions, are smaller companies,” Forde said, while also pointing to many big companies penciling in more flexible office space in the future, as they put together their “return-to-office plans.”

A CBRE survey of 185 corporate real-estate decision-makers last year found an emphasis on hybrid work models, with about half expecting to have at least 10% of their real-estate portfolios in flexible office space in the next two years.

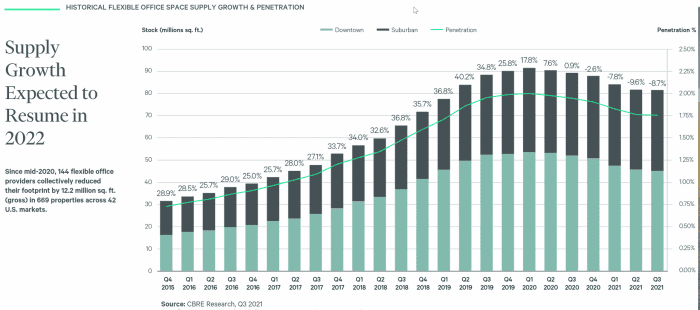

That level of adoption would be a reprieve for flexible office-space providers, which lost about 12.2 million square feet in the U.S. from mid-2020 (see chart), including a 8.7% drop in the third quarter of 2021 from a year before.

Flex office space shrunk in the U.S., but is poised for rebound.

CBRE Research through Q3 2021

The string of quarterly declines stem from office closures concentrated in Manhattan, San Francisco and Los Angeles, which accounted for 47% of the reduction in flexible office space, according to CBRE’s review of 144 operators in the sector.

Digging in further, WeWork and IWG

IWG,

providers of about half of U.S. flex office space, accounted for 48% of the net retreat by square footage, while Knotel’s share was about 20%, according to CBRE.

Even so, Mark Dixon, IWG founder and CEO, told CNN on Monday that his company, already in 1,100 cities globally, expects its footprint to grow by 50% in the next year as more tenants look for hybrid work opportunities and space for “collaboration” instead of simply “everyday work.”

WeWork declined to comment, while Knotel didn’t immediately respond to a requests for comment.

Consolidation trend

Industry consolidation among flex-office companies has been a key pandemic theme as buildings remain only sparsely populated in many big cities.

The average occupancy rate was last pegged at 31.2% for the 10-city Kastle System’s back-to-work barometer, down from above 90% before the pandemic.

WeWork in January said it reached an agreement to acquire Common Desk, a Texas-based boutique flex-space provider. Knotel filed for bankruptcy protection a year ago, with the court later approving its sale to an affiliate of the Newmark Group, a brokerage firm. CBRE has a stake in Industrious.

Forde at CBRE said that despite the recent retrenchment, it is “pretty easy math” to see the sector’s growth potential, given the expected uptake of flexible space by U.S. companies through 2024, and with its current footprint pegged at less than 2% of all U.S. office space, around 80 million square feet, as of the third quarter.

Another area to watch will be what office tenants decide to do as existing leases mature.

“It’s possible that, as leases come up for renewal upon expiration, tenants will take a hard look at their portfolio strategy,” said Julie Whelan, CBRE’s global head of occupier research, in response to a follow-up question from MarketWatch.

“They will likely continue with long-term commitments for the portion of their portfolio that is certain and choose a flexible office-space option (preferably within the same building) for the portion that is variable,” she said.

“As leases come due over the next few years, how this dynamic plays out will certainly become clearer in the market.”

Related: Shorter leases? Top real-estate executives Durst and Jones talk about the future of the office