This post was originally published on this site

A war on multiple fronts is under way in markets.

It isn’t just the military conflict kicked off by Russian President Vladimir Putin in Ukraine, but also the war being waged against rising price pressures and growing concerns about recession in the U.S. We’ll discuss investment tactics with some strategists who will aim to offer a field guide via exchange-traded funds to the new treacherous landscape.

Meanwhile, a pair of Russian ETFs are getting punched in the mouth, but they aren’t the only assets facing withering declines.

Send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn to tell us what you think are important topics for ETF Wrap.

The good

| Top 5 gainers of the past week | %Performance |

|

VanEck Gold Miners ETF GDX, |

5.0 |

|

iShares MSCI Global Gold Miners ETF RING, |

4.9 |

|

Aberdeen Standard Physical Platinum Shares ETF PPLT, |

4.5 |

|

Vanguard Extended Duration ETF EDV, |

3.4 |

|

iShares Silver Trust SLV, |

3.2 |

| Source: FactSet, through Wednesday, Feb. 23, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

Top inflows

| Top 5 weekly inflows |

|

SPDR Bloomberg High Yield Bond ETF JNK, |

| iShares Paris-Aligned Climate MSCI USA ETF (PABU) |

|

Vanguard Intermediate-Term Corporate Bond ETF VCIT, |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, |

|

iShares U.S. Real Estate ETF IYR, |

| Source: FactSet |

Top outflows

Stagflation looms?

On Thursday, we caught up with Nancy Davis, the chief investment officer and founder of advisory firm Quadratic Capital, who said that this environment of uncertainty, marked by rising inflation, a hawkish Federal Reserve and a host of geopolitical risks could lead to stagflation.

Economists and strategists have been kicking around the idea of stagflation. MarketWatch has reported on it here and here. But the notion of higher prices and sluggish growth, last experienced in the 1970s, is starting to look more like a possibility, given supply-chain shortages, $100 oil, chip shortages and the threat of all-out war in Ukraine, which could morph into something more severe and amplify problems.

“It’s hard to have a crystal ball but I think the biggest concern for investors has to be a stagflation,” Davis told ETF Wrap.

She said in such an environment bonds and stocks could selloff together, with the Federal Reserve forced to raise rates, to tackle rising inflation.

“This stuff is really going to heat up inflation pressures,” she said.

She pointed to crude-oil prices

CL.1,

BRN00,

at around $100 and the threat that further embargoes against Moscow could drive futures prices into the stratosphere. “We already have supply-side shocks and labor-market shortages,” she said.

So what does, Davis recommend?

She said investors should consider their allocations to stocks and bonds.

The investor said traditional portfolio allocations where investors own a mix of 60% in stocks and 40% in fixed-income might be a loss-making recipe in this environment.

“I think it’s time to rethink the 60/40 portfolio because investors need diversification,” she said. And the current climate makes it hard to determine “what’s going to work.”

Davis said that investors sometimes make the mistake of owning bonds that tend to have similar beta to stocks, meaning they might not serve as a sufficient hedge against losses in a stagflationary environment.

You have to “make sure on the fixed-income side that you have something that is not the same beta,” she said.

Davis says a fund she rolled out in 2019, the Quadratic Interest Rate Volatility & Inflation Hedge ETF

IVOL,

could be a good diversification bet for investors. The ETF is intended to move in and out of Treasury inflation-protected securities, or TIPS, and over-the-counter fixed-income options in a bid to beat the market. It has about $2.2 billion in assets and has an expense ratio of 1.05%, which means that the fund costs $10.05 in annual fees for every $1,000 invested.

Lest one think Davis is just talking her book, IVOL, referring to the fund’s ticker, is up 1.1% on the day, up 0.5% in the week thus far, and down 2.2% on the year to date. By comparison, the iShares 20+ Year Treasury Bond ETF

TLT,

is up 0.8% on the day, down 0.3% on the week and is looking at a 7% loss in 2022 so far.

Gold shines

Todd Rosenbluth, head of ETF and Mutual Fund Research at CFRA, who responded to us on vacation (sorry, Todd), offered a few ideas for investors amid the calamity unfolding in markets.

He has been seeing investors turn old school and heading for the safety of gold, including the SPDR Gold Shares

GLD,

which was up 1% on Thursday and headed for a weekly gain of 1.6%. GLD boasts some $61 billion in assets and carries an expense ratio of 0.40%.

“While GLD remains the largest, there are many lower-cost alternatives better suited for retail investors such as GLDM, IAUM, and AAAU,” Rosenbluth said.

He was referring to the tickers of SPDR Gold MiniShares Trust

GLDM,

iShares Gold Trust Micro ETF

IAUM,

and Goldman Sachs Physical ETF

AAAU,

which all have expense ratios ranging from 0.15% to 0.18%.

For the faint of heart, the CFRA analyst said lower-volatility and defined outcome ETFs, designed to mitigate the downside, might be a good wager. Those include Invesco S&P 500 Low Volatility ETF

SPLV,

and Innovator U.S. Equity Buffer ETF

BFEB,

which have fees of 0.25% and 0.79%, respectively.

Russia’s very bad ETF day

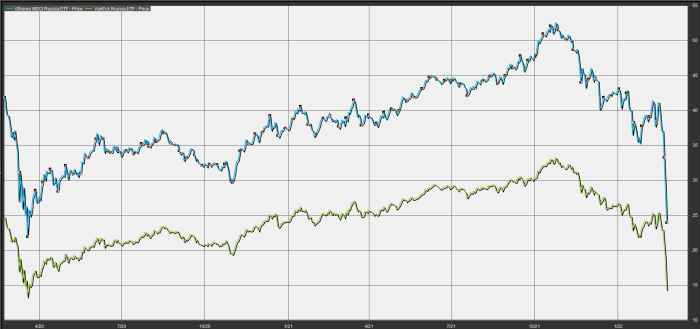

The VanEck Russia ETF

RSX,

plunged 26% Thursday, with all components tumbling, as Moscow’s attack in and around Kyiv and fears of sanctions prompted investors to flee the fund. ETF Wrap has written about growing retail interest in the VanEck single-country ETF, which is down 48% on the year. If the current decline holds through the close it will represent sharpest one-day drop ever, surpassing the Nov. 12, 2008 fall of 22.32%, according to Dow Jones Market Data.

Meanwhile, the iShares MSCI Russia ETF

ERUS,

was down nearly 19% and looking at its sharpest daily slump since March 9 of 2020.

FactSet

The downturn in Russia-pegged ETFs come as the Dow Jones Industrial Average

DJIA,

was down more than 700 points, the S&P 500 index

SPX,

was down 1.5% and the Nasdaq Composite Index

COMP,

was trading 0.6% (after a massive intraday recovery from a drop of 3.5% at the lows), at last check.

Capital Group’s active

Capital Group is entering the ETF fray, marking what Rosenbluth described as a milestone “for active ETFs given that the firm managed $2.6 trillion in assets overall at the end of 2021.” It has been one of the biggest fund providers not to offer funds in the popular ETF wrapper—until now.

The fund manager is kicking off six actively managed ETFs:

Capital Group Growth ETF

CGGR,

Capital Group Core Equity ETF

CGUS,

Capital Group Dividend Value ETF

CGDV,

Capital Group International Focus Equity ETF

CGXU,

Capital Group Global Growth Equity ETF

CGGO,

Capital Group Core Plus Income ETF (CGCP)

Tim Armour, chairman and CEO of Capital Group, said that active ETFs “will be transformative for the industry” and that Capital aims to be a market leader.