This post was originally published on this site

U.S. mutual funds that focus on large-cap stocks are still struggling to beat their benchmarks, while hedge funds are off to a “great start” in 2022, according to BofA Global Research.

Actively managed large-cap funds underperformed their Russell 1000 benchmarks on average by 12 basis points in February, lagging for a fifth straight month, BofA equity and quant strategists said in a research report Thursday. The percentage of large-cap managers beating their benchmarks dropped last month to 43%, from 51% in January.

Funds across all three styles, including core, growth and value, had “similar hit rates” ranging from 42% to 46%, the report shows. Growth funds had been “particularly weak” in the prior four months, according to the strategists.

The U.S. stock market has been volatile amid Russia’s invasion of Ukraine, which has entered its 8th day, and is down so far this year. The BofA analysts said they expect volatility to stay elevated, benefiting hedge funds, which had a “great” February.

Hedge funds gained 0.2% last month on average, while the S&P 500 lost 3%, the report shows. “Four of the nine strategies that we track posted positive returns in February,” with macro funds leading the outperformance, the strategists said.

So far in 2022, hedge funds have declined just 0.8% on average, the BofA analysts said, outperforming the 8.2% drop for the S&P 500 this year through February. In each of the past three years, though, hedge funds lagged the market by 15 to 23 percentage points per year, according to the report.

“The high volatility/low return environment we expect could potentially help hedge funds in 2022,” the BofA strategists wrote. “Hedge funds are having a great start” to the year.

The CBOE Volatility Index

VIX,

or VIX, has been elevated, trading around 30 Thursday afternoon, according to FactSet data. That compares to a 200-day moving average of around 20.

Check out ETF wrap: Ukraine crisis creates cracks in the ETF complex: ‘I think it remains more likely each day’ that popular Russia funds ‘are shut down,’ says analyst

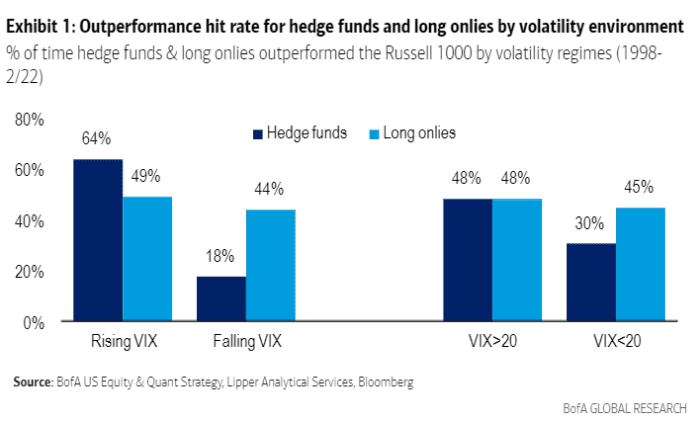

A chart in the BofA report shows that hedge funds tend to outperform when the VIX is rising, while long-only funds fare better than hedge funds when volatility is falling and when the VIX is less than 20.

BOFA GLOBAL RESEARCH REPORT DATED MARCH 3, 2022

All three major U.S. stock indexes closed down Thursday, with the S&P 500

SPX,

off 0.5% and the Dow Jones Industrial Average

DJIA,

slipping 0.3%, according to FactSet data. The Nasdaq Composite

COMP,

booked a sharp decline of 1.6%.

The Russell 1000 Value Index

RLV,

closed flat Thursday, faring better than the Russell 1000 Growth Index

RLG,

which dropped 1.4%, FactSet data show.