This post was originally published on this site

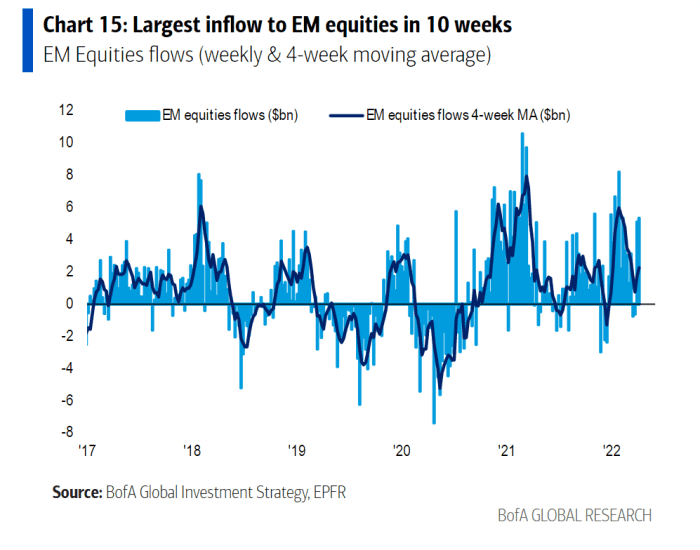

Investors have plowed a lot of money into emerging markets in April.

They added more than they have at any time in the past 10 weeks, says Bank of America. This continues a trend that started in late 2020.

Is this folly? Or will emerging markets (EM) outperform this year and beyond?

It’s the latter, says Neal Dihora, who helps manage the Wasatch Emerging Markets Select Investor Fund

WAESX,

alongside lead manager Ajay Krishnan, who has been at the helm for over nine years.

Sure, they have a bias. They run an EM fund. But their remarkable record tells me they are worth listening to. The Wasatch fund beats its Morningstar diversified emerging markets category by 9 to 13 percentage points annualized over the past three to five years, according to Morningstar Direct.

Besides, they’re not the only ones bullish on EM now. We’ll get to the investing lessons we can borrow from the Wasatch team on how to beat the markets, and several favorite EM names. But first, here’s why EM may outperform this year and beyond.

The dollar will lose its luster

If international tensions ease over the next few months, the dollar will lose some of its safe haven status. This will have investment money flowing out of the dollar into other parts of the world, supporting EM stocks, says Jim Paulsen, the chief equity strategist at Leuthold group. He favors EM outside of China, and this makes sense because a lot of companies are moving supply chains to other EM nations.

EM will benefit from mega trends

Dihora cites five so-called mega trends: population growth; “financialization,” or the greater use of consumer credit; digitalization, meaning greater use of the internet for things like shopping and banking; and industrialization.

This means the buildout of supply chains in EM countries including Vietnam, Indonesia, Malaysia, Brazil and Argentina, among others.

Goldman Sachs agrees. The bank has singled out EM for outperformance.

“An active EM equity strategy may have the potential to outperform a U.S. one over the next decade as EM populations grow and innovation expands,” says the investment bank.

Inflation helps emerging markets

Many EM economies are commodity-based. A sustained rise in commodity prices will support gains in gross domestic product (GDP), improving the tone of business for companies throughout their economies.

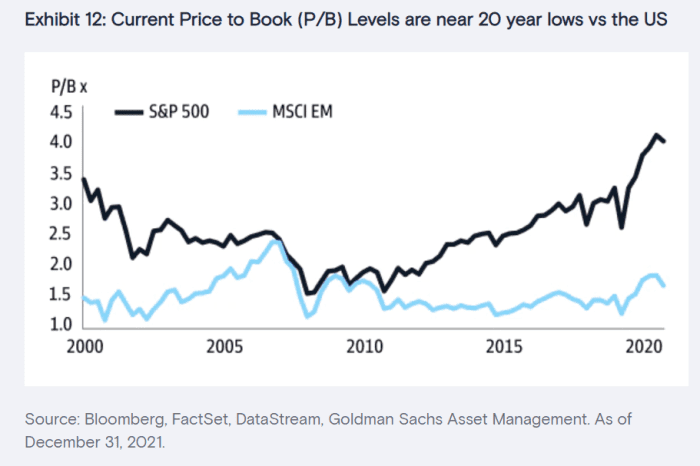

Emerging markets look relatively cheap

While investors agonize over relatively high valuations in the U.S. stock market despite weakness this year, EM looks about as cheap as it has been in the past 20 years, says Goldman Sachs.

The bottom line: While the iShares MSCI Emerging Markets ex-China ETF

EMXC,

has beaten the S&P 500

SPX,

by about a percentage point year to date, this may be the start of a medium-term trend of outperformance.

How to outperform in EM (and elsewhere)

Given the Wasatch Emerging Markets Select Investor Fund’s outperformance over the past five years, it’s worth considering how they get these returns, to see what we can learn.

Dihora offers three key tactics that he and lead manager Krishnan apply.

1. Lesson # 1: Look for enduring businesses with comparative advantages. To see how this works, consider the Mumbai-based HDFC Bank

HDB,

which trades on the New York Stock Exchange (NYSE). The business-model advantage is that the bank has developed a loan-underwriting process that they strictly follow. This helps reduce loan write-offs. The bank also has a low-cost deposit base in part because it is such a trusted brand in India.

Also consider the Mexican airport manager Grupo Aeroportuario del Pacifico SAB de CV

PAC,

likewise listed on NYSE. One reason this is an enduring business is simple: It has exclusive agreements to run its airports in Mexico for decades. This gives it a long runway to keep growing its business by expanding services like parking, dining, lounges and hotel accommodations.

Lesson # 2: Look for companies with large and growing addressable markets. Cynics claim a lot of companies cite bogus studies to overestimate their total addressable market (TAM), a popular investing meme these days. But owning companies with potentially big markets is key to winning investments, says Dihora. You can dodge the pitfalls by thinking through the numbers on your own, as Dihora does.

Consider MercadoLibre

MELI,

a kind of Latin American Amazon.com

AMZN,

The popular online retailer (fourth-quarter sales grew 74%) had 82.2 million users at the end of last year, in a region with over 650 million people. That’s a big potential market.

The company enjoys a positive feedback loop from the network effect, meaning that as more consumers shop there, the platform attracts more merchants, which helps draw more consumers, and so on. MercadoLibre also has a habit of copying tactics of successful competitors like Amazon.com’s use of fulfillment centers and Sea’s

SE,

gamification of apps.

Another example: Globant

GLOB,

which is an IT-outsourcing business that helps companies improve the user friendliness of their apps and websites and digitize their businesses. Clients include Walt Disney Parks and Resorts Online, a part of Disney

DIS,

The potential market size is big considering that both IT outsourcing and the migration of business online still have plenty of room to grow.

Dihora also sees big potential in Globant’s internal business metrics. The company uses the “land and expand” model. This means it starts off small with customers and then build up business with them over time — a big reason why fourth-quarter revenue grew 63% to $380 million.

For example, by the end last year, the company had 12 customers spending more than $20 million a year, up from seven the year before. And it had 185 customers spending more than $1 million, up from 129 a year ago.

“I think it’s clear proof of how we are able to become more strategic in the type of relationships we have and this is what is giving us the confidence to increase our guidance,” CFO Juan Urthiague said in the fourth-quarter earnings call.

Globant has around 1,100 clients, suggesting a lot more room to grow using this tactic, says Dihora. The company is based in Luxembourg but Dihora considers it an EM business because it does a lot of business in emerging economies.

Bajaj Finance (500034 India: Bombay) is another example of a company with a big addressable market. The Indian consumer-lending company has around 57 million customers. But there are around 300 million to 400 million people in urban centers in India, where Bajaj targets customers.

Lesson # 3: Do nothing. This sounds easy, but it is not. The reason: As investors, we are bombarded by signals all day that we have to do something. The financial press, brokers, sell-side analysts and big unexplained moves in stocks are constantly urging us to take action.

“The world around us makes us want to do something,” says Dihora. “But what we have learned is that if we own companies that have an enduring business with a large addressable market, the best course of action is to do nothing.”

Some data points confirm this is a fundamental part of the fund’s strategy. The fund’s annual portfolio turnover is just 20%, on the low end for mutual funds, according to Morningstar Direct.

MercadoLibre has been in the portfolio since 2014. Bajaj Finance since 2015 and HDFC Bank since 2017. Globant is a relative newcomer, having joined the portfolio in 2019.

“You really have to think about the power of compounding. If you can avoid the pressure to ‘do something, do something!’ it really does pay off,” says Dihora.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned MELI and AMZN. Brush has suggested DIS and AMZN in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.