This post was originally published on this site

It’s been a volatile ride for stock market investors lately, but you might want to get used to it. This earnings season will bring more of the same.

Many investors hope a blowout fourth-quarter earnings season will steady the market and bring back the bull. They will be disappointed.

Sure, the strong economy and consumer spending suggest a good earnings season, which is kicking off now. So, yes, companies will beat earnings overall. The problem is, they won’t post anything like the 9% beat for the third quarter.

Bank of America strategist Savita Subramanian expects a 3% beat, based on nuanced quantitative analysis she and her team perform. (There are highlights below.) That’s not going to be enough to steady the market, in my view.

What’s more, she thinks Wall Street analysts’ 2022 profit margin estimates are too high, and they’ll get trimmed based on fourth-quarter results. That, too, will dampen investor spirits.

One issue is analysts have high hopes for the consumer-discretionary and industrial sectors in 2022. But those are two of the most labor-intensive sectors, she notes. Labor costs rose sharply in the fourth quarter and may stay high. Companies are also taking a hit on extra shipping and fuel costs.

Here are three key reasons why you shouldn’t get too psyched about this earnings season, followed three sectors and three stocks to consider favoring nevertheless.

1. Early indications are unfavorable

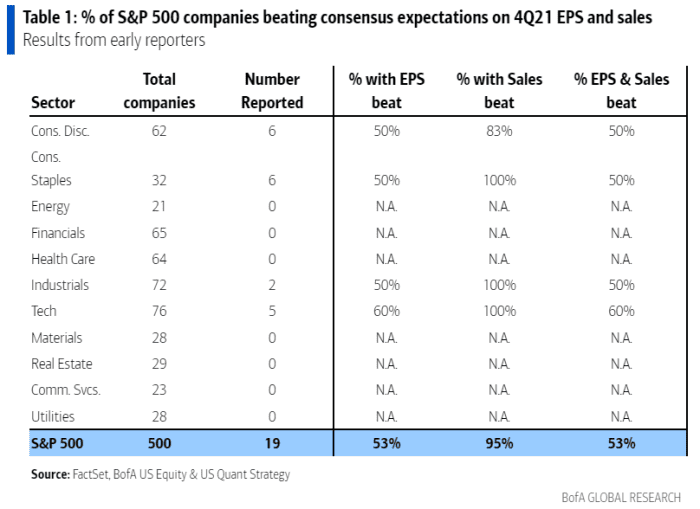

One way to get a read on what’ll happen is to look at the early reporters. There’s a 71% correlation between how the early reporters do and the whole earnings season, according to Subramanian and her team.

As of Tuesday (Jan. 11), 19 S&P 500

SPX,

companies had reported. Only 53% beat on earnings, much lower than the 67% last quarter and 69% on average since 2012. The companies exceeded estimates by an average of 4.2%, also a lot lower than the 9% overall beat for the third quarter.

2. Executives aren’t happy campers

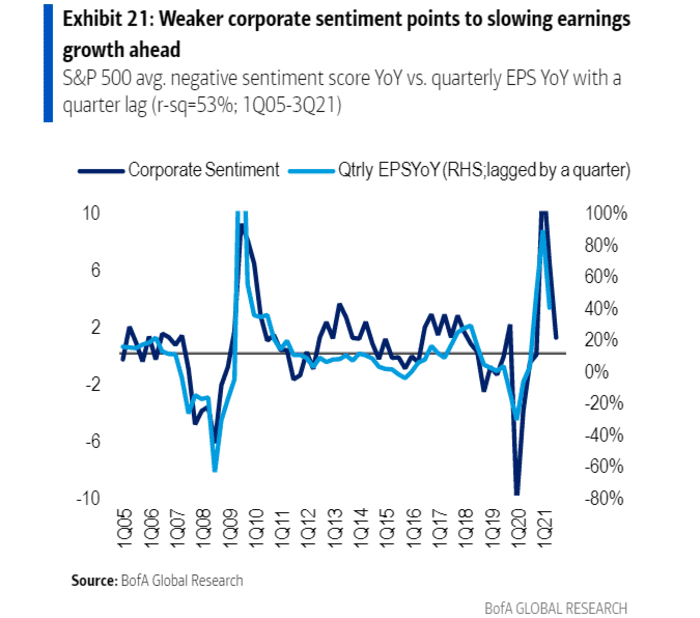

Analysts have gotten good at using “content analysis” of earnings call transcripts to assess the mood of top executives. They use software to count the number of positive and negative words. Examples of positive words include: Accomplish, achieve and outperform, while negatives include abandon, abnormal and downturn. (If you want to learn more about this, check out the research of Tim Loughran and Bill McDonald, who developed a dictionary of key words to count in company reports and earnings calls.)

The upshot: Sentiment in recent calls declined to the lowest level since the third quarter of 2020. This score is highly predictive of the upcoming quarter’s earnings growth. The darker mood points to good, but slowing, earnings growth ahead. This content analysis predicts 14% year-over-year earnings growth, but consensus Wall Street analyst estimates call for 20% growth. If this is right, it’ll come as a negative surprise and create volatility.

3. Guidance is slack-a-lacking

Another trick for predicting the upcoming quarter is to measure how corporate guidance is evolving. Here, you can track two things: 1. The number of companies guiding up vs. the number guiding below prior estimates. 2. How much the entire sell-side analyst community is changing earnings estimates. Both measures suggest relative softness ahead in the release of fourth-quarter results.

The details: The ratio of up vs. downward guidance in the trailing three months was just 1.2 in December compared to a peak of 4.5 last May. The ratio of up vs. down estimate revisions by analysts fell to 1.4 in December vs. a peak of 2.9 in August.

One disturbing guidance trend that’s not in the charts: Guidance on capital spending has fallen below its historical average. This is not good, because many economists are counting on elevated capex investment to juice the economy and raise productivity. That hoped-for productivity gain would ease inflationary pressures. That’s because companies feel less need to pass along cost increases when they are getting more out of workers (the definition of higher productivity). But the capex guidance suggests we may not get that relief on the inflation front.

Sectors and groups to favor

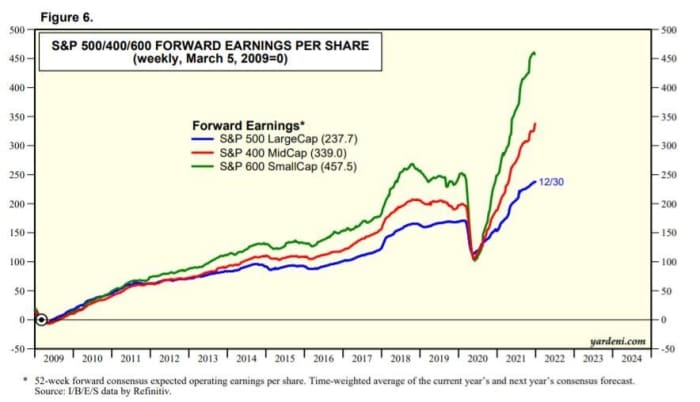

It’s not all grim news. Earnings estimates for small-cap and mid-cap companies have been taking off, as you can see in this chart from Ed Yardeni, at Yardeni Research:

Analysts are forecasting small-cap earnings and sales will grow an impressive 25% and 17% year over year in the fourth quarter, says Subramanian. They expect mid-cap earnings and sales to rise 28% and 19%.

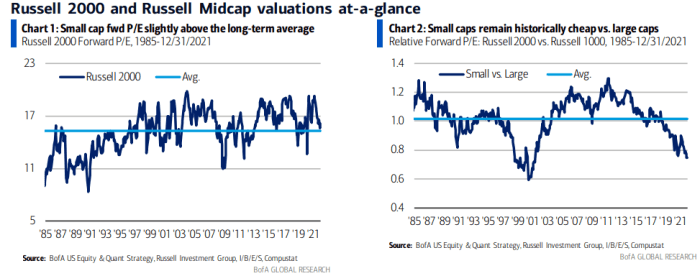

Not only that, but investors seem to be ignoring this trend. We know this because the valuations on small-cap and mid-cap names is low, relative to large companies.

Here you can see that small-caps are priced really cheap compared with large companies, historically. And they trade around their own historic valuation levels, so they don’t look expensive in that sense, either.

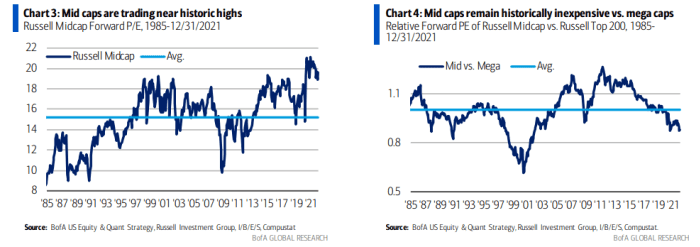

Below, you can see that mid-cap stocks trade cheap relative to large-cap stocks, but they are expensive compared to their own historical levels.

When hunting for stocks, you may want to favor names in real estate, energy and banking because they’ve had the strongest upward guidance and revisions in earnings and sales.

“Historically, sectors with strong earnings per share and sales revisions and guidance have been more likely to have a greater amount of earnings beats than misses in the subsequent earnings season,” says Subramanian.

Another factor to look for is a high ratio of positive to negative surprises in the prior quarter — trends that tend to persist into the next quarter. These three groups pass muster here, too.

Three stocks to consider

To isolate individual names whose stocks might outperform this earnings season and afterwards, Bank of America looked for this trifecta.

1. They beat estimates last quarter, which suggests they might again.

2. The Bank of America analyst’s estimates are above consensus, which may suggest consensus is too low and so there will be a positive surprise.

3. The company is under-owned by active managers relative to their benchmarks, which suggests they might scramble to upsize their position if a stock starts running, to avoid underperformance.

Three of the 13 companies that fit the bill are Marathon Petroleum

MPC,

in energy, Best Buy

BBY,

in retail and Synchrony Financial

SYF,

in consumer finance.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested MPC in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.