This post was originally published on this site

RES Fights To Stay Fit

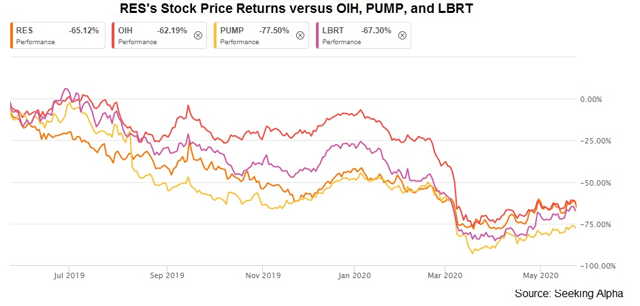

The current energy market crisis has hit the U.S. onshore energy hard, leading to further deterioration in an already weak pressure pumping equipment business. The near term is not conducive to completions activity turnaround, although the recovery in the crude oil price has provided a glimpse of hope. For the past couple of quarters, RPC, Inc. (NYSE:RES) has been preparing to face a sustained downturn by keeping a low pressure pumping fleet count. Its savings from cost-cutting initiatives can offset much of the loss in 2H 2020.

RES has no debt, while a much lower capex can help improve cash flows in FY2020. The top line can decline further in the short-term, and so, I do not expect returns from the stock to improve in the short-to-medium term. However, if the crude oil price stays weak, the stock price can offer more resistance to a downslide than some of its more leveraged peers.

Industry Indicators: Not Strong

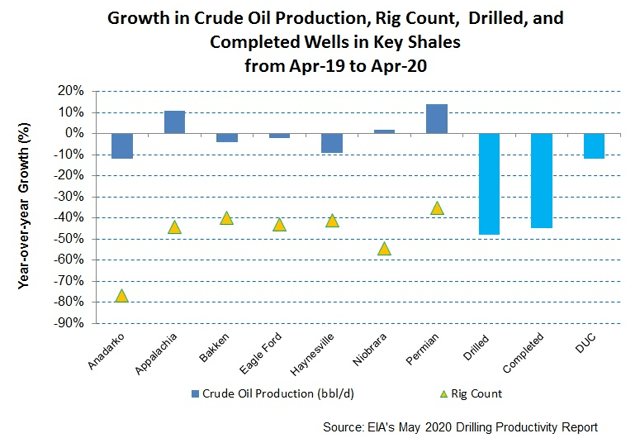

In the past year until April 2020, the DUC (drilled but uncompleted) wells declined (12% down) but was relatively resilient compared to the crash in the completed wells count (45% down) and the drilled wells count (48% down) in the key U.S. unconventional energy resources. The fall in completed and drilled wells continues to reflect the current weakness in the onshore industry, while the producers keep DUCs ready to bring production back in the medium term.

The Permian is one of the two key shales which saw production increasing (14% up) in the past year, although the rig count here decreased by 35%. With the introduction of technologies like multi-pad drilling and deployment of new equipment, drilling efficiency in the unconventional shales has increased significantly over the past years. With increasing efficiency, however, the pressure pumping service requirements have decreased. On average, crude oil production in the key unconventional shales remained unchanged in the past year. RES depends heavily on the Permian region.

What’s The Outlook?

As the business of pressure pumping industry remains oversupplied, the pricing and returns have stayed low. Since the company has been dealing with this situation for some time now, it seems to have learned to live with it. I have already discussed above how the completions well count in the U.S. crashed over the past year, which caused significant redundancy for the pressure pumping and downhole services in the industry. Earlier, in Q4, the company’s pressure pumping fleet count declined to 10 from 16 a couple of quarters ago. Since then, it has remained steady at that level. By Q1 2020, its pressure pumping fleet totaled ~728,000 hydraulic horsepower.

In Q1, the company responded to the demand loss led by the ongoing pandemic and has started to restructure its business and lower the cost structure. Early in Q2, it implemented layoffs and furloughs and reduced compensation, which is expected to result in $60 million in savings. To put it into perspective, the company incurred a $53 million operating loss in the past 12 months. So, the savings can improve its margin substantially. After right-sizing operations, it currently operates three horizontal frac fleets based in Texas and Oklahoma. The company also expects to realize cost savings from vendor price reductions and capex reduction in FY2020.

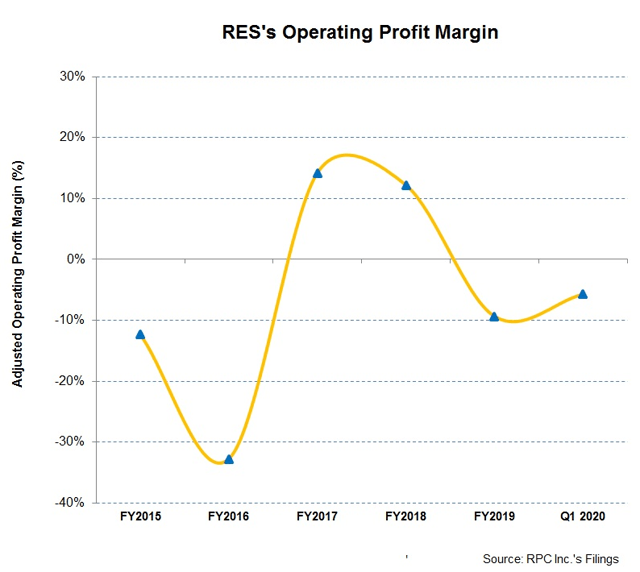

The pressure pumping business contributed to the lower profitability during the 2018-2019 downturn. However, as the company reduced fleet size aggressively, it reduced cost and mitigated the pressure on the margin in Q4. To understand RES’s business in detail, you may read this. The company’s management does not expect pricing to decline significantly from the current low. The company is already operating at a low level of activity, where it has reduced costs by a fair degree. The management is focused on generating adequate cash flows. Investors may note that that, unlike now, the energy price depression during 2014-16 was a slow-burning process where the company could adjust the cost level gradually. However, the current downturn has affected both the demand and supply side and has evolved rapidly. So, the primary concern for the company is survival in a volatile time through cost reduction and balance sheet strength.

With the capital budget rationalization of the upstream energy companies, we have low visibility in the short term. Despite the bearish sentiment, one of the growth catalysts could be EIA’s most recent energy price forecast, which indicates a steady crude oil price in 2H 2020, which can move up higher in 2021.

What Are The Current Drivers?

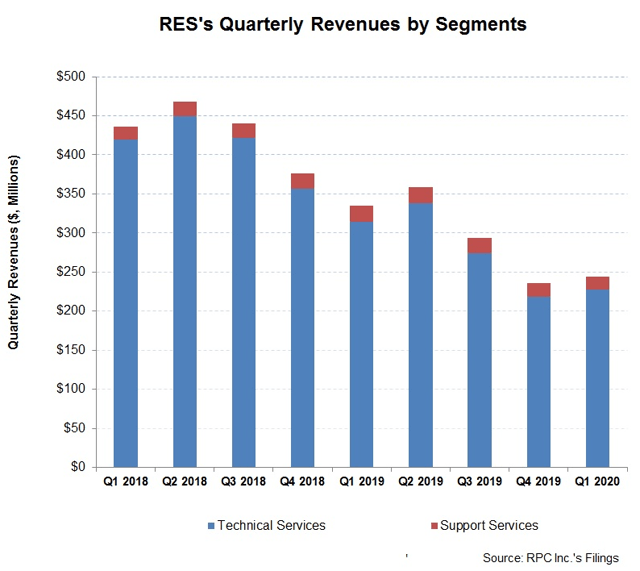

In Q1 2020, Technical Services revenues increased by 4% compared to Q4 2019. Higher activity levels in pressure pumping led to the sequential revenue growth in this segment. Revenues from pressure pumping accounted for 39.7% of the company’s total revenues. Despite the revenue growth, the segment remained loss-making at the operating income level in Q1, which triggered a substantial impairment charge in this segment. The Support Services segment revenue declined by 6% in Q1 versus a quarter ago.

The company’s cost of revenues as a percentage of revenues decreased marginally, from 75% in Q4 2019 to 74.6% in Q1 2020. Increased utilization and operational efficiencies, primarily in pressure pumping activities, led to an improved gross margin in Q1. Adjusted operating loss (excluding the impairment charges) as a percentage of revenues improved to 5.7% in Q1 from a 9.3% loss in the previous quarter.

In Q1 2020, the company recorded $205 million impairment charges related to the underperformance in some of the service lines in the Technical Services segment. In Q1 2020, Schlumberger (SLB) recorded substantial impairment charges associated with its Drilling and Production segments. You can read more on SLB in my article here. In Q1 2020, Halliburton (HAL) recognized $1.1 billion of impairments charges (pre-tax) associated with related to pressure pumping equipment and severance and other costs. You may read more about this here. The charges recorded by the leading oilfield services companies speak volumes about the situation in the market.

Net Debt Is Negative

The company continues to maintain zero debt as of March 31, but positive cash & cash equivalents balance ($82.6 million). In the current scenario, when the has energy price nose-dived and oilfield services companies’ earnings dipped, servicing of debt has become difficult. In this, a debt-free company like RES would be better equipped to survive compared to many of its OFS industry peers. However, investors should note that the company has $33 million in pension liabilities.

In Q1 2020, the company’s cash flow from operations declined by 29% compared to a year ago, led by the year-over-year revenue fall. However, a steeper capex decreased led to higher free cash flow in Q1 2020. Investors may note that, in Q1, the company recognized a discrete tax benefit of $13.1 million following the revaluation of the 2019 net operating loss, which was carried back to 2014. Now, with the CARES Act passing, RES’s management expects to carry the net operating loss back at a higher tax rate. Plus, it will now be treated as current receivable rather than a long-term receivable. So, even though cash flow from operations can fall due to lower revenues, the tax carryforward can mitigate the effect. Also, its current capex guidance for FY2020 is 80% below the FY2019 capex. So, the lower capex will also reduce the adverse effect and lead to improved free cash flow in FY2020.

What Does The Relative Valuation Imply?

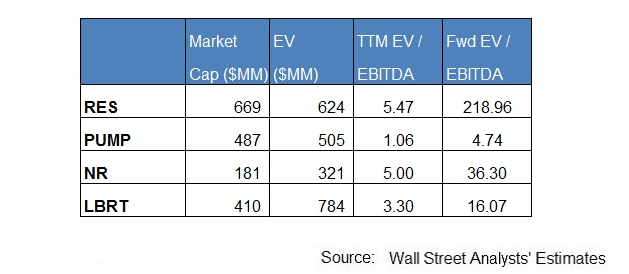

RPC, Inc. is currently trading at an EV-to-adjusted EBITDA multiple of 5.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is significantly higher. The current EV/EBITDA multiple is lower than its average of 7.6x since FY2017. So, it is trading at a discount to the past average.

RES’s forward EV-to-EBITDA multiple expansion versus the adjusted trailing 12-month EV/EBITDA is much steeper than peers because the sell-side analysts expect the company’s EBITDA to decline more sharply compared to peers in the next four quarters. This typically results in a lower EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple is higher than its peers’ (ProPetro Holding (NYSE:PUMP), Newpark Resources (NYSE:NR), and Liberty Oilfield Services (NYSE:LBRT)) average of 3.1x. So, the stock is relatively overvalued at the current level. I have used estimates provided by Seeking Alpha in this analysis.

Analyst Rating

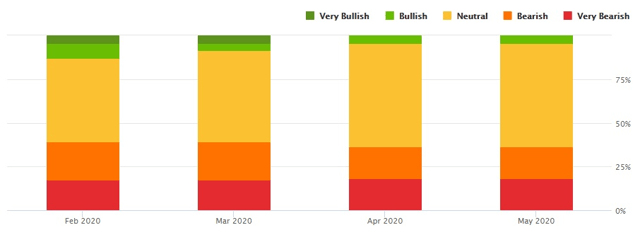

According to data provided by Seeking Alpha, one sell-side analyst rated RES a “buy” in May 2020, while 13 of them rated it a “hold.” Eight sell-side analysts rated a “sell” or “very bearish.” The consensus target price is $2.55, which, at the current price, yields negative ~19% returns.

What’s The Take On RES?

The pressure pumping equipment business was already suffering from an excess supply and upstream capex decline when COVID-19 led to an energy demand evaporation, leading to a sharp crude oil price fall in Q1. It hit the U.S. onshore energy hard, resulting in steep fall in completions wells in the past year. The next quarter is unlikely to provide much encouragement to the prospect of completions activity turnaround, although the crude oil price has started to recover from its lows.

I think RES’s decision to cut down the pressure pumping fleet during late-2019 has let it prepare well for a sustained downturn. Although the top-line can decline further in the short term, I expect the company’s operational and cost-restructuring initiatives to mitigate much of the loss at the operating level in 2H 2020. Industry-wise, as the pressure pumpers stack fleets, I expect demand to match supply in the medium to long term. To its advantage, the company has a clean balance sheet with no debt. Also, a much lower capex can help enhance cash flows in FY2020. At this point, I do not see RES making a sharp recovery in the short to medium term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.