This post was originally published on this site

Uranium prices have gained as much as 40% since Russia’s invasion of Ukraine, touching levels the market hasn’t seen in more than a decade, even though the war has had little immediate impact on global supplies of the fuel used to generate nuclear energy.

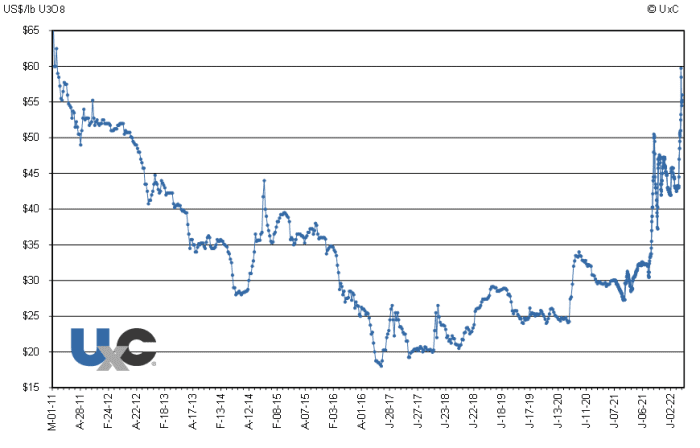

Uranium prices climbed to $59.75 a pound on March 10, according to data from nuclear-fuel consulting firm UxC.

That’s the highest since March 2011, the same month and year that a massive earthquake and tsunami in Japan led to a power outage and meltdown at the Fukushima Daiichi nuclear plant, prompting nations to rethink the safety of nuclear energy.

Chart from UxC is based on weekly uranium prices from 2011-2020, and daily prices from 2021-2022.

UxC

Uranium prices had been trading around $43 a pound before Russia invaded Ukraine on Feb. 24 of this year. The obvious driver behind the increase is the war, and the “changing situation in all kinds of energy markets,” says Jonathan Hinze, president at UxC.

The invasion doesn’t have an immediate impact, given that no one is going to build a new nuclear reactor overnight to compensate for lost natural gas or oil imports, he says. However, there are “signs a few countries in Europe may shift their stance on nuclear power and maintain existing reactors longer, or possibly build new ones sooner as they look to diversify away from Russian [natural] gas.”

Belgium is changing its position on a 2025 deadline to phase out all seven of its nuclear reactors, says Hinze. The country’s Federal Agency for Nuclear Control said early this year that some reactors may operate beyond 2025 if removing nuclear power puts energy supply security at risk, according to a report from World Nuclear News.

Russia’s war with Ukraine has raised global risks to energy supplies, given that Russia is among the world’s biggest exporters of oil and natural gas. U.S. and global oil prices have climbed to their highest levels since 2008, while Europe’s reference, Dutch TTF gas prices, recently touched record highs.

Unlike Europe, the U.S. is not dependent on Russian oil or natural gas, says John Ciampaglia, CEO of Sprott Asset Management, but it is “partially dependent” on enriched uranium from Russia. U.S. utilities rely on Russia for 16% of their enriched uranium supply, while Europe relies on Russia for 20%, he says.

“Any disruption in this supply caused by sanctions imposed by the West, self-sanctions adopted by utilities, or Russia deciding to ban the export of enriched uranium, further exacerbates the structural supply deficit that already exists in the market,” says Ciampaglia.

Global nuclear-power generation grew by 3.5% last year, with China’s increasing by about 11%, though nuclear generation in the U.S. was down by 1.5% to the lowest level since 2012, according to the International Energy Agency.

Since its launch in July of last year, the Sprott Physical Uranium Trust

UUT,

the world’s largest physical uranium fund, has seen its holdings of the fuel climb to over 51 million pounds from 18.1 million and its net asset value grow to over $3 billion from $630 million since its launch, Ciampaglia says. Shares of the trust have climbed more than 20% this year as of March 15.

The interest in uranium investments comes as the world tries to meet climate-change commitments, since nuclear power is a reliable power source that provides zero greenhouse gas emissions, Ciampaglia says.

UxC’s Hinze points out that Russia is a major exporter of nuclear reactors, and the sanctions on Russia could create problems or lead to cancellation of some nuclear projects.

For now, “making any predictions about the future is fraught with uncertainty,” says Hinze, but the recent rise in uranium prices is unlikely to abate, given Russian trade restrictions and related factors affecting the nuclear markets.