This post was originally published on this site

Nuclear energy has a proven record of reliability in a world that’s struggling to accept less dependable sources of renewable energy. That brightens the outlook for the uranium that fuels the sector.

“The world needs more energy from renewable sources, but recent weather events have highlighted one of the key issues: intermittency,” says John Ciampaglia, chief executive officer of Sprott Asset Management. “If wind blows less, or it rains less, or a freak winter storm freezes wind turbines, you need another source of reliable base load power,” he says. “Nuclear power plants operate, on average, 93% of the time.”

Europe was left scrambling for energy sources amid a shift to renewable energy, a shortage of natural gas, and a lack of wind-driven electricity production, during a particularly hot 2021 summer season.

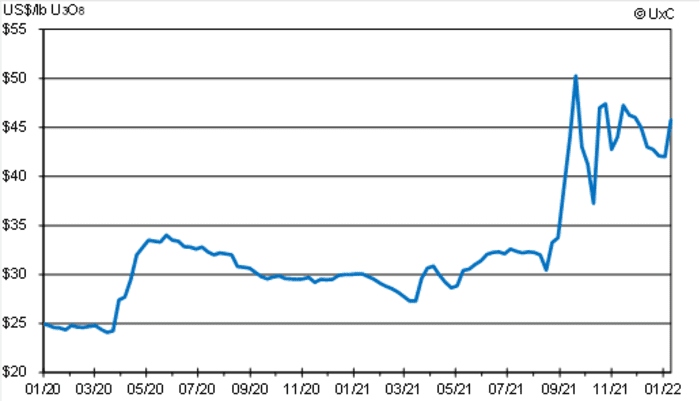

Prices for uranium, which fuel nuclear power plants, rose by roughly 40% last year through December, at $42 a pound, according to nuclear-fuel consulting firm UxC, LLC.

A 2-year chart of weekly spot uranium prices

UxC, LLC

Ciampaglia cites renewed interest in the sector for the price rise, along with an “ongoing structural supply deficit” spurred by production capacity curtailments by the world’s largest miners. Governments in the U.S., U.K., France, and Japan have announced “favorable policy and financial support for nuclear power,” he says.

“There is a growing realization that nuclear has to be part of the energy mix if countries have any chance of achieving their decarbonization targets, while continuing to provide reliable baseload electricity,” Ciampaglia says.

In the U.S., the bipartisan infrastructure deal’s $65 billion investment is described as the largest investment in clean energy transmission and the electric grid in American history, and includes research hubs for advanced nuclear reactors.

The European Union is moving ahead with an approach that includes nuclear power as part of its “‘green finance taxonomy,’ which would potentially give a boost to utilities in Europe looking to invest in maintaining existing nuclear plants as well as building new ones,” says Jonathan Hinze, president at UxC. “This could be a very big deal as nuclear power becomes more accepted as a vital source of non-emitting energy to combat climate change.”

Recent unrest in Kazakhstan has emphasized how important nuclear power is to the world’s energy mix, even as many nations have moved to reduce the number of nuclear power plants in the wake of Japan’s 2011 Fukushima nuclear disaster.

The Kazakhstan situation is “probably good news” for traders and investors, as there are now more questions about uranium supply, and prices for the fuel are likely to remain under upward pressure, says Hinze.

The uranium spot market has been active this year, due partly to concerns over future supplies coming out of Kazakhstan, as 2021 preliminary results show the country’s uranium output represented about 45% of the fuel’s total world production, says Hinze. There haven’t been indications of uranium output disruptions in Kazakhstan but there are possible issues down the road as transportation and supply chain constraints could be exacerbated by security restrictions, he says.

The uranium market is now “clearly in the midst of a price recovery, and given the generally positive outlook for future uranium demand, there is no doubt that prices will remain on an upward trajectory as idled mine capacity and later, new mine capacity will need to be incentivized into production over the coming decade,” Hinze says.

“There is no doubt that [uranium] prices will remain on an upward trajectory as idled mine capacity and later, new mine capacity will need to be incentivized into production over the coming decade.””

Ciampaglia, meanwhile, says he’s bullish on the sector with nuclear energy likely to be part of the low greenhouse gas energy mix for many countries seeking to decarbonize and provide reliable energy.

Investment choices include physical uranium, uranium producers, and exploration and development companies, Ciampaglia says.

Among those are the Sprott Physical Uranium Trust

UUT,

a closed-end trust that holds 43 million pounds of uranium valued at $2 billion.

The Northshore Global Uranium Mining exchange-traded fund

URNM,

meanwhile, offers exposure to a basket of uranium producers, developers and exploration companies.