This post was originally published on this site

Long-dated U.S. Treasury yields on Wednesday were trading around the highest since June with the advance in yields being attributed to intensifying inflation fears.

The inflation worries are centered on supply-chain problems that are amplifying pricing pressures in everything from energy to goods and services.

What yields are doing

-

The 10-year Treasury note yield

TMUBMUSD10Y,

1.546%

is at 1.547% but had touched an intraday high at 1.572%, briefly touching highs not seen since June, compared with 1.528% at 3 p.m. Eastern Time on Tuesday. -

The 30-year Treasury bond rate

TMUBMUSD30Y,

2.108%

was at 2.120%, versus 2.097% a day ago, when yields reached their highest since June 28. -

The 2-year Treasury note yields

TMUBMUSD02Y,

0.293%

0.294%, up from 0.288% on Tuesday.

What’s driving the market?

Growing concerns about inflation continue to drive yields higher and may compel the Federal Reserve to increase the pace of its planned reduction in monthly asset purchases and lift benchmark interest rates sooner if inflation proves to be not as “transitory” as expected.

A run-up in energy prices in parts of the world, notably the U.K., was highlighting the elevated concerns on inflation, which were weighing on appetite for bonds.

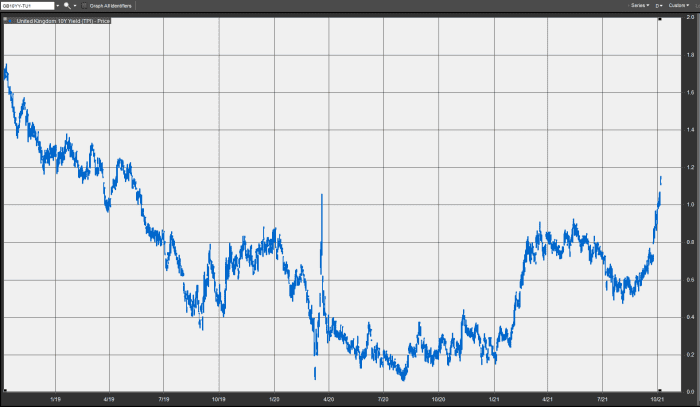

10-year U.K. government debt, known as gilts, for example, were at around their highest since May of 2019, FactSet data show.

FactSet

Prices for natural-gas futures

GWM00,

in the region trading on ICE Europe are surging 10% on the session and have climbed 490% so far this year.

In U.S. economic data, investors are awaiting a monthly report on private-sector payrolls from Automatic Data Processing Inc.

ADP,

due at 8:15 a.m. Eastern Time, with Wall Street estimating on average that 425,000 jobs were added in September, based on a poll of economists surveyed by Econoday. August saw 375,000 jobs created.

The private-sector report comes ahead of the more closely watched nonfarm-payrolls report from the U.S. Labor Department for September due out at 8:30 a.m. ET Friday.

The debate around the U.S. debt ceiling, with investors watching Oct. 18 as a date when the government could run out of money if the funding ceiling isn’t raised or suspended, is being closely watched by fixed-income investors. Developments centered on the health of the Chinese economy, the world’s second largest, and its heavily indebted property developer China Evergrande, also are on investors’ radar.

What analysts are saying

- “I’ll say this again, central banks have essentially left the world’s bond markets naked in yield defenses against a period of higher inflation. Higher inflation that of course these same central banks have been rooting for. If negative rates didn’t exist, if the fed-funds rate was 3% and the US 10 yr at 4% for example, there would be a nice cushion against inflation. But of course, we have none of that now,” writes Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a Wednesday brief.

- “With serial supply shocks and unbalanced demand pushing inflation higher for longer, central bankers the world over are doubling down on indicators of longer-term inflation expectations as guideposts as to whether they can continue largely to look through current excess inflation on the basis that it is unlikely to have material implications for the medium-term inflation outlook,” writes Krishna Guha, head of global policy and central bank strategy at Evercore ISI, in a Wednesday note.