This post was originally published on this site

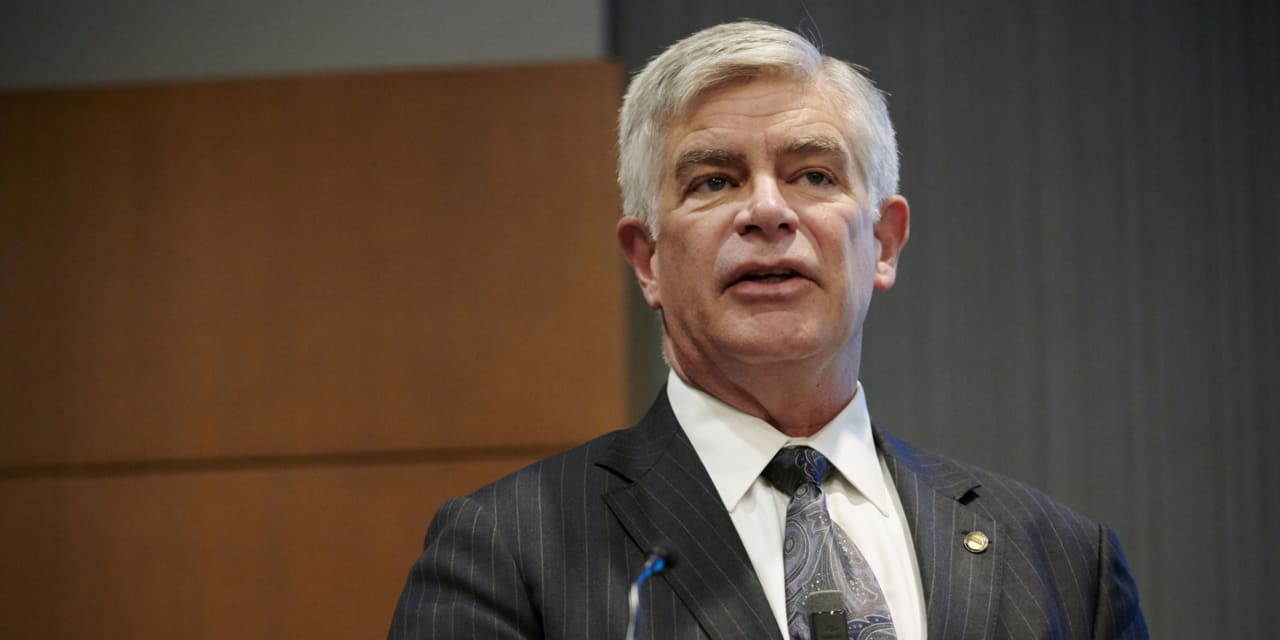

Should the federal government start backing mortgages even longer than 30 years? Philadelphia Federal Reserve Bank president Patrick Harker thinks it could be a solution to an emerging problem in the housing-finance ecosystem.

In a speech where Harker called on the central bank to act more aggressively in fighting inflation, he also focused on developments in the housing market.

“In general, the housing market is largely healthy; if anything, it’s not keeping up with demand,” Harker said Tuesday.

One potential problem on the horizon, though, is the large number of Americans who are behind on their mortgage payments. And that’s where the 40-year mortgage may come into play.

The Philly Fed has tracked the evolving situation involving mortgage forbearance. At the start of the pandemic, lawmakers mandated that borrowers whose home loans were federally-insured be allowed to suspend payments amid the economic turmoil. Through the CARES Act, lawmakers also established a moratorium on foreclosures. For loans not backed by the federal government, private lenders largely adopted the same policies — though some gaps existed.

All told, more than 8.5 million borrowers entered into mortgage forbearance at some point during the pandemic, representing over 15% of the nation’s mortgage market. Today, that figure has shrunk to only 680,000 mortgages, a roughly 90% decline.

“The number of homeowners in forbearance on their mortgage has dropped by 90% since peaking in 2020.”

“Nearly three-quarters of those who have exited forbearance have paid off or are performing, many making use of payment deferrals or loan modifications,” Harker said.

Nevertheless, nearly 1 million mortgages are seriously delinquent — only half of which are in loss-mitigation programs, Harker said. (Loss mitigation can include entering into forbearance, a loan modification, and other options.) Many of the borrowers who have not availed themselves of loss mitigation options never entered forbearance and were behind on mortgage payments even before the COVID-19 pandemic. Black and Hispanic borrowers currently have higher shares of mortgage nonpayment, Harker noted, either because they’re in forbearance or delinquent on their loan.

While the housing market is by no means facing a foreclosure crisis on the magnitude of what occurred around the Great Recession, many homeowners are in a tight spot. “Interestingly, just as the unemployment rate has returned to pre-pandemic levels, the number of delinquent mortgages has also returned to pre-pandemic rates,” Harker said. Notably, the nationwide foreclosure moratorium expired at the end of 2021.

Lenders, Harker noted, could consider solutions that would limit the costs to modify loans while providing borrowers with payment relief. And he pointed to 40-year mortgages, specifically from the Federal Housing Administration, as one such solution.

The government hasn’t made good on its promise of 40-year loans

Last year, Ginnie Mae, the government-owned corporation that insures mortgages created through programs run by the FHA, the Department of Veterans Affairs and the U.S. Department of Agriculture, announced that it would start supporting the securitization of loans with terms up to 40 years. But as Harker pointed out, while the Department of Housing and Urban Development proposed facilitating a 40-year mortgage, “it has yet to materialize.” A draft of such a new policy was circulated last fall but no final version was ever distributed.

The Ginnie Mae program, if it were to roll out, would allow lenders to offer loan modifications to borrowers with 30-year mortgage that extend the duration of their loans. By doing this, borrowers would be able to reduce their monthly payment, which could make it easier for homeowners to manage ongoing payments as they recover from pandemic-related financial hardship.

Freddie Mac

FMCC,

and Fannie Mae

FNMA,

already support loan modifications up to a 40-year term through their “Flex Modification” programs.

Having access to a 40-year loan may be critical for many homeowners with FHA, USDA and VA loans. Throughout the pandemic, these mortgage borrowers were more likely to be in forbearance than people with loans backed by Fannie Mae and Freddie Mac. FHA, VA and USDA loans come with less stringent requirements in terms of credit scores and down payments, making them more popular with less affluent home buyers.

A 40-year mortgage could be a risky proposition

While Harker’s comments only pointed to 40-year mortgages as being a useful tool in helping struggling homeowners to get back on track, the 40-year mortgage modification program could serve as a testing ground for the product’s popularity overall.

“Whether or not that’s going to be viable is ultimately going to boil down to investor demand — and that can change with the wind,” said Greg McBride, chief financial analyst for Bankrate.com.

If investors were to be receptive to securities backed by loans that originally had shorter terms but were then modified into 40-year mortgages, it could be seen as an indication that they would support such a product if lenders were to offer it to home buyers and people refinancing outright. Given that investors grease the mortgage market’s wheels, their opinion carries a great deal of weight.

But as McBride notes, a 40-year mortgage is far from fool-proof, especially given where we are in the current market cycle. Home prices are very elevated across most of the country, and many economists expect the pace of home-price growth to slow as mortgage rates increase.

Up until now, the fast pace of home-price appreciation has benefited struggling homeowners. Families behind on their mortgage could rely on selling their home and benefitting from the run-up in equity. But with a 40-year mortgage, homeowners would build up equity at a snail’s pace — made even slower in a market where home-price growth is decelerating.

That not only has implications for borrowers “in terms of how much equity you’re building, but whether or not you even have enough equity to pay the transaction costs,” McBride said.