This post was originally published on this site

Suddenly, nuclear energy looks a lot more attractive.

Russia’s invasion of Ukraine and the awkward exclusion of energy from sanctions serve as a powerful reminder that Europe is too dependent on Russia for natural gas. The crisis has European countries thinking more seriously about adding nuclear power generation. Germany is even reconsidering its nuclear ban.

In the background, factors including slow progress on decarbonization to counter climate change, China’s aggressive nuclear buildout and years of chronic underinvestment in uranium mining could drive uranium prices for years.

The bottom line: Even though uranium prices are up nearly 200% since I suggested it in this 2017 column, I think it can go higher.

“The developments in our industry over the past year support our belief that there is durability to demand that I am not sure we have ever seen in our industry before,” says Tim Gitzel, CEO of uranium miner Cameco

CCJ,

“I’ve been in the nuclear industry for 20 years now, and I’m not exaggerating when I say that it’s actually never been brighter,” agrees Per Jander at WMC Energy, which helps companies secure uranium.

Some of the best ways to invest in this trend include: Cameco, Uranium Energy

UEC,

Uranium Royalty

UROY,

the Global X Uranium

URA,

exchange traded fund, the North Shore Global Uranium Mining

URNM,

ETF, and Exelon

EXC,

and Duke Energy

DUK,

which have lots of nuclear plants.

We’ll get to more detail on those names and a few others later in this column. But first, here are the three big-picture trends that will drive uranium prices higher, with lots of volatility, of course, since that is typical with commodities. It’s better to have a multi-year, medium-term time horizon.

1. Geopolitical risk in fossil fuels

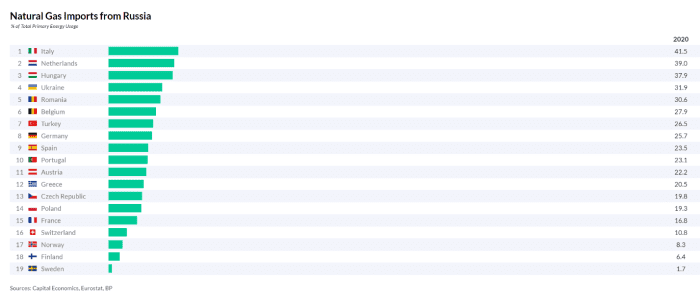

Europe gets 40% of its natural gas from Russia. So, when Western countries slapped sanctions on Russia, they had to exclude this fuel, weakening the measures considerably. Sanctions aside, it’s obviously poor security policy to be so dependent on Russia for natural gas. This has European countries rekindling their interest in nuclear or rethinking their aversion to it, notes Goldman Sachs strategist Jeffrey Currie.

“Hopefully, it is now extremely obvious that Europe should restart dormant nuclear power stations and increase power output of existing ones. This is *critical* to national and international security,” tweeted Tesla

TSLA,

CEO Elon Musk.

“The Ukraine situation would be much easier to handle if Germany had not made the decision to close all of its nuclear reactors by the end of 2022,” says Carl Delfeld, chief analyst of the Cabot Explorer stock letter. “Germany’s decision to shut down its nuclear energy program exposed Europe’s vulnerability and surely emboldened Russian President Vladimir Putin to invade Ukraine.”

Here’s how much European countries import:

2. The ESG effect

After the Russian invasion, Poland’s undersecretary of state for climate said the country may slow its transition to gas from coal. For anyone concerned about climate change, this should serve as a wakeup call on nuclear energy.

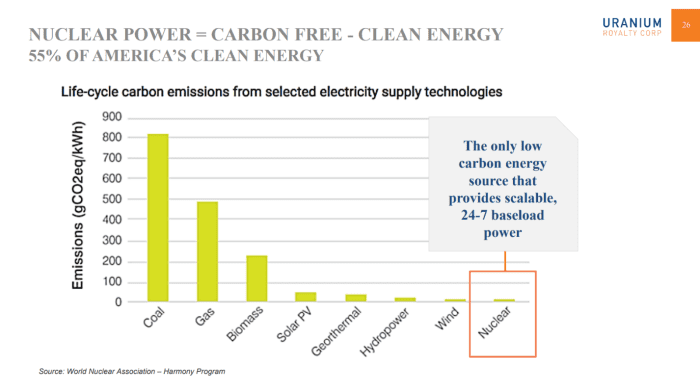

Wind and solar will eventually be meaningful solutions, but they’ll always be inconsistent, creating risks until electricity storage gets more developed. Even hydro power is far less reliable than you might think. A drought in China last year cut hydro production, creating a spike in aluminum prices because producers lost juice, notes Larry McDonald of the Bear Traps report, a uranium bull. Baseload power from nuclear can add stability to the grid.

“Carbon-free nuclear power is an absolutely critical part of our decarbonization equation,” Energy Secretary Jennifer Granholm recently told a Nuclear Energy Institute online conference.

Nuclear is already contributing greatly to decarbonization. Nuclear energy diminishes carbon dioxide emissions by 470 million metric tons each year, the equivalent of 100 million cars, according to the Nuclear Energy Institute. “If you are concerned about climate change, you should be a supporter of increasing nuclear power,” says Delfeld, at Cabot Explorer.

This chart from Uranium Royalty shows the relative carbon production of various sources of energy.

3. Broadening support

Nuclear energy gets bipartisan support. U.S. President Joe Biden’s administration supports nuclear energy to help reach net-zero carbon goals. “We are not going to be able to achieve our climate goals if nuclear power plants shut down. We have to find ways to keep them operating,” Energy Secretary Granholm recently told a House Appropriations subcommittee.

Sizeable nuclear buildouts are planned around the world. China plans at least 150 new reactors in the next 15 years. India targets 21 new reactors by 2031. The UK, the Netherlands, the Czech Republic, Poland, Estonia, Slovenia and Serbia also plan new nuclear capacity.

Japan, the site of the frightening Fukushima nuclear plant disaster, recently said it has to get dozens of reactors back online to meet greenhouse gas reduction targets.

Sure, nuclear plants take a long time to build. But capacity can be bolstered by investments to get more power out of them and extend plant life. Tax credits in the recent infrastructure bill in the U.S. support this. And small modular reactors (SMRs) could cut the time and cost to build new reactors. France, which gets about 70% of its power from nuclear, is developing SMRs. Bill Gates wants to put one in Wyoming.

The bottom line: Deployment of nuclear will be key to reducing carbon, and satisfying the estimated 50% increase in global electricity demand by 2050.

Stocks

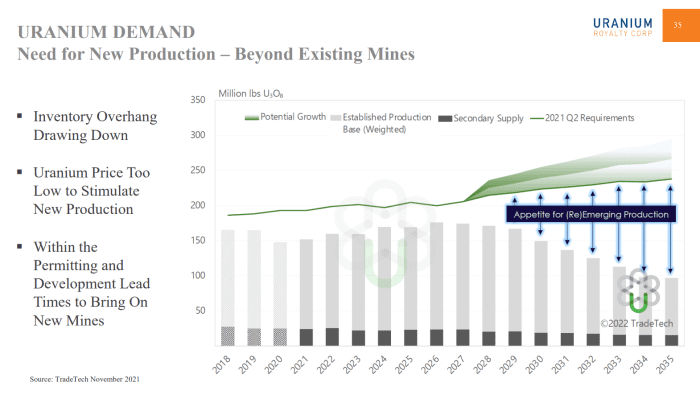

Because of underinvestment in mining over the past several years as uranium prices were so low, demand exceeds new supply by around 60 million pounds this year, says Uranium Energy. The shortfall will average around 45 million pounds per year over the next decade. The difference is made up out of secondary supplies like stockpiles and reclamation from waste. “New production will be needed to meet longer-term requirements and that will require higher prices to stimulate new mining activity,” says Uranium Energy.

In short, you want to own the miners.

Cameco: This uranium miner holds the world’s largest high-grade reserves on 2.1 million acres of land. Most of it is in Saskatchewan, Canada, including 1.9 million acres in the uranium-rich Athabasca Basin. This reduces exposure to geopolitical risk, like the unrest in Kazakhstan in January, though Cameco has a little exposure there. Kazakhstan is the “Saudi Arabia of uranium.”

Cameco accounted for 9% of global production last year. That would have been higher, but Cameco has been holding back production to take supply off the spot market. It operated 75% below full capacity last year. This has helped push up spot market uranium prices. Now it is payoff time for Cameco.

“It is time to prepare our proven Tier 1 assets for operational readiness and flexibility, because a market transition is taking hold,” says CEO Gitzel. Higher spot market prices mean Cameco can negotiate better terms in the long-term contracts Cameco and utilities favor over spot market sales.

Uranium Energy: This company has the largest collection of permitted mining projects. It has projects in Wyoming and Texas. UEC also holds mineral rights in Arizona, Colorado, New Mexico, Texas, Wyoming, Canada and Paraguay.

Uranium Royalty: This one invests in uranium projects in exchange for royalty streams. It has exposure to highly productive McArthur River and Cigar Lake mines in Canada. It also invests in physical uranium.

BWX Technologies

BWXT,

: This company makes components used in nuclear energy, reactors and nuclear fuel. Delfeld at Cabot Explorer likes this company in part because it is developing small modular reactors. Utah Associated Municipal Power Systems plans to commission one by 2027.

ETFs

* The Global X Uranium ETF offers exposure to companies in the production of nuclear power equipment and components, extraction, refining and exploration.

* The North Shore Global Uranium Mining exchange traded fund gives you broad exposure to mining companies.

* The VanEck Uranium and Nuclear Energy ETF

NLR,

tracks the MVIS Global Uranium & Nuclear Energy Index (MVNLRTR), a collection of companies in uranium mining, nuclear power plant construction and maintenance, and nuclear energy production.

* Sprot Physical Uranium Energy (ticker: SRUUF) is a closed-end fund that owns uranium.

Utilities

You can also get exposure to nuclear energy by owning shares of Exelon and Duke Energy, which run several nuclear power plants. About 40% of Duke’s power, for instance, comes from nuclear energy.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush is editor of the stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.