This post was originally published on this site

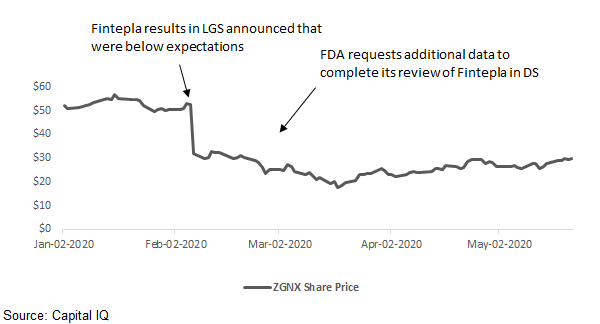

Zogenix (ZGNX) pulled back hard in late February of this year, touching a three-year low on Fintepla® Phase 3 data for Lennox-Gastaut syndrome, “LGS”, which met the trial’s objectives, but were not as good as some expected given the drug’s impressive efficacy in Dravet syndrome,”DS”. The stock took a second hit when the FDA requested additional data to complete the regulatory review for Fintepla in DS. While the stock has rebounded somewhat from its lows during the COVID-19 pandemic outbreak, opportunity remains after Zogenix provided regulators with the requested additional data, and the FDA action date, or PDUFA date, is approaching on June 25th. With what looks to be best-in-class efficacy and disease control durability, Fintepla is expected to rival GW Pharma’s Epidiolex® in the treatment of certain intractable seizure disorders that together represent an annual revenue opportunity of a billion dollars or more. Zogenix management, and smart money investors have high confidence in the approval of Fintepla, with the company announcing that its commercial infrastructure is in place to launch the drug immediately after FDA approval. With ZGNX trading at less than half the value of GW Pharma (GWPH), FDA approval of Fintepla is expected to be a catalyzing event that could send the stock back up into the $50 range, where the stock was in late December/early January. For reference, as of May 20th, the market cap and enterprise value for GWPH were $3.73B and $3.26B, respectively, and for ZGNX were $1.6B and $1.21B, respectively.

In addition to Fintepla as a treatment for Dravet syndrome, Zogenix’s pipeline includes Fintepla follow-on indication, LGS, as well as the development of MT1621, a drug to treat thymidine kinase 2 (TK2) deficiency. The company expects to submit a supplemental new drug application (sNDA) for LGS after meeting with the FDA later this year, and is also meeting with FDA this year to determine the regulatory path forward for MT1621. With momentum building into the potential Fintepla approval as a preferred treatment for Dravet syndrome, and an advancing pipeline with key milestones anticipated later this year, we believe that ZGNX is one to add to the portfolio.

Epidiolex was first to market for Dravet syndrome, but leaves room for improvement offered by Fintepla. Dravet syndrome is a rare, catastrophic, and often lethal pediatric epilepsy that begins in the first year of life and is characterized by frequent and/or prolonged seizures. Persistent seizures in sufferers lead to other comorbidities such as behavioral and developmental delays, movement and balance disorders, delayed language and speech, infections, growth and nutritional disorders, and other issues. Prolonged seizures, SUDEP (sudden unexpected death in epilepsy), and seizure-related accidents such as drowning underlie the 15-20% mortality rate in patients diagnosed with the disorder.

Despite the many anti-epileptic therapies on the market, none of the traditional mechanisms have shown a major benefit in this patient population. In June 2018, GW Pharma’s Epidiolex, a plant-derived cannabidiol, received FDA approval for both DS and LGS. Several traditional anti-epileptic drugs have shown modest efficacy in LGS, but for Dravet syndrome, Epidiolex is the only treatment approved for the disorder in the U.S.

While some patients are receiving significant initial benefit from Epidiolex, it is becoming apparent that the effect can wane over time, and some physicians are noting a relatively high discontinuation rate with the drug. For instance, Dr. Kathryn Davis at the University of Pennsylvania has stated that durability of response has been disappointing with several high responders regressing back to baseline over time. In LGS, over 50% of her patients have stopped using Epidiolex due to efficacy waning or side effects. Dr. Elaine Wirrell, a pediatric neurologist at the Mayo Clinic, also notes that the waning efficacy of Epidiolex has and will continue to lead to many of her currently treated Dravet and LGS patients to discontinue use over time. While complete inhibition of seizures is rare, management of total seizure occurrence and frequency is often used as the primary clinical endpoint.

Fintepla is expected to offer best-in-class efficacy in Dravet syndrome with more durable responses. Zogenix has completed several clinical studies for Fintepla (fenfluramine oral solution) in the treatment of Dravet syndrome, including Study 1, the company’s Phase 3 trial that evaluated patients with uncontrolled seizures who have Dravet syndrome; Study 1504, key for EU approval and designed to determine the pharmacokinetics (“PK”) and safety profiles of Fintepla combined with the anti-convulsant drug stiripentol (approved in Europe); and Study 1503, the company’s ongoing open-label extension trial evaluating long-term safety and efficacy of Fintepla. Results for Study 1 were published in the journal, The Lancet in December 2019, and demonstrated a significant, dose-dependent reduction in convulsive seizure frequency in Dravet syndrome patients compared to placebo. The study’s lead investigator, Dr. Joseph Sullivan, UCSF Benioff Children’s Hospital, stated that the results were “tremendously encouraging in reducing the magnitude and duration of seizures” and that “if future outcomes are as positive, it could help clinicians set new standards of care for a treatment-resistant disease like Dravet syndrome”.

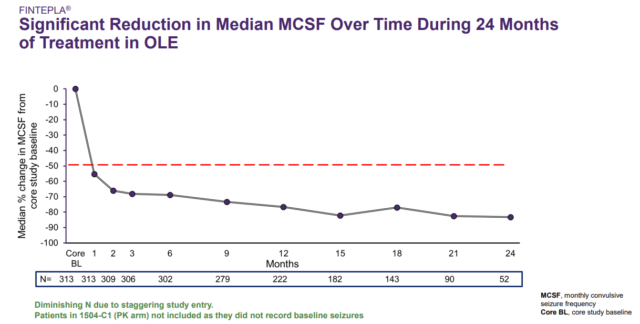

Durability expected to be key competitive advantage for Fintepla. Low-dose fenfluramine has been studied and used in Dravet syndrome patients for decades outside of the U.S. In 2001, fenfluramine’s higher dose, which was approved for weight loss therapy, was withdrawn from the market due to an association with cardiac valvular issues (i.e. Fen-Phen market withdrawal); but a subsequent Belgium Royal Decree issued in March 2002 allowed low-dose fenfluramine to continue to be manufactured and used in clinical studies for refractory epileptic seizures. In 2012, Ceulemans and colleagues (Belgium) first reported results from a small observational study of Dravet syndrome patients age one to 19 that were treated with fenfluramine. In total, results from the study demonstrated patients were seizure-free for a mean of 6 years. Although this was a small open label study, it does present the prospect of longer-term effectiveness with Fintepla, compared to Epidiolex, particularly in conjunction with data from the company’s open label extension study. In October 2019, Zogenix presented several posters at the Childhood Neurology Society Congress, which included data demonstrating clinically meaningful and profound reduction in the frequency of grand-mal seizures in Dravet syndrome patients from prior Phase 3 trials. Additionally, the company presented a poster showing data from its ongoing open label extension study demonstrating long-term, clinically meaningful reduction in convulsive seizure frequency in Dravet syndrome patients under 6 years of age. In April 2020, long-term follow up data in Dravet patients from the company’s open label extension study were presented on a webcast in lieu of presenting at the cancelled 2020 AAN meeting. These data showed that at 2 years on treatment, fenfluramine-treated patients had a median monthly convulsive seizure frequency (MCSF) change of -83% versus the pre-fenfluramine baseline (p<0.001 — see image below). Importantly, the trend indicates that seizures declined substantially and continued to remain low over the 24-month period. We believe that these data are impressive and evidence of the potential best-in-class efficacy and long-term durability of Fintepla.

Source: Zogenix Fintepla Investor Call

Potential for combination use

We also see the potential for additional revenue through combination use with other anti-epileptic drugs. Therapeutic regimens for many patients diagnosed with epilepsy are multi-drug in nature, and existing data on Fintepla suggests that it could be the superior drug for such combination use. In a poster presented at the Childhood Neurology Congress in October 2019, results of a Phase 1 study evaluating concomitant use of Fintepla and Epidiolex were reported. The poster states that FFA (fenfluramine or Fintepla) and CBD (Epidiolex) are likely to be co-prescribed in multi-antiepileptic drug treatment regimens typically used to treat LGS and Dravet syndromes because both conditions are pharmacoresistant and usually require polypharmacy. Based on the study results, the poster concludes that despite increases in Cmax and Area Under the Curve for Fintepla, the effects of CBD on FFA PK are unlikely to require dose adjustments when coadministered. As a result, it is possible to see combination use of these two agents in the field once Fintepla is approved in Dravet and other intractable epileptic conditions. Fintepla and concomitant dosing of stiripentol (Diacomit) was also studied in a clinical trial in Dravet patients with no untoward side effects including no valvulopathy, the cardiovascular adverse effect linked to fen-phen before it was removed from the market. We note that Epidiolex’s label indicates that higher doses of the drug used concomitantly with the anti-epileptic drug valproate, increases the risk of liver enzyme elevations. Fintepla may be a preferred drug for combination use as it is not expected to have similar drug-to-drug interactions, as it has been tested in several trials often in combination with other anti-epileptic agents.

Lennox-Gastaut indication follow-on to Dravet

LGS is another childhood epilepsy that typically begins between the ages of 2 to 5 years old, however onset can be as late as adolescence. Different types of seizures can occur with this syndrome such as tonic seizures (stiff muscles) and atonic seizures (muscles suddenly relax and lead to drop seizures), and the development of learning disabilities and behavioral problems are common in diagnosed children. Zogenix plans to expand the label for Fintepla beyond Dravet syndrome, with LGS as its first additional indication.

In February 2020, Zogenix announced Fintepla’s topline Phase 3 (Study 1601) results in LGS, with Fintepla’s 0.7 mg/kg/day dose achieving the primary endpoint of a statistically significant reduction in monthly drop seizures from baseline compared to placebo (p=0.0012). The key secondary endpoint of the number of subjects with a >50% reduction in drop seizures versus placebo was also achieved. The median for the lower dose (0.2 mg/kg/day) did not reach statistical significance for monthly drop seizure reduction versus placebo, but this lower dose was only an exploratory dose to determine a minimal effective dose.

When the results were announced, investors focused on the trial’s placebo response rate, which was less than in Epidiolex’s LGS trial, despite Fintepla providing a greater multiple of its placebo response (3.4x) compared to the multiple in the Epidiolex trial (~2X). Because the LGS patient population is known to be heterogeneous and more resistant to treatments compared to Dravet patients, this also can make comparisons of LGS clinical trials challenging. Importantly, variation often occurs in epilepsy trials’ placebo responses. A 2016 published peer reviewed article in the medical journal Epilepsy Research titled Response to Placebo in Clinical Epilepsy Trials – Old Ideas and New Insights directly addresses this issue. The article states, “In this review, part one will explore observations about placebos specific to epilepsy, including the relatively higher placebo response in children, apparent increase in placebo response over the past several decades, geographic variation in placebo effect, relationship to baseline epilepsy characteristics, influence of nocebo on clinical trials, the possible increase in sudden unexpected death in epilepsy (SUDEP) in placebo arms of trials, and patterns that placebo responses appear to follow in individual patients.”

While there are several anti-epileptic drugs approved to treat LGS, most children need a combination of different drugs, and seizures often continue into adult life. As a result, Epidiolex has gained good traction in treating the disease. However, the waning effect of this CBD product leaves a major opportunity for Fintepla in the treatment of LGS. Key opinion leaders point to the long durability of Fintepla’s effect as a major potential competitive advantage, and analyst estimates may need to be raised for this indication once Fintepla is approved, as this opportunity may be larger than many expect. With pediatric neurologists and their LGS patients still searching for effective and durable treatments, there could be initial off-label use of Fintepla in this indication even ahead of approval for severe sufferers. Zogenix plans to discuss its supplemental new drug application (sNDA) with the FDA later this year, with potential approval for the LGS indication expected in 1H 2021.

Pipeline includes other indications for Fintepla and ultra-orphan drug candidate MT1621. Zogenix is also studying Fintepla in numerous other rare epilepsy disorders that could provide additional upside to the stock. In 4Q19, the company began Study #1901, a phase 2 “basket study” exploring Fintepla in difficult-to-treat epilepsy disorders such as CDLK5 deficiency disorder, Dup15q syndrome, Doose syndrome, tuberous sclerosis complex, and others. In 1Q20, the company paused the study out of an abundance of caution for COVID-19, and will resume the study once conditions improve. Given Fintepla’s clinical trial success in DS and LGS, we are optimistic that the drug will likely work in certain other seizure types, and could see additional upside should results from the study read out positively.

MT1621 advancing and could represent additional value if regulatory guidance is favorable

The company is also developing another compound in its pipeline, MT1621, for thymidine kinase 2 (TK2) deficiency, an ultra-rare genetic disorder that is often fatal. Zogenix announced positive top-line results from the RETRO study, a retrospective Phase 2 study, which showed that 94.7% of treated patients had an overall response (either improved or stable disease) to treatment in major functional domains. A survival analysis showed that the difference in probability of survival between treated patients and untreated natural history control patients was statistically significant (p<0.0006). Among responders, a subset demonstrated profound responses, in some cases re-acquiring previously lost motor milestones such as ambulation, respiratory function and feeding, and the drug was generally well-tolerated. Zogenix expects to receive feedback from regulatory authorities this quarter to determine the regulatory path forward. Assuming the guidance is favorable, this event could serve as an additional catalyst for ZGNX shares.

Valuation and Conclusion

Zogenix traded at over $50 earlier this year before declining on the LGS results and PDUFA date push back. Assuming Fintepla receives FDA approval in late June, we believe Zogenix should trade at least back to levels seen in late 2019/early 2020, which factor in successful launches to treat DS in the second half of 2020, and LGS next year. In the long-run, we see Fintepla as having potential to generate $1.5 billion in peak sales. With Zogenix shares trading at less than half the valuation of GW Pharma shares, we believe that FDA approval of Fintepla on or before June 25th could propel ZGNX stock significantly higher.

The Illumination Capital Marketplace is coming soon! We are dedicated to helping our future subscribers realize a strong return on investment by working with seasoned healthcare and finance professionals. We plan to provide subscribers with the following research tools and techniques to help them construct a winning portfolio of healthcare stocks:

- Advanced access to our stock reports

- Live daily chat with our analysts

- Real-time market commentary

- Expert opinions and interviews

- Weekly recap and newsletter

- Portfolio management tips and tools

- Model portfolio

- Real-time technical analysis

- Options strategies

Track our performance (HERE)

Disclosure: I am/we are long ZGNX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.