This post was originally published on this site

ETF Overview

WisdomTree U.S. MidCap Dividend ETF (DON) invests in mid-cap dividend stocks in the United States. DON tracks the WisdomTree MidCap Dividend Index. The fund has high exposure to cyclical sectors and hence may continue to underperform in the current recessionary environment. In addition, many stocks in DON’s portfolio may be forced to cut their dividends if this recession prolongs. In this environment, it may be better to own dividend funds that invest in large-cap stocks due to their stronger balance sheet.

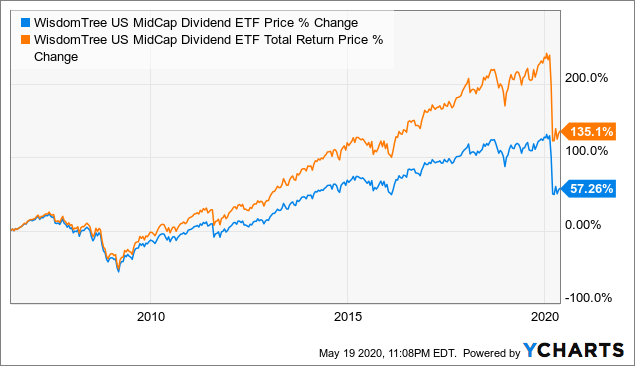

Data by YCharts

Data by YCharts

Fund Analysis

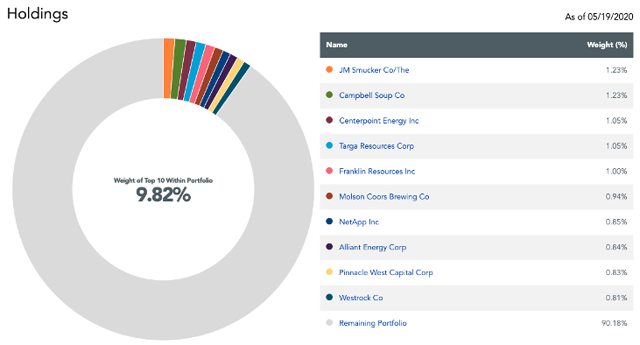

No concentration risk to single stocks

Evaluating the risk and reward profile is important as investors should invest in a fund that has better risk and reward profile in order to mitigate the risk. Here, we will begin by examining the fund’s concentration risk. What we like about DON’s portfolio of stocks is the fact that no one stock represents over 5% of its total portfolio. At the moment, its top holding only represents about 1.23% of DON’s portfolio, and its top-10 holdings represent less than 10% of the total portfolio. Therefore, concentration risk is low.

Source: WisdomTree Website

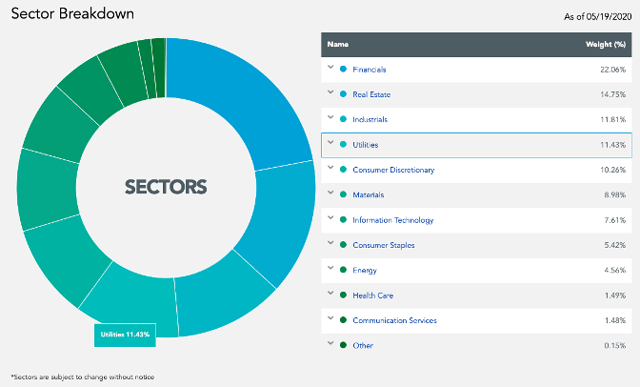

High exposure to cyclical sectors is not good in a recessionary environment

Despite low concentration risk to any single stocks, DON’s portfolio may have higher exposure to individual sectors. This is because the fund only caps sector weightings at 25% of its portfolio. As can be seen from the chart below, the largest sector by weighting, financials sector, represents about 22.1% of its total portfolio. This sector is rate sensitive and often underperforms in a recessionary environment. If we take a closer look at the chart, we will realize that cyclical sectors (financials, real estate, industrials, consumer discretionary, materials, and energy) represent overwhelming majority of DON’s total portfolio. In fact, cyclical sectors represent over 72% of its total portfolio. On the other hand, defensive sectors such as consumer staples, utilities, communication services, and healthcare only represent about 19.8% of its total portfolio.

Source: WisdomTree Website

This high exposure to cyclical sectors and low exposure to defensive sectors is simply not healthy. As we know, cyclical sectors tend to perform poorly in an economic downturn. Since we are now in a recessionary environment that is caused by the outbreak of COVID-19, we do not think DON will perform well in the near term. Depending on how long this recession will be, it may be challenging for many cyclical stocks in DON’s portfolio to grow their businesses. If the pandemic continues or multiple waves of pandemic occurs, we suspect that many stocks in DON’s portfolio may face liquidity issues, and they will be forced to cut their dividends in order to preserve cash.

We prefer its large-cap peer fund at the moment

We believe this recession caused by COVID-19 has the potential to be a lengthy one unless COVID-19 can be controlled effectively. In this environment, it is important to invest in companies with strong financial ratings. Therefore, large-cap dividend stocks may be a better choice than mid-cap stocks since we do not know how long this recession will last. Looking forward to the future (e.g. end of 2021 or early 2022), as the economy gradually shifts towards a recovery stage, mid-cap stocks will have the potential to outperform its larger peers. However, the time is not now. We will recommend investors to buy DON when the economy is prepared to move to the recovery stage.

DON has an inferior growth profile than its larger peer

Let us now compare DON with its larger peers WisdomTree U.S. LargeCap Dividend ETF (DLN). As can be seen from the table below, DON’s P/E ratio of 15.33x is lower than DLN’s 16.94x. Similarly, its cash flow growth of 5.46% is lower than DLN’s 7.14%.

|

DON |

DLN |

|

|

P/E Ratio |

15.33x |

16.94x |

|

Sales Growth (%) |

3.26% |

3.65% |

|

Cash Flow Growth (%) |

5.46% |

7.14% |

|

Forward Dividend Yield (%) |

4.70% |

3.65% |

|

Expense Ratio (%) |

0.38% |

0.28% |

Source: Created by author; Morningstar

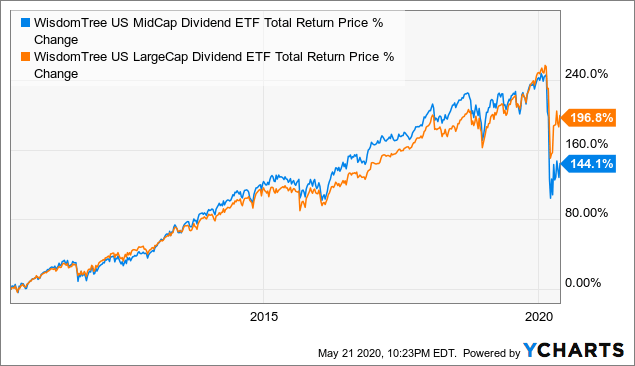

As can be seen from the chart below, DON generated a total return of 127.8% in the past 10 years. This was better than WisdomTree SmallCap Dividend ETF DES‘s 79.9% but lower than DLN’s 186.7%. Therefore, large-cap peer fund DLN appears to be a better choice, given its better growth profile and past performance.

Data by YCharts

Data by YCharts

Investor Takeaway

Based on our analysis, it may be better to invest in large-cap dividend stocks than mid-cap stocks, especially when we do not know how long this recession will last. Hence, we think investors may want to invest in its peer fund DLN instead of DON.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.