This post was originally published on this site

Once again, technology markets are leaving Hewlett Packard Enterprise (HPE) behind as it rewards technology investors with an 8% gain year-to-date. Well-run firms dominate the Nasdaq (QQQ), while HPE stock continues to trade in a very narrow range of between $9.00 and $10.00. In the second quarter, the company reported a sharp drop in revenue due to the COVID-19 pandemic. Still, the company is a value stock idea. It could end up like a lagging performer, like my DXC Technology (DXC) or Micro Focus (MFGP) picks in the past. Investors need to have the patience to bet on management bringing back prosperity.

HPE reinstated its dividend, announced a strong backlog in the billions, and cut staff and executive pay. Is this enough to justify holding the stock?

Second Quarter Disappointments

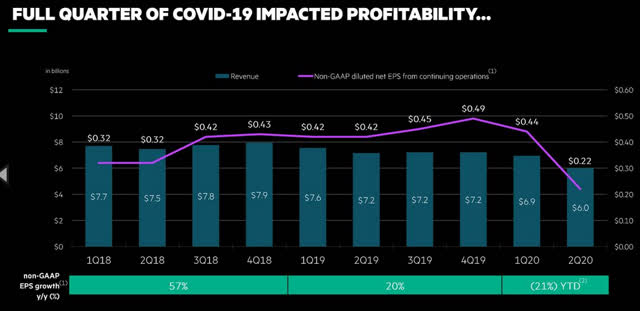

Executive Antonio Neri said that the COVID-19 crisis significantly disrupted its supply chain productivity. Non-GAAP operating profits fell 42% and revenue fell 15% to $6 billion. Its annualized revenue run rate is its only bright spot: it rose 17% to $520 million. Its backlog topped $1.5 billion in Q2, thanks to Storage, Compute, HPC, and mission-critical systems.

HPE will implement pay leaves and cut pay in the short term from July 1-Oct. 31, 2020. The bigger pay cuts at the executive level is a good gesture for investors and staff.

Source: Hewlett Packard Enterprise

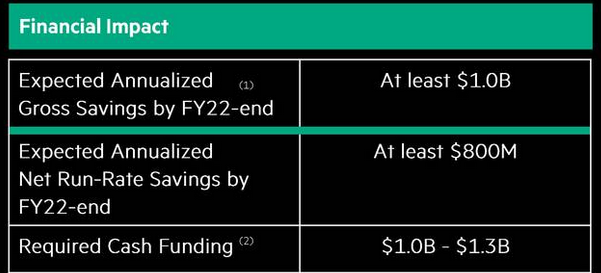

The company estimates its new cost optimization and prioritization plan will save the company at least $1 billion annually by fiscal 2020 year-end.

Growth Opportunity

Aruba Central, the core of HPE’s edge strategy, is a growth opportunity for HPE. When secure cloud platform demand is on the rise while 5G and edge computing are on the way, the company does not have any excuse for missing out on the growth in this space.

The working from home emphasis lifted HPE’s wireless LAN product business by 7%. Demand for WiFi 6 certified access points grew 35% Y/Y in North America. Readers may look at this Netgear WiFi 6 article here. Overall, gross margins rose by 570 basis points to 11%. As demand for switches and wireless LAN continues in 2020, profits should climb steadily.

The negative impact of COVID-19 on quarterly results scared off investors last week:

Source: Slide 9, Hewlett Packard Enterprise

The good news is that as the U.S. States aggressively allow for the reopening of businesses, HPE’s profits should bounce back.

HPE ended the quarter with ~$5.1 billion in cash and cash equivalents. It has around $10 billion in liquidity. The timing of its $151 million share buyback in the second quarter is not fully ideal. If management bought back stock in February at between $12 and $15, it would have lost around 35%. Still, the Q3/2020 regular dividend reinstatement signals management’s vote of confidence in its strong liquidity position.

Outlook

When an analyst asked if HPE would get back to pre-COVID-19 levels, CEO Antonio Neri did not commit to getting there. Instead, he said that HPE would lower its cost structure, implying a loss of around $1 billion in business annually. CFO Tarek Robbiati said that “it’s quite difficult to call the bottom or trough quarter, given the level of uncertainty that is currently visible.”

CEO Neri is confident that it will reach an annualized run rate revenue of 30-40%. HPE GreenLake and HPE GreenLake Central are cloud-native platforms that should resonate with its customers. He said GreenLake “is a true cloud-native platform where you can deploy the right mix from edge to cloud and consumer as-a-service and deliver the workload optimized solutions in a standardized way.”

Valuation and Your Takeaway

16 analysts rating HPE stock to have an average price target of $11.17, according to Tipranks:

Only one analyst issued a “buy” rating in the last week, while the rest ranked the stock as a “hold.” Technology value investors may end up waiting a long time (at least three more quarters) before the stock rebounds again. Previously, investors would have done better holding MongoDB (MDB), Dropbox (DBX), or other beaten-down technology stocks instead of HPE. Buying the dip in HPE or adding to stocks that already bounced depends on the investor’s risk tolerance.

Please [+]Follow me and select “real-time” to get free email alerts on my publications. Get coverage on neglected, undervalued technology stocks. Previous DIY Top Idea tech alerts included MongoDB, Dropbox, and Fabrinet. Click on the “follow” button beside my name.

Join DIY investing today.

Disclosure: I am/we are long MFGP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.