This post was originally published on this site

I had the good fortune of studying a couple of summers in Spain when I was younger, and the thing that amazed me the most about it was how the same streets that would be nearly empty in the heat of the day would burst with life after sunset. There’s something intuitive about the night being a time of growth and activity that gets suppressed during the day. To this point, I wasn’t surprised when I learned that the financial markets also display a surprising day/night split in their return profiles. Research shows that the stock market gets close to 100 percent of its returns overnight, while the actual trading session returns little to nothing. I’ll share what I found and how you can apply it to make more money in the financial markets.

What The Research Says

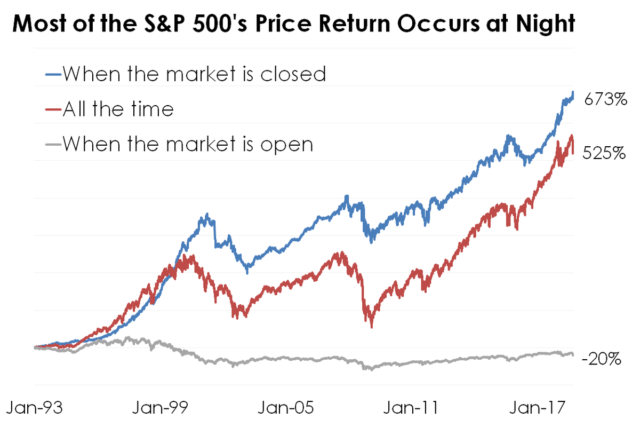

Depending on the time period you look at, the stock market is either flat or has a slightly negative return during daytime hours.

Source: The Motley Fool

The long-run positive return expectation for stocks means that the expectation for stocks is to slightly appreciate each calendar day. During the trading day, however, the market is basically a zero-sum game of poker. Like poker, most participants who choose to day-trade lose, while a few – mostly market makers and high-frequency traders, but also a few at-home traders with strong knowledge of price anomalies – win big.

The natural question is if almost all of the stock market gains happen during the night, then why? Unlike the classic “Sell in May” effect, which may or may not be statistically significant due to quirks of history, the day/night effect has held over tens of thousands of days since researchers first discovered it. There are a few theories I think are reasonable, so I’ll share.

Researchers at the New York Fed have argued that large investors in Asia and Europe are responsible for a good part of the effect in the S&P 500, and used the observance/non-observance of daylight savings time in various countries to support their argument. I found a paper from research firm Alpha Architect that found that the overnight effect is strongest for momentum stocks, as defined by stocks with high past returns, which research shows tend to keep going up. Bias also may play a role, with investors reacting to news flow during the day, while cooler heads prevail when markets aren’t open. High-momentum stocks, which are always counterintuitive, have even shown a tendency to go down during the day, even while posting 20+ percent annual returns, all from overnight moves.

I have my own hypothesis too relating to the constraints and biases of retail and institutional investors. There are a lot of day traders out there – on the retail side it’s just guys trading at home, and on the institutional side there are market makers and proprietary trading firms. A key feature that day trading participants share is the use of leverage (4-1 day trading margin for retail investors). Both retail and institutional traders tend to have a constraint towards reducing leverage or even being in cash overnight, either by choice or by risk management constraints. Thus, it’s not that hard to figure out what the effect would be on stock prices. If there are a bunch of traders out there who are buying stocks with loans around 9:30 Eastern Time that are called due at 4 pm every day, it’s natural for prices to rise around the open and fall at the close. This has the effect of turning the trading session into a giant game of poker for short-term traders, while long-term investors earn their capital gains overnight.

How to Profit From the Day/Night Split

Source: Bespoke Investment Group

A seemingly intuitive way to profit from the day/night split would be to buy stocks every afternoon and sell them back in the morning. However, this strategy doesn’t work because it’s the same gross return as owning stocks long term, minus transaction costs, which will eat up your profit. The value in understanding the day/night split comes from improving the timing of your trades, getting a slightly higher price when you sell and paying slightly less when you buy. There’s a tug of war between the higher transaction costs around the opening bell and the higher prices you tend to get if you successfully transact, but the best time to sell stocks at the moment appears to be around 10 am Eastern. Similarly, the best time to buy stocks appears to be in the last hour of trading. The shorter your typical investment time frame, the more this helps you, but investors of any time frame can put this in use.

Conclusion

I think that understanding this effect is most important for investors who own momentum stocks. If you know that a lot of people are playing hot potato with your holdings with daily margin loans, then you can ignore a lot of the noise that occurs in your stocks and trade based on weekly and monthly changes, which are better at picking up the signal of improving company fundamentals and less caught in the noise. As someone who has had success over the years trading stocks on momentum, I found that knowing this price anomaly improves my investment process and confirms some of what I thought might have been the case from observing trading patterns.

Did you enjoy this piece? Follow me on Seeking Alpha for future research updates!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.