This post was originally published on this site

Thinking of ways to gain exposure to bitcoin as prices rise?

Shares of bitcoin

BTCUSD,

miners are too high compared to owning the cryptocurrency outright, according to Sam Doctor, chief strategy officer at digital asset financial services platform BitOoda.

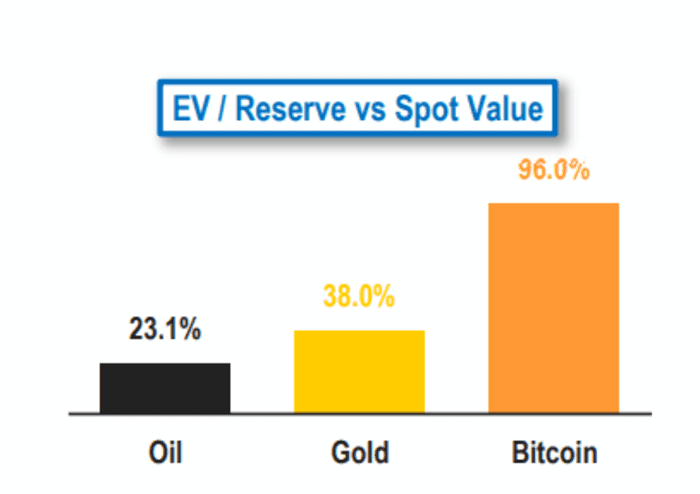

In the commodity extracting industry, investors could calculate a miner’s enterprise value per unit of reserve, and compare it to the commodity’s spot price. The former should be lower, as miners need to bear operation and capital expenses. For example, major oil companies, on average, trade at $25 per barrel of oil, or 23% of the current spot price of oil

CL00,

while major gold miners on average trade at $737 per ounce of gold

GC00,

reserves, or 38% of the metal’s price.

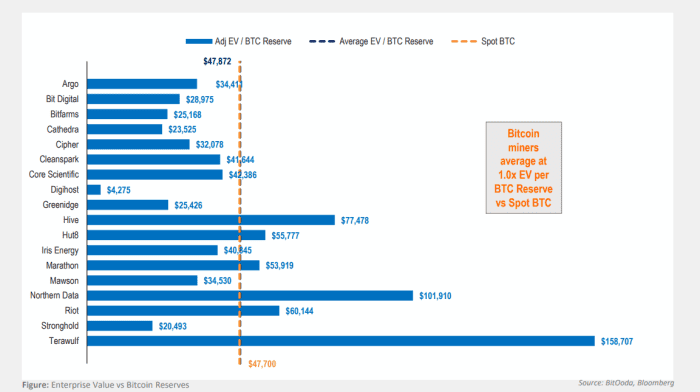

The same framework can be applied to crypto mining too, according Doctor. Public bitcoin miners, on average, trade at an adjusted enterprise value per bitcoin in reserve of $47,872, or 96% of bitcoin’s recent spot price of $47,700, according to the BitOoda report. Its ratio (see chart) is much higher than in the oil or gold industries, Doctor noted.

BitOoda

“If the miners are already richly valued, if their enterprise value per bitcoin that they will mine is already almost the same as the spot price of bitcoin, then there’s no margin of error,” Doctor told MarketWatch in a phone interview.

“The stocks will do well if the [bitcoin] price goes up. But out of that mining reserve, miners have to pay for the electricity, the people, and they have to pay to replace machines as the new generations come out,” Doctor said.

Bitcoin recently was trading at around $47,486, up 0.4% during the past 24 hours and up 13% over the past seven days, according to CoinDesk data.

“We would rather own spot bitcoin than bitcoin miners as a group, and

selectively see opportunity in lower valued stocks and/or diversified stocks,” according to Doctor.

Bitcoin miner’s enterprise value/bitcoin reserve

BitOoda

For individual bitcoin miners, Marathon Digital Holdings’s

MARA,

enterprise value to bitcoin reserve stands at $53,919, or 113% of bitcoin’s recent price, according to the report. The company’s shares closed at $30.91 on Tuesday, down 0.7%. Digihost

DGHI,

enterprise value to bitcoin reserves is about $4,275, or 90% of bitcoin’s recent price, while its shares closed 5% lower at $3.61.

The Dow Jones Industrial

DJIA,

Average ended up 1% on Tuesday at 35,294.19.