This post was originally published on this site

West Virginia taxpayers will pay $1.7 billion to attract a profitable steel company to a corner of the state where workers from Ohio and Kentucky may also be employed, thanks to what some observers call a hurried deal struck in a special session of the legislature in January.

The deal includes $1.35 billion in tax credits over several years, and $315 million in cash to match the company’s investments in infrastructure. The company in question is the steelmaker Nucor

NUE,

which in December issued a press release calling 2021 “the most profitable year in Nucor’s history,” and alerting Wall Street to expect “the highest quarterly earnings in Nucor history” for the fourth quarter. Meanwhile, the unemployment rate in Mason County, home to the proposed plant, is 2.7%, the lowest on record.

Nucor did not respond to a request for comment.

As eye-popping as the numbers are, what may be more striking about this deal is the way multiple state advocacy groups have banded together to express concern about it.

“In this case, West Virginia taxpayers are on the hook, while Kentucky and Ohio will see a big chunk of any economic and tax-revenue benefits — though research shows that these deals rarely produce their promised value for local communities,” said Kelly Allen of the West Virginia Center on Budget and Policy, in a release.

It’s not even clear what the cost-benefit analysis shows for this deal. A local news story raised questions about the economic analysis used for approval of the deal, which was pushed through in a two-day special session of the legislature. MarketWatch reached out to the West Virginia University professor in charge of that analysis, Eric Bowen, but he did not immediately respond to that inquiry.

The memorandum of understanding between Nucor and the state can be found here. It documents the various benchmarks the company must meet to receive each set of subsidies.

“They want the process to be compressed, to make people do things hastily so there’s a smaller chance of anyone questioning anything or gumming up the works,” said Greg LeRoy, executive director of Good Jobs First, a national corporate-subsidy watchdog, in an interview with MarketWatch.

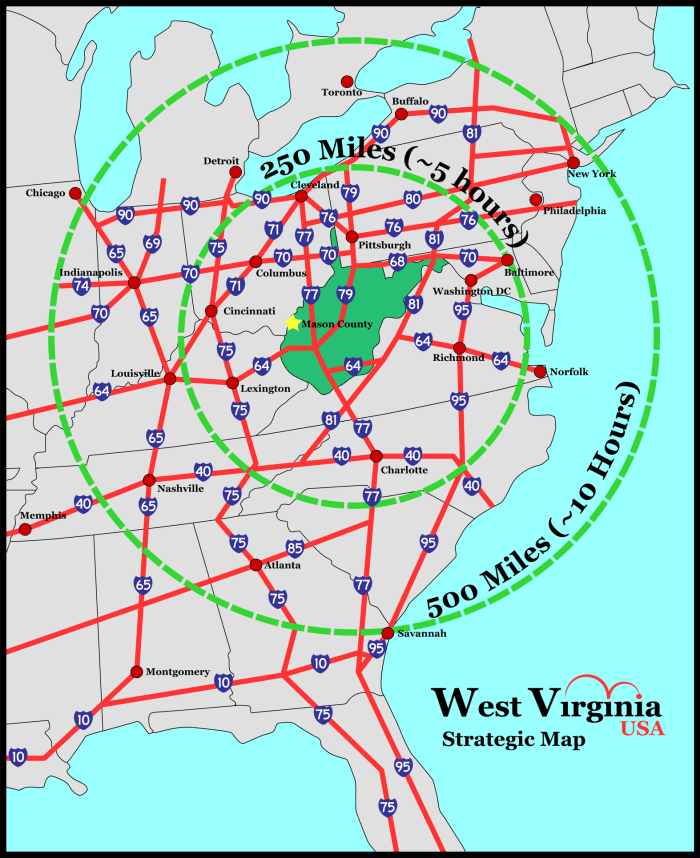

The steel mill Nucor intends to build will be located in Mason County, which borders Ohio and sits near Kentucky.

Source: Mason County Economic Development Authority

Representatives of policy groups from Ohio and Kentucky also voiced concerns.

“We added our voice because it is important for states to cooperate together to address the ever-escalating cost of corporate tax breaks,” Jason Bailey of the Kentucky Center for Economic Policy told MarketWatch.

“Corporations are playing states against each other and extracting larger and larger breaks,” Bailey said. “The only way to stop that is for states to work together to agree to limit these subsidies, or we will all lose out.”

Zach Schiller, research director for Policy Matters Ohio, acknowledged that the deal would likely bring “some benefits” to Ohioans. “Why look a gift horse in the mouth? More often than not this is not successful and it creates a race to the bottom and all of the different states have less public resources to provide the services that are key to business success.”

Schiller and other advocates opposed to corporate subsidies believe that the Foxconn debacle in Wisconsin, in which a high number of promised jobs supported by taxpayer money and a special-use case for Lake Michigan water never materialized, was eye-opening.

“It really underlined the problems with a dependence on economic development incentives,” Schiller said. While some state legislatures are starting to come around to that way of thinking, others — like in West Virginia — may need more nudging.

A MarketWatch request for comment to the Mason County Economic Development Authority was referred to the West Virginia Department of Commerce, which did not immediately respond.

Read next: Should New York pay Plug Power hundreds of millions to create 68 jobs?