This post was originally published on this site

Home builders have warned of a housing recession. Now home buyers are gaining bargaining power even in the hottest markets and sellers make fresh concessions, Aarthi Swaminathan reports.

The housing bubble and black home buyers

Getty Images

The combination of price increases and rising mortgage loan rates has cut the number of black renters who can afford to buy a home in half in only a year, according to a Harvard researcher. Emma Ockerman reports on how residential segregation continues to affect Black Americans.

Don’t fear the Fed

Federal Reserve policy makers have repeatedly made clear their desire to squelch inflation in the U.S.; they voted unanimously to raise interest rates on July 27 as part of that fight.

When the minutes of that meeting were release on Wednesday, however, some observers claimed to see signs of softening in the Fed’s tough talk.

Rex Nutting brings investors back to reality.

Student borrowers who didn’t get what they paid for are made whole by the government — now guess who owes $1 billion to U.S. taxpayers

Anna Moneymaker/Getty Images

ITT Technical Institute closed in 2016, and the Education Department has decided to forgive $3.9 billion in student loans tied to the failed college.

What about the government’s losses? Higher education institutions owe U.S. taxpayers more than $1 billion, Jillian Berman reports.

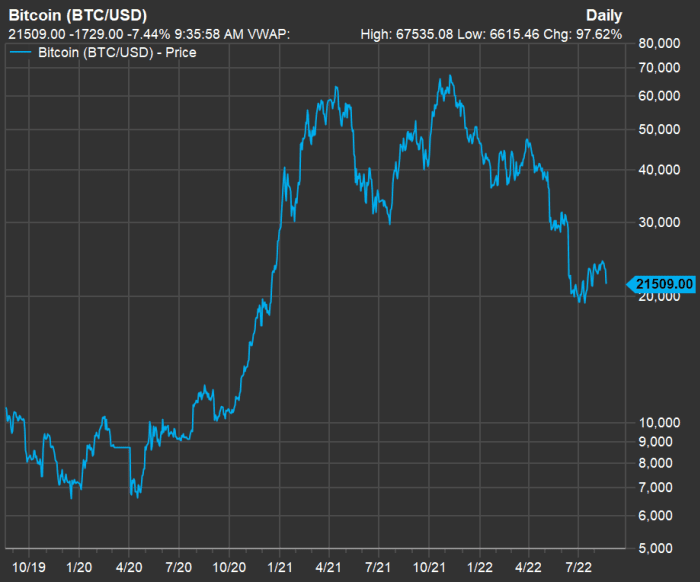

Can bitcoin be a hedge?

Three years of bitcoin prices.

FactSet

Frances Yue writes the Distributed Ledger column, covering the world of bitcoin

BTCUSD,

and virtual currency trading. This week she reports on growing interest in bitcoin among institutional investors.

Read on: This is why bitcoin won’t ‘diversify’ your 401(k)

Good news on healthcare expenses, and not only for seniors

The Inflation Reduction Act, signed into law on Tuesday, requires Medicare to negotiate prices with suppliers for some drugs. But younger users of prescription medications are likely to benefit as well.

Of great interest to people over 50 who pay for health insurance but aren’t yet eligible for Medicare is that the new law also extends subsidies under the Affordable Care Act for three years.

On a related note, Biden issued an executive order in July that required the Food and Drug Administration to set rules for over-the-counter sales of hearing aids. The FDA has now issued rules that take effect in mid-October.

How might the expansion of the IRS affect you?

istock

The Inflation Reduction Act includes $80 billion in additional funding for the Internal Revenue Service over 10 years. This follows a long period during which the IRS has been forced to curtail audits because of staff shortages and antiquated systems — problems that have also slowed refund processing. Bill Bischoff looks into how the changes at the IRS might affect middle-class taxpayers.

A long-term investing horizon is probably lots longer than you think

istock

Are you really a long-term investor? Maybe not. Mark Hulbert explains.

Plus: This “financials first” method for investing in technology stocks might be best in the current economic environment.

More: These stock pickers have beaten their benchmark while giving fundholders needed diversification

Meme-stock trading: Burned by Bed Bath and Beyond

Following the famous examples of GameStop Corp.

GME,

and AMC Entertainment Holdings

AMC,

the meme-stock crowd jumped on the Bed Bath and Beyond

BBBY,

bandwagon, scooping up the heavily-shorted retailer’s shares. BBBY was up nearly fivefold for the month through Wednesday.

Then on Thursday, the troubled retailer’s stock dropped 20% on after Ryan Cohen (GameStop’s chairman) said he was selling a large stake in Bed Bath’s shares. Bed Bath’s stock skidded as much as 43% on Friday, after the company said it is working with “external financial advisors and lenders” to strengthen its balance sheet.

Mark Hulbert explains why investors should avoid meme stocks.

More on short-term trends: Hedge funds pile up $125 billion bet against the S&P 500’s big summer rally

Which of these snacks does the least harm to your body?

MarketWatch/Getty Images, iStockphoto

Charles Passy issues the challenge as he describes the new Food Compass developed by researchers at Tufts University.

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.