This post was originally published on this site

As the House of Representatives on Tuesday joins the Senate in getting back to work on Capitol Hill after an August recess, there are growing expectations of a partial government shutdown.

“My guess is that we will have a lot of screaming and shouting, and we’ll end up shutting down the government, and a lot of people will be inconvenienced or hurt as a result of doing that, but we’ll do it,” said Republican Sen. Mitt Romney in an interview with a TV station in his home state of Utah.

“And by the way, we’ll shut down government, and then we’ll open it,” he added. “It’s not like that means that we win. No, no. We just shut it down to show that we’re fighting and making noise.”

Investors should view the shutdown as largely noise, according to a number of analysts in Washington, D.C., who track lawmakers’ moves for Wall Street.

“The stakes here are significantly lower than they were back in June, when we were facing default,” said Ed Mills, Washington policy analyst for Raymond James, referring to lawmakers’ efforts earlier this year to reach a deal on raising the U.S. debt ceiling in order to avert a market-shaking default.

“For the most part, this is a 1 or 2 on a scale of 1 to 10 in terms of concern,” Mills told MarketWatch, adding that a U.S. default, on the other hand, would have registered as a 10 on that scale.

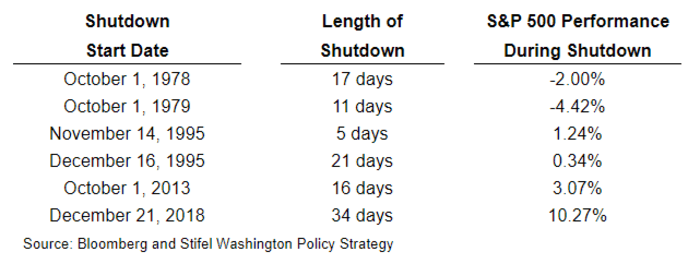

There have been six government shutdowns since 1978 that lasted five days or more, and the S&P 500 stock index

SPX

gained in the four most recent shutdowns. Brian Gardner, chief Washington policy strategist at Stifel, emphasized that history in a note to clients.

“Headlines regarding a potential budget impasse will grow and there could be a whiff of panic in the air, but investors should take all of this in stride. Markets tend to ignore the impact of a government shutdown,” Gardner wrote. He provided the chart below.

There have been six shutdowns since 1978 that lasted five days or more. Here’s how stocks handled them.

Stifel

From MarketWatch’s archives (September 2021): Here’s how the stock market has performed in past government shutdowns

And from January 2019: The latest government shutdown is ending, after becoming the longest on record — by a wide margin

How government shutdowns can hurt

Stifel’s Gardner said that while past shutdowns suggest that investors should not panic, there still is some potential damage.

“There will be extensive media coverage of closed entrances at national parks and other government facilities. Government salaries will not be paid on time which is, certainly, a hardship for some families,” he wrote. At the same time, he emphasized that “much of the country will operate as usual,” including the military

ITA

and air traffic controllers — and any missed paychecks will come through once the shutdown ends.

From MarketWatch’s archives (January 2019): How furloughed federal workers can rebuild their finances after the shutdown

“From a market perspective, the biggest concern relating to a government shutdown is that it could delay official government data reports at a pivotal time for the Federal Reserve,” said BTIG’s Issac Boltansky and Isabel Bandoroff in a note.

Related: Jackson Hole recap: Fed rate hikes likely on hold for ‘several meetings’

The BTIG analysts said they expect a shutdown will occur but that it should be a “nonevent for markets” overall, because it “would have no impact on debt payments and any missed activity would be settled on the other side of reopening.”

There could be a greater-than-anticipated impact on stocks

DJIA

COMP

if the shutdown lasts longer than expected or if the deal to end the shutdown features unexpectedly large cuts to spending along with significant repeals of parts of the Democrats’ 2022 Inflation Reduction Act, according to Mills, the Raymond James analyst.

“The most likely scenario is that it’s days, not weeks,” he said in reference to the length of any shutdown. He also noted that a shutdown could affect consumer confidence and disrupt the initial-public-offering process for some companies.

What’s likely to happen on Capitol Hill

While the House is returning to Washington on Tuesday after the August recess, the Senate resumed its work on Capitol Hill a week ago.

Ahead of the returns of the two chambers of Congress, the Biden White House budget office pushed last month for passage of a short-term funding measure to avoid a partial federal government shutdown on Oct. 1, when the government’s 2024 fiscal year starts.

Such a measure is known as a continuing resolution, or CR, and is often used as the House and Senate work to agree on a dozen or so appropriations bills that would fund government operations for a full fiscal year.

The debt-ceiling deal negotiated between House Speaker Kevin McCarthy and President Joe Biden set spending levels over the next two years, keeping nonmilitary spending for 2024 the same as 2023 levels. But House Republicans have adopted spending targets for the coming fiscal year at levels below those in the McCarthy-Biden agreement.

McCarthy has raised the idea of a short-term funding bill with his fellow Republicans.

“The thing that Kevin McCarthy is trying to tell his caucus is that we probably need to have a short-term CR, so that the House can finish its work on appropriations bills and establish the best negotiating position,” Mills said.

The House Freedom Caucus, a hardline GOP group known for causing headaches for the chamber’s leaders, has voiced concerns. It said in an Aug. 21 statement that its members want to rein in outlays and will oppose any spending measure that doesn’t include a House-passed bill focused on security at the southern U.S. border. In addition, the group said any spending measure must address the “unprecedented weaponization” of the Justice Department and the FBI, as well as end “woke policies in the Pentagon.”

One House Freedom Caucus member, Rep. Andy Biggs of Arizona, put a positive spin on a potential shutdown in a post on X, formerly known as Twitter.

“A government ‘shutdown’ is a misnomer. 85% of the government continues as usual. Social Security, Medicare, and Medicaid are all paid in full. More accurately, it is a temporary pause in nonessential spending that would allow us to get our fiscal house in order,” Biggs wrote.

The most likely path forward is that the GOP-run House passes a short-term funding measure that incorporates House Freedom Caucus goals, which would set up a showdown with the Democratic-controlled Senate over those policy riders, with a short-lived shutdown potentially taking place, Mills said.

The Raymond James analyst said the most likely deal is a budget that’s in line with what was negotiated as part of the debt-limit deal. He also expects supplemental measures that provide relief for areas affected by Hurricane Idalia and by the Maui wildfires, as well as some funding for Ukraine as it continues its fight against Russia’s invasion.

“For investors, they have seen McCarthy go up to the brink, go through a tough situation and be able to pull a rabbit out of it,” Mills said, referring to his January battle to become House speaker and the spring debt-limit talks. And they’ve “gone through government shutdowns in the past, mostly with very minimal market reaction,” he added.