This post was originally published on this site

This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. Asia and Europe are awash in red as investors fret over U.S.-China geopolitical tensions, plus a new wave of shutdowns and coronavirus spikes from Hong Kong to California.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are all lower in afternoon trade with the Shanghai Composite Index off 1.5%, leading the way down.

- Dark geopolitical clouds continue to gather… The Trump Administration has not completely ruled out ending Hong Kong’s dollar peg as it looks for a way to punish mainland China for the new national security law.

- Meanwhile, China has slapped sanctions on Lockheed Martin over its latest arms deal with Taiwan.

- One bright spot, however… China is easing travel restrictions for the gambling hotspot Macau, a move that’s lifting casino stocks.

Europe

- The European bourses reversed yesterday’s gains, nosing down at the open. The benchmark Stoxx Europe 600 was off 1.2%.

- EU leaders need to agree to a recovery plan, and it has to be “massive,” says Germany’s Angela Merkel, as she tries to rally the fractious bunch behind a €750 billion coronavirus bailout plan.

- Britain’s economy may be coming out of lockdown, but it’s barely growing, the latest GDP data shows.

U.S.

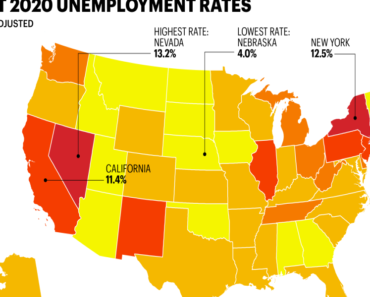

- The major averages were cruising to a Monday rally when California announced a major rollback of re-openings yesterday afternoon. Just about everything bombed after that, with the S&P 500 finishing down nearly 1%. Spoiler alert: California won’t be the last major economy to order a new wave of shut-downs.

- When Hollywood inevitably puts the story of this bull market on the big screen, a prominent character will be the Robinhood day trader blithely running up the price of Tesla shares. Tesla at one point was up 16% yesterday. In one four-hour stretch, 40,000 Robinhood traders had topped up their accounts with Tesla shares.

- Another character will be the Amazon bull. Get a load of this data point: so far in July, Amazon has padded its market cap by $210 billion, a sum that surpasses the entire market cap of 95% of the S&P 500. We are [looks at calendar] just halfway through the month. Happy Bastille Day, btw.

Elsewhere

- Gold is down.

- The dollar is flat.

- Crude is down again. On Monday, OPEC released annual production data that showed the cartel was hurting well before COVID.

***

Earnings, schm-earnings

Today is the biggest day on the earnings calendar so far with banking giants JPMorgan Chase and Wells Fargo, plus Delta Air Lines, due to report Q2.

For most of the S&P 500, it’s going to be a brutal quarter. The Street consensus is earnings will fall 44% year-on-year. As my colleague Anne Sraders points out, Goldman Sachs thinks the nadir is closer to -60%. The numbers will be so bad that, Goldman advises, investors should probably all but ignore them and just tune into management’s comments.

“Given the recent resurgence of COVID-19 cases in the U.S., we expect management commentary will prove more important to gauging the forward path of earnings than actual 2Q results,” the analysts wrote in a recent investor note.

Earnings-wise, this quarter will be an across-the-board dud. According to Refinitiv, tech and utilities earnings growth will be merely bad (not awful). They project EPS on utilities to dip 4.8% and IT to drop 8%. Yes, that counts as the best of the bunch.

For the ugly, you need look no further than energy. Refinitiv analysts are putting a negative-154.9% handle on the energy sector.

Let’s get to this week’s calendar. 128 companies have scheduled earnings calls, with big names from each sector set to report. I’ve listed the big ones here:

But that’s not to say there’s no room for surprises. Beats could still happen, particularly if, say, trading revenues lift the bottom line of the banks, or if pharma or health care experienced a turnaround towards the end of Q2.

Stay tuned.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

A note from my Fortune colleagues on a timely new initiative:

Many companies are speaking out against racial injustices right now. But how do they fare in their own workplaces? Black employees in the corporate world, we want to hear from you: Please submit your anonymous thoughts and anecdotes here. https://bit.ly/WorkingWhileBlack

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.