This post was originally published on this site

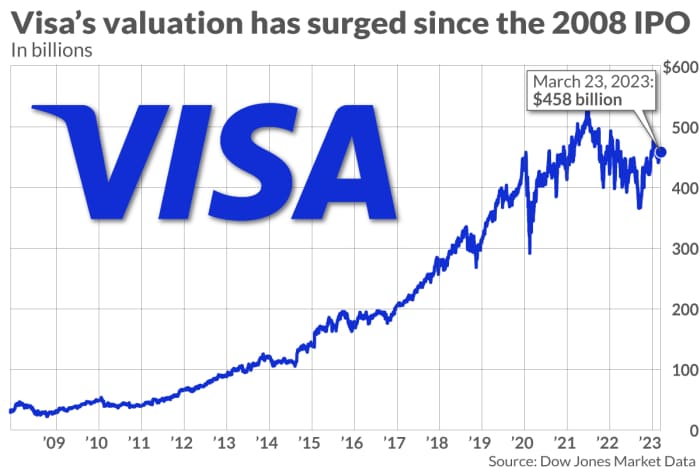

Visa Inc. shares have shot up about 1,900% from the price of the company’s historic initial public offering, which took place 15 years ago this past weekend.

The company went public in 2008 in a trepidatious banking climate — days after the collapse of investment bank Bear Stearns — and amid questions about the competitive outlook for the payments system. In a way, it was a landscape not dissimilar to today’s, which has seen high-profile bank failures and the Federal Reserve’s announcement that it would begin operating its own instant-payments service in July.

Visa’s

V,

IPO was unique because before making its public debut, the company was a not-for-profit cooperative owned by the big banks. At the time, a MarketWatch columnist mused, “the banks are looking to dump Visa at a time when things couldn’t be better,” meaning that “when investors buy shares of Visa things could get a lot worse.” He pointed to concerns about slowing growth and the threat of competition from Silicon Valley.

But a purchase of Visa shares at the time of the IPO has ended up paying off big time for investors. Visa, valued at $39 billion at the time of the IPO, is now worth upwards of $450 billion and is the ninth-largest U.S. company by market value.

MarketWatch illustration

Though some of the concerns that dogged Visa ahead of its IPO — fears about regulation, competition and merchant lawsuits — are still relevant today, Visa has found ways to neutralize or adapt to many issues as they’ve emerged. The company survived the Durbin amendment, which capped debit interchange in the U.S., and turned financial-technology competitors like PayPal Holdings Inc.

PYPL,

into partners.

The IPO turned out to be “a home run,” Baird analyst David Koning told MarketWatch. “It was basically taking one of the best businesses in the history of the markets out of banks that traded at bank multiples and bringing this incredible business into the public markets.”

‘Such a strong business’

Visa’s IPO was unusual in that the company was owned by banks that were selling parts of their stakes, but it wasn’t unprecedented. Smaller rival Mastercard Inc.

MA,

came out of the gate first, making a 2006 debut that offered a framework for how a massive company could go from a cooperative to a for-profit entity.

Mastercard also gave Visa executives a preview of how the market would react to the various issues facing the credit-card giants at the time. One was a massive pending merchant lawsuit over high fees.

“No one wanted to touch the stock because there was a huge concern that this was going to impact the business down the road,” Wedbush analyst Moshe Katri said of Mastercard in its early public life. “That lawsuit didn’t really go anywhere, and the risk is still here, but the regulatory risk really impacted people’s appetite for Mastercard’s IPO” at the time, he said.

Visa took a different approach from Mastercard’s in preparing for that merchant suit. The company set up special Class B shares owned by financial institutions that functioned in an escrow model and could be used to fund litigation.

The Class B shares “took that risk off the table,” allowing shareholders to “focus on the merits of the business,” said Tien-tsin Huang, an analyst with JPMorgan for more than 25 years.

There was enthusiasm for Visa’s IPO even though the market for IPOs at the time wasn’t particularly strong, said Nick Einhorn, the director of research at Renaissance Capital, who covered Visa when it went public 15 years ago. Bear Stearns had just collapsed and the S&P 500 index

SPX,

was down by about 9% on the year.

But Visa was “such a strong business,” he said, noting that “it’s always easier for a company like that to go public in a weak market.” And going public in a less ebullient market “can sometimes lead to strong long-term performance” because the initial valuation is at a more reasonable level, he added.

Visa went public at a discount to Mastercard, Einhorn noted, at a 21-times ratio of price to 2008 earnings, whereas Mastercard was trading at about 28 times.

Visa ended up raising $19.65 billion through its IPO, according to data from Dealogic, in what was the largest sum of proceeds for a U.S. IPO at the time. In the ensuing 15 years, Visa has only been eclipsed once, by Alibaba Group Holding Ltd.

BABA,

which raked in $25.03 billion in its debut on the New York Stock Exchange.

Bank on it

Visa, like Mastercard, was bank-owned, and that structure helped drive the need for an IPO.

Visa and Mastercard set interchange rates, which are the fees that merchant banks pay card-issuing banks when a consumer makes a purchase using a credit card. As merchant litigation heated up, analysts say the banks likely saw the sale of the majority of their shares as a way to avoid perceived conflict of interest.

“The market believed that’s one way for the banks to say they’re not involved,” Katri said. Plus, some of them “were not in great economic shape,” so the IPO “was a way to monetize their ownership.”

Once public and independent, Visa was able to change course on other elements that might have been awkward for a bank-owned entity, and that helped improve the company’s financials and its business prospects.

“Historically, banks didn’t always work well together,” Koning said, hypothesizing that they might have been less likely to all pool funds to buy something like a “cool cross-border technology” that would benefit the Visa system and thus help their competitor banks as well.

“The beauty of this business is it helps the banks do better, but the banks themselves probably weren’t willing to unlock the value,” he said.

Visa also had to transition to life as a public for-profit entity, which meant a cultural shift, but also opportunity.

Once public, Visa shifted to what Huang describes as the “demutualization” process, as it increased pricing commensurate with value and focused more on expense management. “The margin expansion and the growth from IPO for Mastercard and Visa has been pretty special,” he said.

Visa generated a 12.8% profit margin for its September-ended fiscal 2008, the year of the IPO, before seeing its profit margin rise to 34% in fiscal 2009. The company logged a 51% profit margin in its most recent fiscal year.

The company’s operating margin has shown similar growth, rising from 19.7% in fiscal 2008 to 51.2% in fiscal 2009 to 64.2% in fiscal 2022.

“It shows you how much scale you have in the business if you run it the way you should be running it as a for-profit business,” Katri said.

Visa also proved resilient during the financial crisis, growing both revenue and net income in 2009.

“The market realized how relatively defensive the business was,” Katri added. “Visa is a profitable business where below the cost-of-sales line, a big chunk is discretionary. No doubt the business will be impacted by top-line growth, but the company has a lot of ability to manage the bottom line.”

While best known as a credit-card company, Visa has expanded far beyond plastic into areas like bill payments, remittances and the giant market for business-to-business payments. The company showed its strength during the pandemic, as well.

“They laid the groundwork for electronic payments to overcome the stress of stores being closed and things like that,” Huang said. “Visa proved they’ve been very future-proof and made the right bets on technology and partnerships to stay relevant, which isn’t easy to do.”

Everywhere you want to be

Visa’s success since the IPO is also rooted in the company’s ability to keep concerns about competition and regulation at bay.

Since going public, Visa has seen merchants and financial-technology upstarts alike attempt to eat into its business, but none have been able to supplant Visa and Mastercard. While a group of large merchants at one point considered building an alternative network, Katri said, they ultimately appeared to realize it wasn’t worth the effort of incentivizing usage and coordinating data-gathering among themselves.

“Economically, the cost associated with providing rewards outweighed the benefits of bypassing interchange fees,” he said.

The big U.S. telecommunications players also considered a rival initiative, according to Huang, though they relatively quickly opted to partner with the networks instead.

Partnerships have helped Visa fend off fintech competitors as well. The company has found ways to work with PayPal, Apple Inc.’s

AAPL,

Apple Pay and other services that could have become threats.

And Visa and Mastercard have come up with innovations to make themselves continually relevant to partners. Visa’s work to promote tokenization, or the conversion of card numbers for mobile transactions, has proved useful to Apple, for instance.

“When Apple Pay launched, Visa was prominently displayed as a partner along with the banks,” Huang said. “What was deemed a competitor turned out to be a partner. That’s been a very important story for Visa over time.”

That’s not to say Visa has extinguished all threats of encroachment on its business. The Federal Reserve plans to soon launch its own instant-payments service, FedNow, which could usher in “a material change in how consumers use electronic money,” as TD Cowen analyst Jaret Seiberg wrote in a recent report. And the company’s arrangement with PayPal, through which users of its mobile wallet are no longer steered toward funding payments with bank accounts, reportedly has sparked the attention of the Department of Justice.

The company also faces competition from Mastercard, its closest competitor, but Huang says the rivalry makes both companies stronger.

“Mastercard was more aggressive up front with some of the noncard payment areas, and that probably raised the sense of urgency for Visa to do the same,” he said. “It’s good to have those guys make each other better.”