This post was originally published on this site

When trying to decide what is the best age to file for benefits, often folks find it useful to get an understanding of the “break-even” point between two filing ages.

(The break-even point shouldn’t be your only factor to consider, as we have discussed in this article.)

Today we have an email from a reader who specifically is asking what his break-even point would be, given his specific potential benefit amounts at the age of 62 versus his full retirement age of 67.

Hello Jim,

According to the Social Security tables, I will be eligible for full retirement benefits at the age of 67 at which time I will start receiving $2,861 each month. If I wait until I am 70 years old, the benefit will increase to $3,554.

However, I can start collecting as early as 62 and my reduced benefit will only be $2,014. If I choose to collect at 62, my payments will start immediately and continue into the future at that reduced amount. Since I will be collecting early I will have the benefit of receiving reduced monthly payments vs. waiting until I am 67 and receive nothing in the meantime.

Question: At what point will my future, delayed payments finally exceed my current reduced payments?

($2,014 X 12 X 5) = $120,840

This can be calculated easily using a spreadsheet. Before you ask — no, I did not include the annual COLAs in this calculation, simply because the COLAs are unknown, and since they’re applied to all future benefits after your initial eligibility age, the outcome would be essentially the same with or without applying the COLAs.

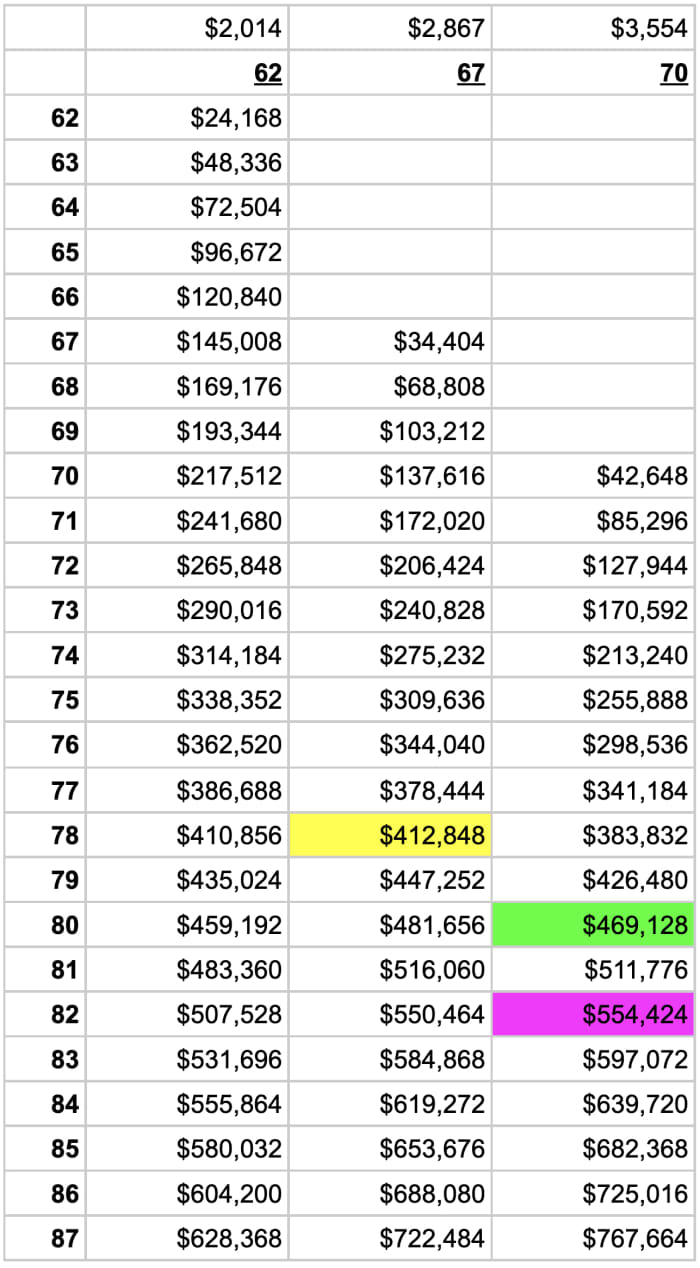

So here is the spreadsheet:

Jim Blankenship

The first column is the attained age of the emailer. The second column indicates his total received benefit up through the age specified in the first column. In other words, this is a running total of all benefits received. The very first line above the age “62” in the second column is the amount of benefit that he’s going to receive if he starts at age 62.

Subsequently, the third column represents starting at age 67, his full retirement age, and the third column shows the same thing only starting at age 70.

I’ve highlighted three cells in the sheet — the yellow cell is when the age 67 benefit surpasses the amount of benefits received if starting at age 62, and this occurs at the individual’s age 78. So it takes 11 years for the age 67 benefit to be the better lifetime benefit.

The green cell is when the age 70 benefit surpasses the age 62 start column, at his age 80. Within 10 years after starting benefits at age 70, that delay option works out better for him versus starting at age 62.

And lastly, the purple cell is when the age 70 benefit surpasses the age 67 start amounts, and this is when he is age 82. So 12 years after starting benefits at age 70, the individual will have received more benefits by delaying.

This analysis isn’t perfect, because it doesn’t account for the month in which you started benefits. But the point is that if you take any date during the year and consider the coming 12 months as that year in the spreadsheet, you’re going to come up pretty close to my answer.