This post was originally published on this site

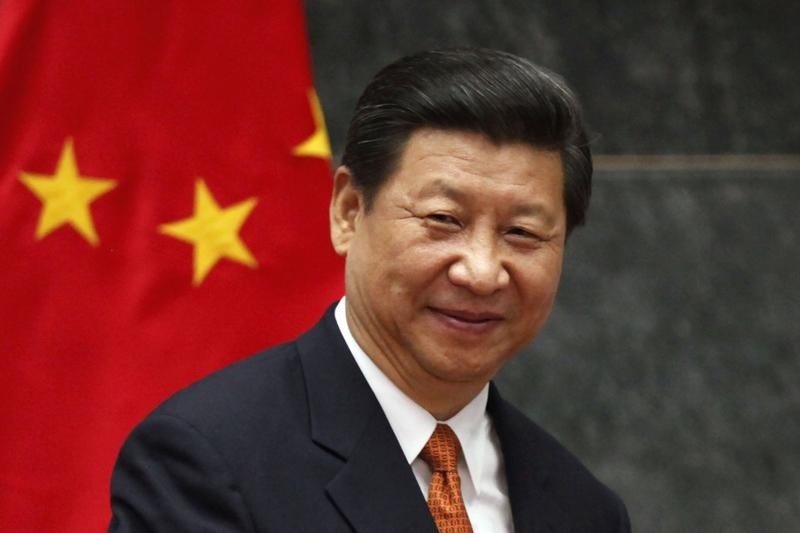

Chinese companies listed on U.S. exchanges experienced a sharp decline on Monday due to investor worries that Chinese President Xi Jinping’s policies, which have resulted in a slowing economy, will continue.

Xi Jinping was confirmed as leader of the CCP for a third five-year term. There has been a departure of what some have described as pro-stimulus officials and reformers in a leadership reshuffle, causing concern that a further crackdown on technology companies will continue.

The reshuffle has spooked investors, alongside a slowing Chinese economy, with Chinese equities tumbling on Monday (the Shanghai Composite fell over 2%) while the Chinese Yuan also weakened. In addition, Hong Kong’s Hang Seng Index fell 6.4%, marking its most significant daily decline since November 2008.

Although data revealed that the Chinese economy grew more than anticipated in the third quarter, the year-to-date pace of growth was well below the annual growth target.

Among some of the U.S.-listed Chinese companies, electric vehicle stocks Nio Inc (NYSE:NIO), Xpeng Inc (NYSE:XPEV), and Li Auto Inc (NASDAQ:LI) are all down significantly at -17%, -13%, and -19%, respectively, at the time of writing.

In addition, other names, such as Alibaba (NYSE:BABA) -15%, Baidu (NASDAQ:BIDU) -13.5% and JD.com (NASDAQ:JD) -14.5%, have also tumbled.