This post was originally published on this site

The world has been made aware of the critical importance of a resilient supply chain on our global economy. Covid-19 put a plethora of deficiencies into focus. The war in Ukraine only increased that. And largely, we are hearing an array of opinions as to when these issues may be rectified.

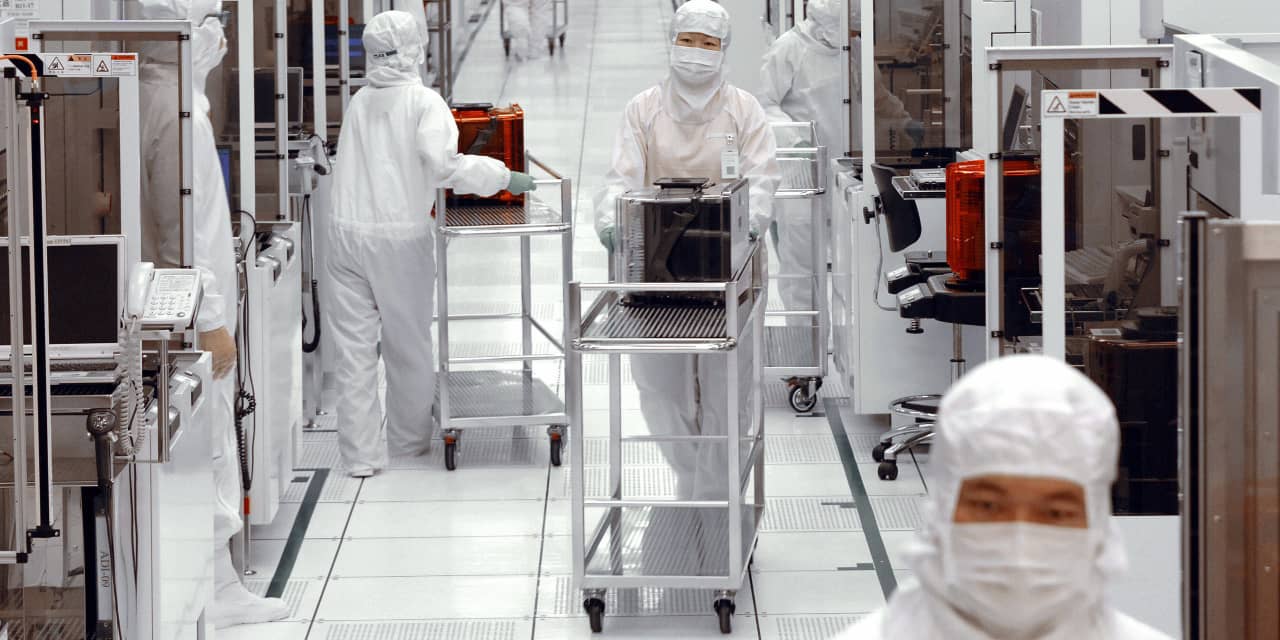

One level deeper in the supply-chain discussion lies the chip shortage. And while semiconductors were far from the only thing that had massive demand spikes met with an array of materials, labor and finished product production, our disproportionate dependence on semiconductors was undoubtedly highlighted the most.

Despite the pandemic, the economy grew fast after it was temporarily shut down. The unprecedented stimulus that was pumped into the economy led to a notable jump in demand for everything from laptops for e-learning to cars.

However, the early impact of the pandemic exposed the glaring shortcomings of our chip-manufacturing capacity and the disproportionate manufacturing being done in Asian countries, largely Taiwan and Korea. We also witnessed the impact that a 50-cent chip can have on entire industries such as automobiles, which saw supply chains stall due to the inability to source a single lagging edge semiconductor.

Now there’s a new potential risk, at least according to some analysts who believe we could see a massive glut of semiconductors in the next year. This hypothesis is largely based on the idea that a focus on increased production coupled with a slowing economy being further tempered by high inflation and rising interest rates could see demand for chips fall off a proverbial cliff. That would place semiconductor companies in a rare position: too many chips, not enough buyers and slowing growth.

An abundance of chip supply is possible. However, I see it differently. Technology is deflationary, and while a number of macroeconomic and geopolitical factors have brought down growth stocks, including cloud, infrastructure and chipmakers over the past several months, I simply do not see leading semiconductor companies enduring a prolonged period of decline, if at all.

In fact, secular trends and the deflationary characteristics of tech would likely keep semiconductor companies booming, even if a recession does play out — and this doesn’t even weigh in the continued wave of Covid-19 and geopolitical uncertainty that only further hamper supply.

There are many ways things could play out for chipmakers and the race to greater resiliency in the supply chain, but here are the two scenarios I see most likely to shape the near- to mid-term for chipmakers.

Tech as a deflationary tool

The first scenario is almost status quo. It is rooted in tech’s deflationary properties and the acute awareness of the world that chip demand is high and our supply chain is too dependent on Taiwan and Korea.

Secular trends such as remote work, autonomous vehicles, metaverse and cloud computing will act as catalysts for semiconductors. While a slowdown in the economy and a less accommodative Federal Reserve may hurt equity prices, tech companies’ revenue growth and earnings will likely remain strong.

We witnessed this during the past financial quarter despite more than three months of intense selling in tech, leading the Nasdaq into correction territory despite recent positive moves for growth and tech names.

Note, this doesn’t mean that share prices for tech and semiconductor companies don’t see a further pullback based on a more negative sentiment toward growth. However, if this occurs, it will mark the sometimes obtuse disconnect between markets and economies where stock performance doesn’t always coincide with company performance.

Both Republicans and Democrats know the high stakes of getting the supply chain rectified as not only crucial for meeting the demand for finished goods, but the evidence that a more resilient supply chain could temper inflation has become glaringly obvious.

Higher rates and inflation hurt such a large swath of the population that policymakers looking to win the hearts and minds of voters know that a stable supply chain for everything from gasoline to food to chips must be prioritized. That’s a bullish outlook, perhaps, but highly realistic.

Keep demand high, fill the gaps in supply through substantive investment in excess manufacturing capacity, and see off inflation while enabling the Fed to stay more dovish. A win for lawmakers, businesses, investors and constituents alike.

Demand from all areas

The second scenario is one that I could see as the worst case for chipmakers, tech and the economy as a whole — however, it would likely be temporary. This scenario would most likely play out if the Ukraine war is prolonged, inflation remains high despite the Fed’s actions. That would mean high gas prices, food prices and supply shortages keeping prices for chips and finished goods high despite a prolonged contraction in the economy.

In this case, I still see chipmakers struggling to keep up with the demand as companies spend on software, automation, security, connectivity and cloud to streamline business operations. However, the likely pullbacks would be in some consumer-discretionary goods powered by chips like premium-tier smartphones, laptops and gaming consoles.

Depending on the severity and length of the recession, coupled with the sustained demand for technology, it is hard to see this lasting long. A continued recessionary environment would most likely push the Fed to become more accommodative. The recent track record of policymakers indicates another stimulus could be pumped into the economy, again spinning up the demand cycle for chips.

I remain confident that chip demand will stay strong as everything we use, from cell phones to crypto mining to smart homes, continues to see greater chip density to accommodate our insatiable thirst for greater productivity, intelligence and connectivity.

Add the continued impact of world events from Covid to the current war. We see continued risks to the supply chain, such as temporary factory shutdowns in the East or raw-material shortfalls like neon gas and palladium in eastern Europe can potentially further dent the delicate semiconductor supply chain.

Companies including Intel, TSMC, Micron, Samsung and GlobalFoundries that build manufacturing capacity in the U.S. and Europe remain critical. Further support from policymakers is imperative. Any glut would likely be temporary, while the potential risks of future shortfalls continue to be significant.

Chipmaker rundown

My near-term favorites: Nvidia

NVDA,

AMD

AMD,

Marvell

MRVL,

Qualcomm

QCOM,

“Sleepers”: Lattice

LSCC,

Micron

MU,

GlobalFoundries

GFS,

Longer-term (two-plus years): Intel

INTC,

Taiwan Semiconductor

TSM,

Daniel Newman is the principal analyst at Futurum Research, which provides or has provided research, analysis, advising or consulting to Nvidia, Marvell, Intel, Qualcomm, Lattice, Micron, Samsung Semiconductor and dozens of other companies. Neither he nor his firm holds any equity positions in companies cited. Follow him on Twitter @danielnewmanUV.