This post was originally published on this site

This article is part of a series that provides an ongoing analysis of the changes made to Prem Watsa’s 13F portfolio on a quarterly basis. It is based on Watsa’s regulatory 13F Form filed on 05/15/2020. Please visit our Tracking Prem Watsa’s Fairfax Financial Holdings Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q4 2019.

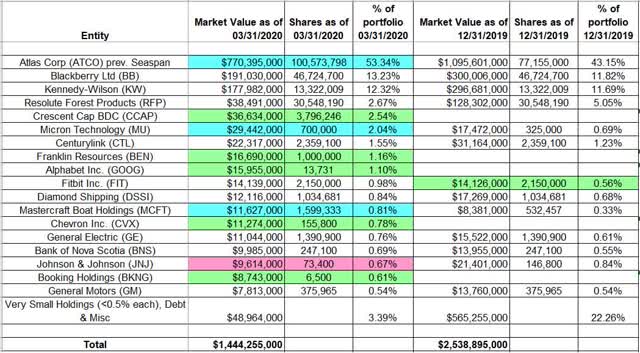

This quarter, Watsa’s 13F portfolio value decreased ~43% from $2.54B to $1.44B. There are 56 securities in the portfolio, but it is concentrated among a few large stakes. The focus of this article is on the larger (greater than 0.5% of the portfolio each) equity holdings. The top three positions are Atlas Corp. (NYSE:ATCO), BlackBerry (NYSE:BB), and Kennedy-Wilson (NYSE:KW). Together, they account for 79% of the entire 13F portfolio.

Note: Fairfax Financial’s (OTCPK:FRFHF) 13F holdings only represent a small portion of their overall investment portfolio. The total size as of Q1 2020 was ~$40B, of which ~25% is in cash and short-term positions. Prominent equity allocations include investments in Greece, India (OTCPK:FFXDF), and Africa (OTCPK:FFXXF). It has a huge position in CPI linked derivative contracts ($87.4B notional amount, $54.6M fair value, 2.9 years average maturity) designed to protect against global deflation. FRFHF currently trades at ~$251, well below Book Value (Q1 2020) of $422 per share. The equity portfolio was 100% hedged starting from around 2003, but those were removed in Q4 2016.

New Stakes

Crescent Capital BDC (CCAP), Franklin Resources (BEN), and Alphabet Inc. (GOOGL): CCAP is a 2.54% of the portfolio stake purchased at prices between $6.21 and $17.10 and the stock currently trades at $10.98. The 1.16% BEN position was established at prices between $15.30 and $26.25 and it is now at $17.89. GOOG is a 1.10% stake purchased at prices between $1,057 and $1,527 and it now goes for $1,410.

Chevron (CVX) and Booking Holdings (BKNG): These two are very small (less than ~1% of the portfolio each) stakes established this quarter.

Stake Disposals:

None.

Stake Increases:

Atlas Corp. previously Seaspan Corp: ATCO is currently the largest 13F stake at ~53% of the portfolio. It came about as a result of exercising 38.46M in warrants in July 2018 and the same amount in January 2019 at t $6.50 per share. The stock currently trades at $7.30. This quarter saw a ~30% stake increase which came about as a result of Atlas Corp.’s reorganization and acquisition of APR Energy.

Note: Regulatory filings from March show it owning 126.25M shares (46.5% of the business). This is compared to 100M shares in the 13F report. Last January, Fairfax added $500M more in a structure similar to the first tranche made in March 2018 (debt + warrants converted early). Total investment is $1B – $500M each in equity (38.46M warrants * 2 converted at $6.50 per share) and debt. The early conversion of warrants in July last year resulted in Fairfax also getting 25M in seven-year warrants exercisable at $8.05 per share.

Micron Technology (MU): MU is a ~2% portfolio position that saw a ~60% stake increase in Q1 2019 at prices between $31 and $44. The position was increased by ~115% this quarter at prices between $34.50 and $60. The stock currently trades at ~$45.

Mastercraft Boat Holdings (MCFT): MCFT is a very small 0.81% of the portfolio position that was built this quarter at prices between $5.90 and $19.80. The stock currently trades at $13.29. Fairfax has a ~8.5% ownership stake in the business.

Stake Decreases

Johnson & Johnson (JNJ): JNJ is a long-term position that has been in the portfolio since 2007. The original stake was 5.9M shares purchased at a cost-basis of $62.29. In Q3 2013, roughly half the position was sold at prices between $85.50 and $94.50, and in the following quarter, the remaining stake was almost eliminated at prices between $85.50 and $96. Q4 2016 saw an about turn: ~80% increase at prices between $111 and $120. This quarter saw a ~50% selling at prices between $111 and $154. The stock currently trades at ~$144 and the position is at 0.67% of the portfolio.

Kept Steady

BlackBerry Ltd.: BB is Watsa’s second-largest position at ~13% of the portfolio. The stake was first purchased in 2010 at around $50 for 2M shares. The position was aggressively built up to 46.7M shares (~9% of the business) in the following years. Its net cost on a fully converted basis is $12.30 per share and the stock currently trades at $4.54. There has only been very minor activity in the last six years.

Note: In Q4 2013, Fairfax co-sponsored a cash-infusion of $1B through convertible debentures ($10 conversion price earning 6% interest) – it financed $500M of that transaction and the remaining was funded by a consortium of other investment funds – the implied dilution took its ownership up to ~16.5% of the business. In Q3 2016, those shares were redeemed and new ones issued ($605M in 3.75% debentures convertible at $10 due 11/13/2020) to the same entities in a private placement.

Kennedy-Wilson Holdings: KW stake is a large (top three) ~12% of the 13F portfolio position. Watsa’s ownership stake in the business is ~9%. Q4 2016 saw a ~40% increase at prices between $20 and $23 and that was followed with a ~8% increase in Q1 2018. KW currently trades at $13.47.

Note: The original 2010 stake was from a private placement for Kennedy-Wilson convertible preferred stock. The total investment from that point through Q3 2016 was $645M. Since then, it has invested another ~$85M. By EOY 2015, it had already received distributions of $625M and so the net investment was ~$105M. That is compared to current market value of ~$180M.

Resolute Forest Products (RFP): The RFP stake is now at 2.67% of the portfolio. The position was first established in Q4 2010 when it was named AbitibiBowater and the stake has since been more than doubled. Over the years, its net investment in RFP was $745M ($24.39 per share) and the current value is ~$57M (~$1.86 per share) – in the books, the cost is listed at ~$200M as it wrote down losses.

CenturyLink (CTL): CTL is a small 1.55% of the portfolio stake established in Q4 2017 at prices between $13.50 and $20.50 and increased by ~30% next quarter at prices between $15.50 and $19. Q2 2019 saw another ~20% stake increase at prices between $11.50 and $16.75. The stock currently trades at $9.82.

Fitbit Inc. (FIT): FIT is a small ~1% merger-arbitrage stake established last quarter at prices between $3.45 and $7.15 and the stock currently trades at $6.43. Last November, Google agreed to acquire Fitbit for $7.35 per share cash.

Diamond Shipping (DSSI): DSSI is a small 0.84% of the portfolio stake established in Q2 2019 as a result of its Direct Listing in March. Fairfax’s investment goes back to 2011 when it was part of a $1B funding round headed by Wilbur Ross. Shares started trading at $10.40 and currently go for ~$10.

General Electric (GE): GE was a minutely small stake as of Q1 2018. Q2 2018 saw a ~160% stake increase at prices between $12.75 and $15.25 and that was followed with a one-third further increase next quarter at prices between $11.25 and $14.20. Q4 2018 saw another ~30% increase at prices between $6.75 and $13.75. The stock currently trades at $6.41 and the stake is at 0.76%.

Bank of Nova Scotia (BNS): BNS is a small 0.61% of the portfolio position established in Q4 2018 at prices between $49 and $60 and the stock currently trades well below that range at $36.54.

General Motors (GM): GM is a small 0.54% position. Q3 2018 saw a huge ~370% stake increase at prices between $33.50 and $40. The stock is now at ~$26.

Note: Greek allocation in the investment portfolio primarily consists of Eurobank (OTCPK:EGFEY) (OTCPK:EGFEF) and Praktiker. Grivalia Properties merged into Eurobank in Q2 2019 and Watsa’s 52.4% stake got converted to Eurobank shares. Fairfax now owns around one-third of Eurobank.

The 13F portfolio also has numerous very small equity positions (less than ~0.5% of the portfolio each) that add up to a total allocation of less than 5%. The stakes are Argan Inc. (AGX), Berkshire Hathaway (BRK.A), Callaway Golf (ELY), Cirrus Logic (CRUS), Colliers International (CIGI), Culp Inc. (CULP), CVS Health (CVS), Darling Ingredients (DAR), Delek US Holdings (DK), Dine Brands Global (DIN), FLIR Systems (FLIR), Forescout Technologies (FSCT), FreightCar America (RAIL), Garrett Motion (GTX), GCI Liberty (GLIBA), Granite Real Estate (GRP.U), Helmerich & Payne (HP), iRobot Corporation (IRBT), Jacobs Engineering (NYSE:J), KKR & Company (KKR), Kulicke & Soffa (KLIC), LHC Group (LHCG), Liberty TripAdvisor (LTRPA), Loral Space & Communications (LORL), Madison Square Garden (NYSE:MSGS), Middleby Corp. (MIDD), NetEase Inc. (NTES), Northwest Pipe (NWPX), Osisko Gold (OR), Pacific Biosciences (PACB), Penn National Gaming (PENN), RA Pharmaceuticals (RARX), Restaurant Brands (QSR), Six Flags Entertainment (SIX), Taiwan Semi (TSM), Tiffany (TIF), TransAlta Corp. (TAC), and Wabco Holdings (WBC).

The spreadsheet below highlights changes to Watsa’s 13F stock holdings in Q1 2020:

Disclosure: I am/we are long BB, BRK.B, CTL, FRFHF, GE, GOOGL, RFP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.